Seen the headlines today?

Dozens of stocks that took a hit last year are suddenly picking up steam.

But before you jump back into the markets with both feet…

There’s something you should know.

Let's start with a few points from my email today.

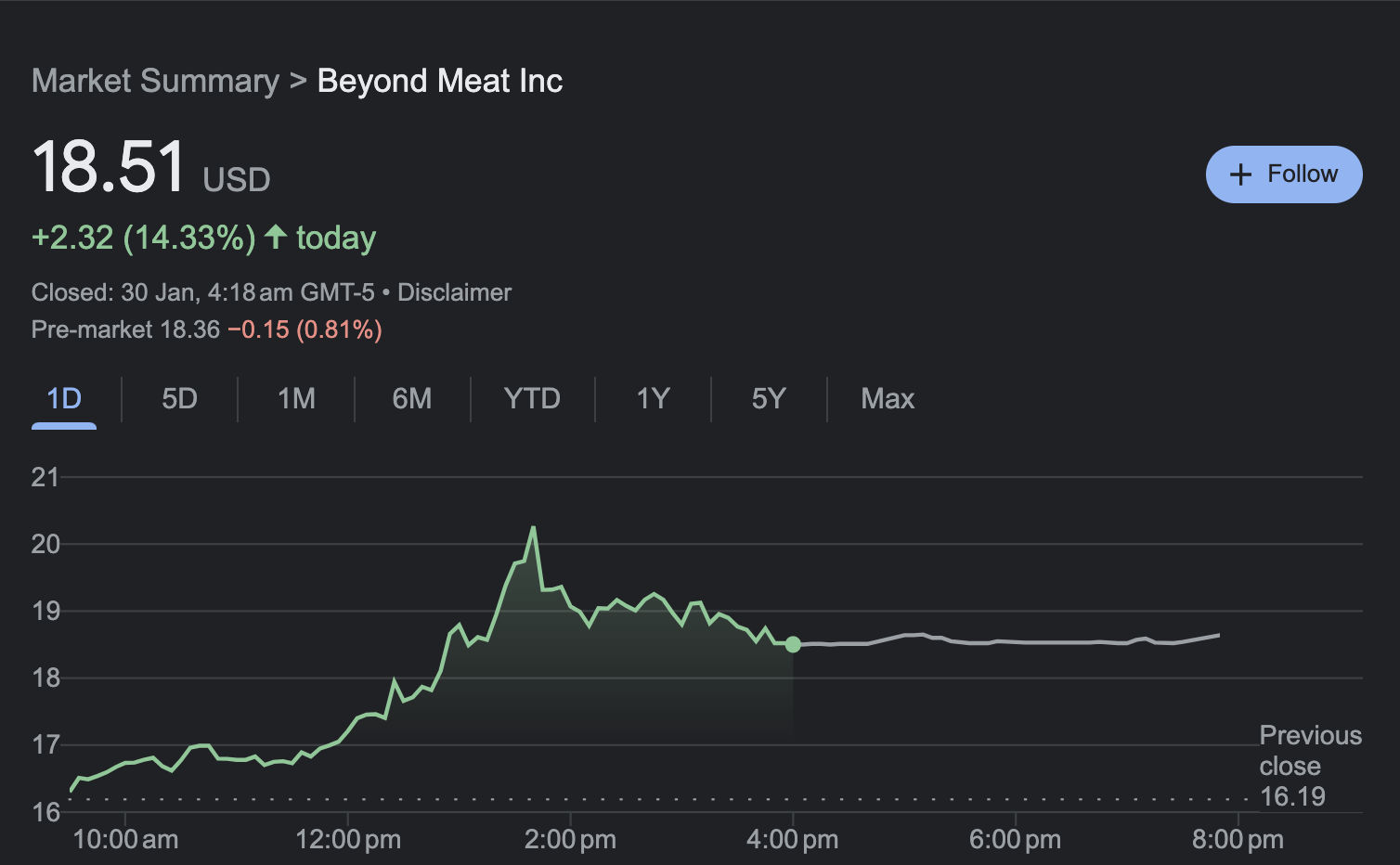

Beyond Meat (which sells artificial meat) started today’s session with a 14.33% bump.

Beyond Meat Inc Chart

Upstart (an AI lending platform) is up 10.44%.

Upstart Holdings Inc

And Wetouch went parabolic over the weekend following a new product launch.

Wetouch Chart

I could go on with more examples.

But here’s the long story short.

Most analysts forecast an upward trend is on the horizon.

Why?

Because the December employment report showed the U.S economy added a lower-than-expected 223,000 jobs last month…

And the average hourly wage rate is expected to slow to 0.4% from 0.6% in November…

That negative bit of news suggests rate cuts are underway.

As such, many believe the Fed will slow its interest rate hiking pace at its next FOMC meeting (slated for January 31 - February 1).

And that sentiment is sending certain stocks higher.

Here’s what the general forecast looks like:

This optimistic forecast is part of why the markets’ risk appetite is revving up.

And certain stocks are picking up steam.

For some investors, it’s time to pull cash from under the mattress (or wherever they stashed it during the 2022 storm) and go bargain-hunting.

I can’t stop you from following your instincts.

But after 13 years of trading through some of the worst bear markets in history…

Here’s what I can tell you:

Every time the bulls expect rate cuts, the Fed goes in the opposite direction.

A recent example is December 2.

Right after the November employment report showed declining wages, the bulls cheered because that negative news seemed to confirm a rate cut was underway.

Stocks got a lift that week, but it didn’t last.

And if you were one of those who jumped back in with both feet…

Your portfolio would’ve taken a hit.

The same story is playing out today.

Even though Fed chair Powell has maintained a hawkish stance…

Bulls choose to believe rate cuts are underway.

So the market’s risk appetite is revving up…

We’re seeing more cash flow in certain sectors…

And a number of stocks have gained momentum.

But as I told my clients this morning, it’s too soon to have a good estimate of…

Especially since Fed Chair Powell doesn’t want to repeat his predecessor’s mistake.

Like Powell, Paul Volcker fought inflation with interest rate hikes in the 80s.

Except, he cut rates too early and we all know the horrors that followed.

Powell doesn’t want to be remembered for the wrong reasons.

That’s why the Fed will continue to hike until something breaks.

So while the current “greed momentum” may continue for a while…

I wouldn’t go bargain hunting yet.

Not with America’s financial system on the cusp of its biggest bankruptcy since 2008.

This doesn’t mean there are no good opportunities out there.

You just need to look in the right places.

And when you find an opportunity that checks the right boxes…

It helps to manage your risks properly.

That’s all I’ve got for you today

If you need more help navigating this market…

I’m holding a free webinar at 11 am ET on Wednesday to reveal what I’m doing to protect and grow my money as America braces for its biggest bankruptcy since 2008.

Here’s the link to save your seat.

Original Post Can be Found Here