If you want to understand what’s happening in the global tariff chess match, you don’t need a crystal ball.

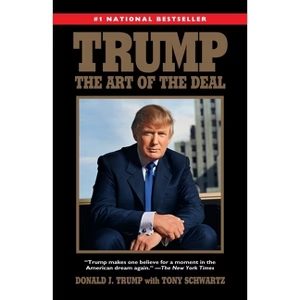

You need a copy of The Art of the Deal.

Because what we’re seeing isn’t traditional policy – it’s classic negotiation theater, straight from Trump’s 1987 playbook. And whether you love him or loathe him, understanding his strategy gives you a lens to interpret what’s actually happening behind the headlines.

In The Art of the Deal, Trump lays out his signature style: anchor the conversation with something extreme, escalate tension to gain leverage, control the narrative, and then walk back just enough to make a deal feel like a win for everyone…

Most of all him.

That’s what we’re watching now.

First came the broad threats: 10% across the board tariffs.

Then the walk-back: selective tariffs on a case-by-case basis.

Then the escalation: 125% tariffs on China.

Now the real game: 130+ countries negotiating individually with the U.S., desperate to cut their own side deals.

The point isn’t the tariffs. It’s the leverage.

This is about isolating China, forcing global compliance, and establishing a new trade regime with the U.S. at the center.

To get there, though, the process needs to feel chaotic. Uncertain. Unstable.

Why? Because that’s how you create leverage.

Here are just a few tactics from Trump’s negotiation arsenal now playing out in real time:

If you’re looking for certainty in this, I hate to be the one to break it to you: We’re not going to get it.

Markets are trying to price in something that doesn’t have a clean resolution. It’s not clear when a deal will happen… or what a “deal” even looks like.

There are no rules, no roadmap. Just one guy with the microphone and a copy of his own book.

But that doesn’t mean we’re flying blind.

While investors chase headlines and try to interpret cryptic tweets, corporate boardrooms are doing something else entirely: Assessing real risk and real opportunity.

They’re asking:

And when they decide they’ve got clarity, they act. Quietly. Through insider buying.

Because insiders don’t guess. They know when their business is about to benefit – and they put money behind it.

That’s why we’ve been watching insider transactions as the most reliable signal for what comes next. Not what people say…

But what they do with their own capital.

Want to see what they’re telling us?

I recently hosted a live session exploring how insider buying can reveal which stocks might rise from the ashes of this tariff turbulence – who the next winners and losers might be in this brand-new regime.

I encourage you to watch the recording right here… because while no one knows exactly what this market will do next, the people inside the boardrooms just might.

Original Post Can be Found Here