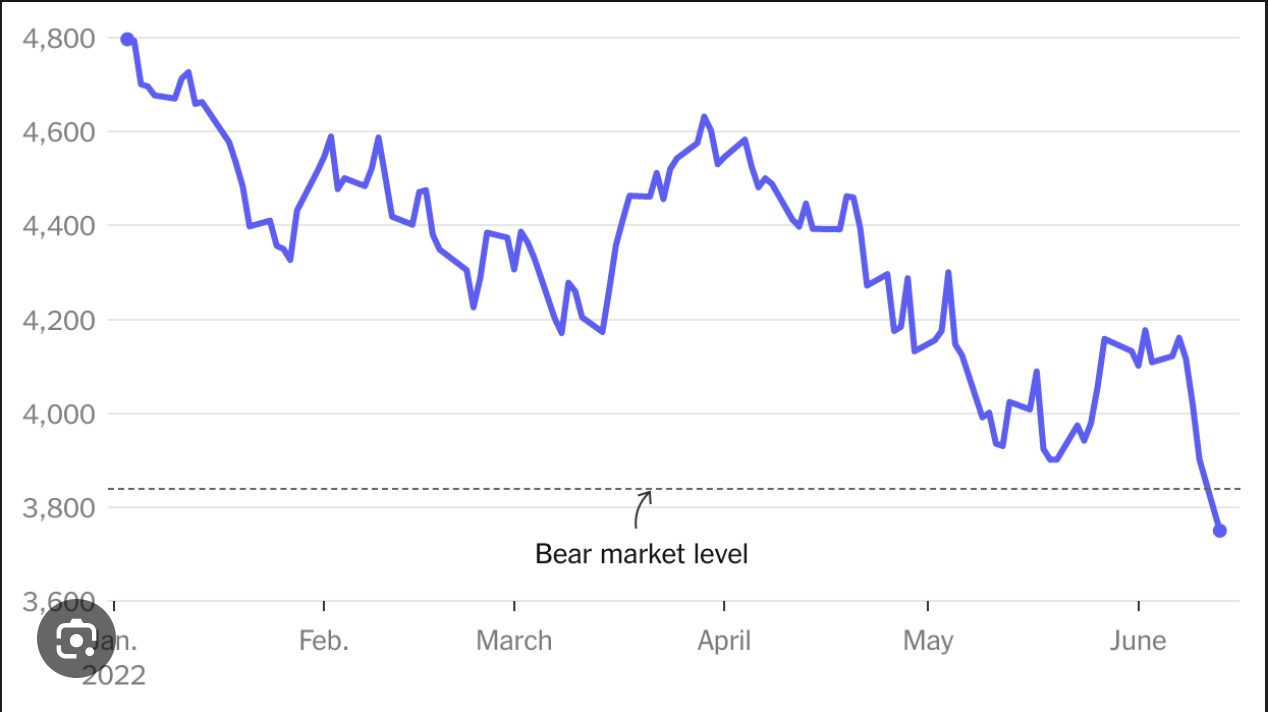

Eighteen months ago, the market was driven by extreme fear.

Inflation, interest rate hikes, and geopolitical tensions sent stocks tumbling.

When Greed Replaces Fear (And

How to Leverage The Greed Cycle)

Most folks will give anything to recover the money they lost amid the turbulence.

But if you’ve as much as bought a treasury bill, you know it doesn’t work like that.

I bring this up because the market is driven by extreme greed today.

The mainstream media keeps talking about how we’re finally out of the woods…

And even so-called sophisticated investors are throwing caution to the wind.

I can’t stop you from bargain hunting, but…

The so-called bull market is driven by a handful of tech stocks (not a good sign).

And the so-called tech rally is driven by the hype surrounding artificial intelligence.

It feels like the dot com bubble all over again.

And folks flying blind in this market will suffer painful losses soon.

Sure, there are sensible opportunities for substantial profits this summer.

We even have three stocks poised for double-digit returns after tomorrow's market bell.

But we didn’t get in because of bullish sentiments around the Fed’s “rate hike pause.”

These stocks have been on our radar for a while.

And the only reason we’re making our move now is because…

This macroeconomic event won’t make you rich overnight.

But it will significantly impact stock prices in the second half of 2023.

And if you know how to leverage price flow relative to institutional cash flow.…

This is a safe, lucrative opportunity to earn substantial returns from a few “Blue ocean stocks” as more institutional capital flows into three overlooked market corners.

If you want to see how we leverage this opportunity and several others on our radar…

I share more details in this free video.

Give it a watch, and let me know if you have any questions.

Original Post Can be Found Here