Ship

This shipping company doesn’t own ships, but even while stocks cratered, it handed investors a 335% return in eighteen months.

Enough to turn every $500 invested into $1,675.

How’s that possible?

Well, do you remember Airbnb?

The vacation rental company that makes around $5 billion annually leasing hotels and apartments they don’t own (or manage?)

This company operates the same.

They don’t own ships.

Instead, they make a fortune by selling long-term leases to short-term needs.

The company has been in business since 1945, but revenue generation only took flight at the start of the COVID-19 pandemic despite its longevity.

Its top line has shot up by a whopping 314% since January 2020, thanks to surging demand for shipping services and a spike in global freight rates.

After boosting its dividend payout to 30% of net income in the most recent quarter, the company’s effective annualized yield for 2023 presently stands at approximately 19.6%.

This yield may even be markedly higher if the company follows through on plans to raise its payout to 50% of annual net income.

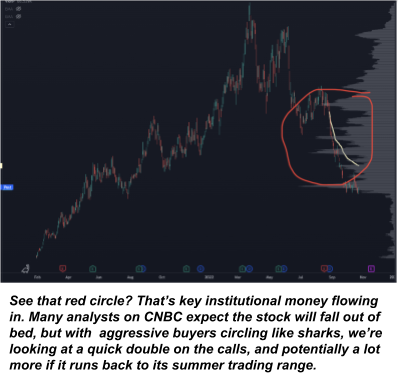

Chart

With China’s demand for commodity shipments expected to rise in the fourth quarter —as investments in steel production and oil products exports pick up pace…

This shipping company is positioned to profit from that uptick in activity.

Although the stock is down 46% this year, its earnings per share (EPS) improved.

The company has improved its bottom line lately, and we’ve noticed positive estimate revisions that reflect analyst optimism about the company's business and profitability.

And now, with more aggressive buyers on the horizon, we’re looking at a quick double on the calls and potentially a lot more if it runs back to its summer trading range.

To benefit from this, I’ve developed the Precision Roadmap, a proprietary model that lets you know when institutional players are moving in and what price levels to leverage.

Click here to see how it works.

Original Post Can be Found Here