You can’t turn on the news without hearing about the end of fossil fuels.

Yet, clued-in investors like Warren Buffett are doubling down on oil investments.

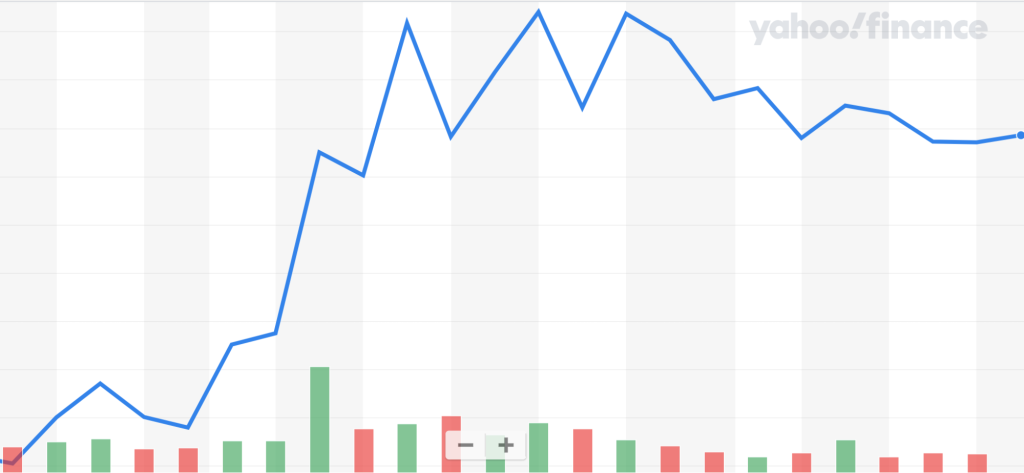

Since the first quarter of 2023…

Buffett has bought an additional 29.7 million shares of Occidental Petroleum.

The bet paid off nicely, and he intends to buy more.

Why?

Chart

Because while most oil and gas production companies focus on the costly process of extracting the crude product (making them more prone to oil price fluctuation)...

Occidental Petroleum has assets across two oil and gas streams that let them collect a fee for transporting crude and charge a premium for refining it into usable products.

Buffett knows this makes the company less prone to oil price fluctuations.

And that’s why he keeps increasing his stake almost every quarter.

But it’s not just Occidental returning substantial gains to investors in 2023.

See one “energy ETF for reliable income” in difficult times.

Original Post Can be Found Here