Did you see this post on Twitter?

It’s from Keith Gill, aka Roaring Kitty… aka the man who kicked off the GameStop (GME) squeeze in 2021.

He came back in a big way. Gill posted his positioning on social media, and was still loaded up with long stock and a ton of call options.

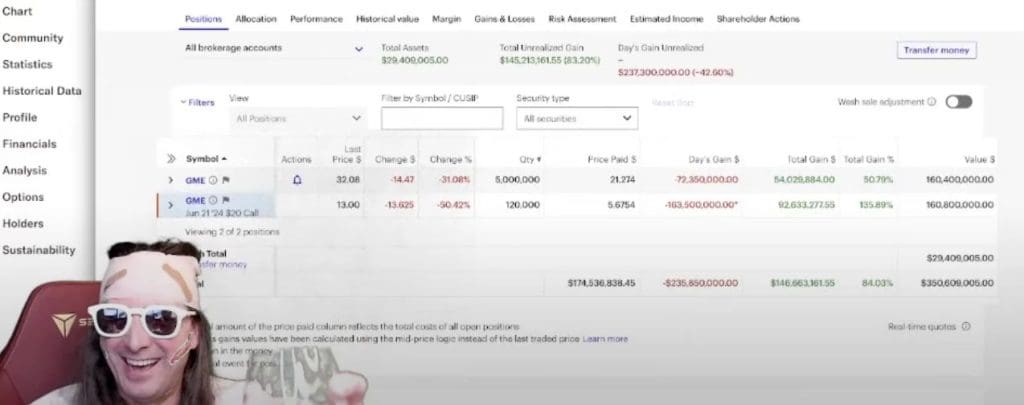

Here’s a screenshot from one of his livestreams:

During the overnight session on June 7th, he was set to become an official billionaire (on paper, anyway)…

Until GME released earnings early, and announced another secondary to raise capital…

And the stock jammed back down to $24.

Here’s Gill’s problem: Because everyone knows he owns the June $20 calls, the stock is starting to trade a little heavier.

Because we have just a few days until options expiration, he needs to start unwinding his position.

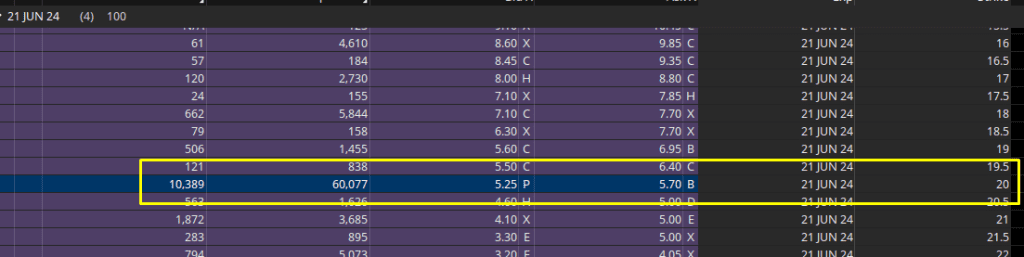

Traders are watching the open interest on these options to see how many options he is converting into stock:

With 60k still left in the open interest, he still has a ways to go to unwind his option position.

This is one of the most fascinating stories in finance right now, and nobody is understanding the lesson here.

Have you?

During the entire GME trade, did anyone think to look at the fundamentals of GameStop?

There’s a company attached to that stock ticker! It sells things for money, and if they do well enough, they’re supposed to return that capital to shareholders in exchange for providing earlier capital.

Nobody cares!

And that’s the lesson.

There is a difference between the company and the stock.

Only one of those will make you money in the markets… and it ain’t the company.

A company having better earnings doesn’t earn you a single cent unless the price of the stock moves.

And the only way the stock price moves is if you have liquidity – ideally institutional liquidity.

We have a simple yet powerful way for seeing precisely when institutional liquidity is moving in or out of a name like GME…

Original Post Can be Found Here