If you’ve traded for any stretch of time, you’ve obviously been thoroughly introduced to Market Makers before.

You know… the ones that always screw you over?

Their shady algorithms jump in and get filled before you or get you out at a terrible market order after you get on the wrong side of a trade.

They might seem like strangers with some very suspicious candy…

But, what you might not know is that these are actually HUGE companies listed on exchanges themselves.

One of the biggest names is Virtu (VIRT).

They pay hundreds of millions of dollars to access your order flow so they can peel off a tiny edge.

The business model works great when there’s lots of action in the pond…

So these market maker firms love lots of volatility, wide bid-ask spreads, and panicky investors flitting in and out of the markets.

But when the flies stop buzzing about, the frogs can’t get their fill.

That pretty much sums up VIRT in the last few years.

The chart tells the story, VIRT probably pulled a lot of earnings from 2021 into 2020 (like a lot of other names).

And since then, they’ve taken a big hit along with the rest of the market.

Now, I don’t think we’re going back to the grinding uptrend like we had in 2017.

Volatility has come to town and it packed several bags so I’d anticipate a long stay.

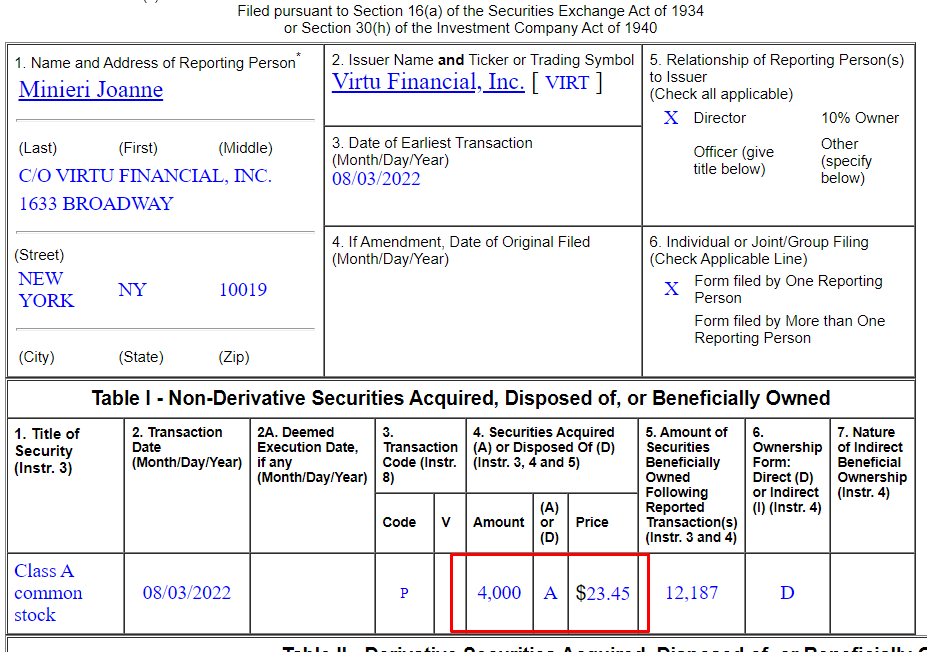

And I’m not the only one saying this… Joanne Minieri is following the same tack.

She’s an insider at VIRT who just increased her stake by a cool $93K.

Considering where VIRT is trading right now, it looks like a stranger whose candy is safe to eat after all.

So, given the price action, and the big insider buy, you might want to know how to play this sucker to the long side.

Good news, this Thursday, myself and an intimate group of traders from this tribe are going to have a little “pow wow”.

I’ll be sharing how you can follow folks like Minieri and other “Insiders” who can consistently lead us to the promised land.

>>> Why These 4 Dozen Names Can Help You Finish Out 2022 With A Bang

Original Post Can be Found Here