If you’ve spent 10 minutes on the internet in the last few years, you’ve definitely heard some self-satisfied halfwit spew out the line…

“Correlation does not equal causation.”

It’s almost always used to bolster a half-baked argument to begin with… but it does bring up an important point.

People have a natural talent for ignoring the way things really work.

It’s probably because our brains are ultimately designed to help us kill antelope and forage for edible bark…

Our ability for abstract thought is a derivative of this primal bargain so our instincts easily warp our sense of reality.

If someone tosses a coin and it lands heads 12 times in a row, that’s not a sign that you should put a big bet down on tails for the 13th.

The odds on any individual flip are always the same.

But people DO play this way in reality…

A cold slot machine draws attention from every rube with a giant plastic bucket of casino tokens…

“This sucker is due for a big payout!” they’ll say… pumping in coins with a big, stupid grin on their face.

They fail to realize that a bunch of servers in a data center running randomized software is what’s determining the fate of their button presses…

Cold slots can get even colder… hot machines can turn into liquid magma…

It’s all up to a bunch of blind software variables that couldn’t care if you sleep in the penthouse or lose your life savings.

But markets aren’t built entirely on independent observations, and investors frequently act in totally irrational ways…

So that’s how we end up with asset classes trading together like they’re linked at the hip…

Even though there’s nothing fundamental tying them together.

Currently, the Yen is trading like a risk equity when, in reality, there’s no causal link.

It just so happens that the Fed taking away the punch bowl also creates a global dollar shortage.

Since the BOJ went the other way in this “choose your own adventure” of market madness… the Yen dropped while the dollar soared.

But, if investors become more afraid of deflation than inflation, that trade could turn on a dime.

Funds will rush into Yen as a “safehaven” like they’ve done in the past.

You don’t have to outrun the lion, you just have to outrun the other guy…

The lion will eat the slowest of the two.

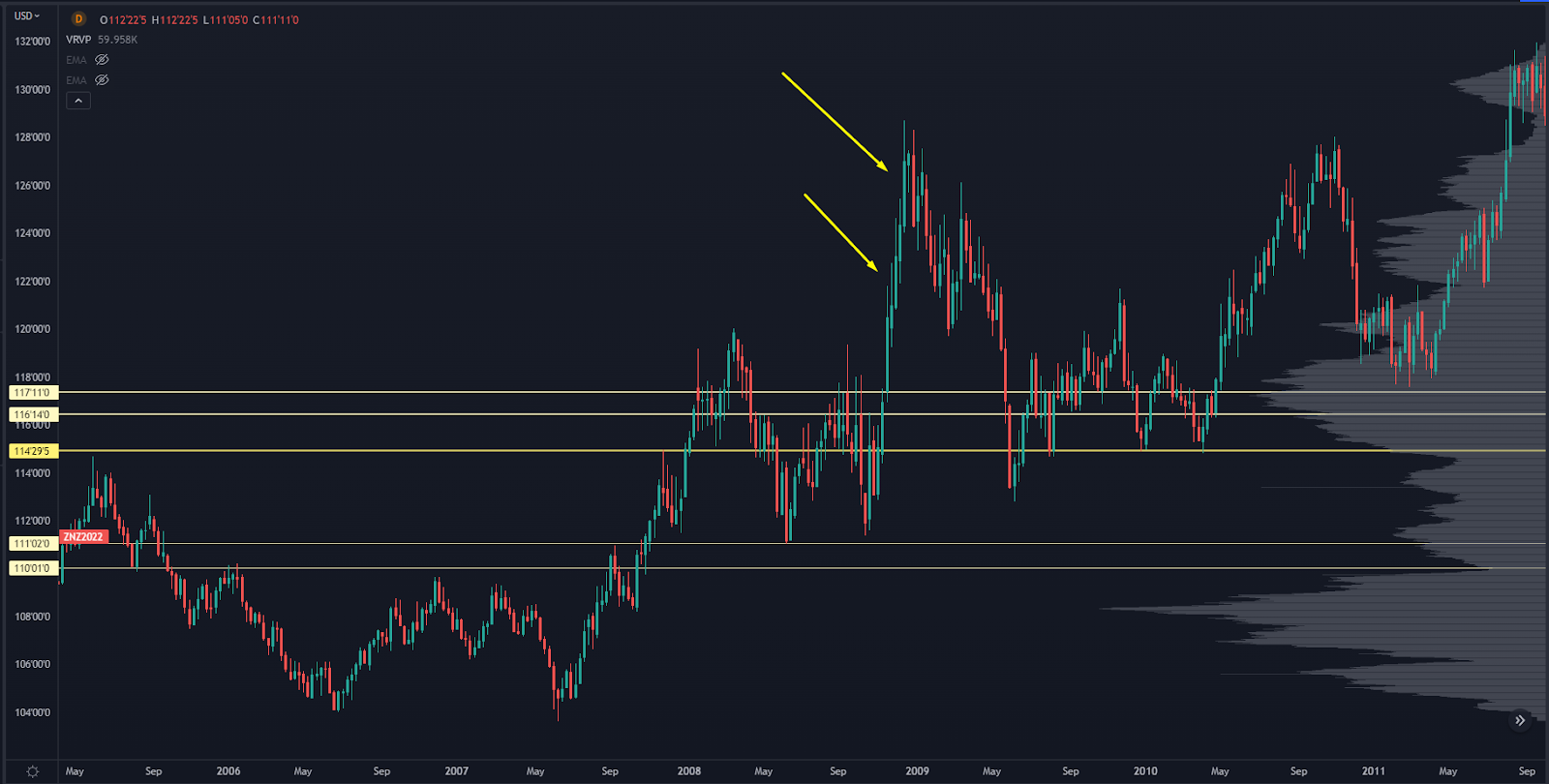

We could see something very similar in US Treasuries…

Early in the year, paltry yields caused an historic collapse in bond prices.

But, if equities fall off a cliff… the story could change in a heartbeat.

Investors will park cash in these instruments even if they still won’t outpace inflation because losing 2% is better than losing 30%.

Here’s a look at how the bond market performed during the 2008 crisis:

Bond Market Chart

Basically, the risk spread between inflation and deflation compared to the yield in USTs might offer an attractive option in a crisis…

Recently, we picked up a trade in a Bond ETF and we’re using our Trading Roadmap to time our entry…

Interested in knowing what we’re doing?

>>> Check Out Our Training Here

Original Post Can be Found Here