Well it’s been a dizzying few weeks in the markets, with a lot of strong moves both in the indices and some key names…

… but at this point, we’re coming into some steep shelves that could lead to a little rollover in the markets.

Just in case you missed it, we covered a lot of this in your Market Primer from Monday.

Here’s what I’m seeing right now:

S&P 500

S&P 500 Chart

The chart might look messy, but if you look at the arrows…

… we’ve got an all-time high AVWAP with a key LVN.

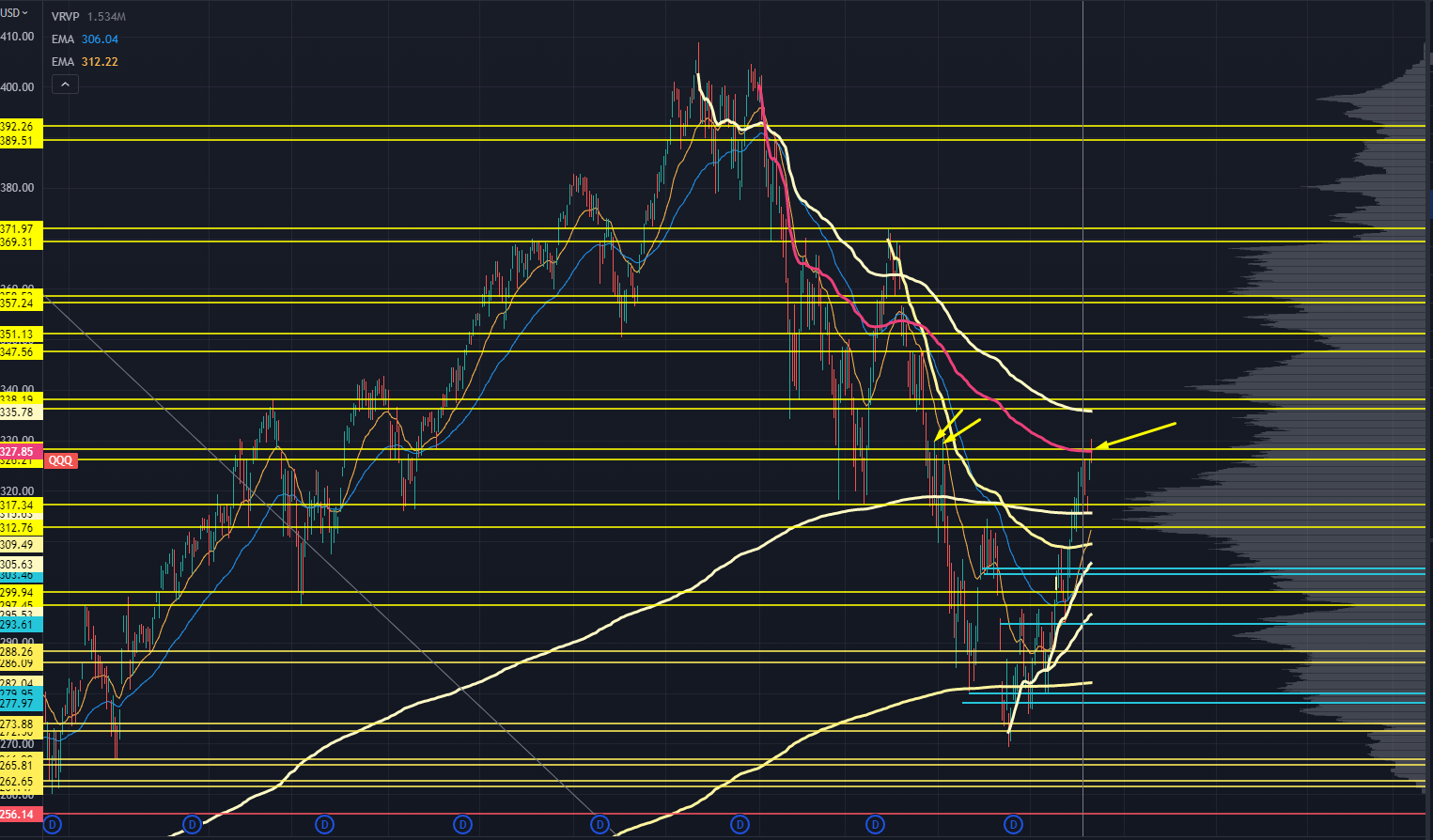

Nasdaq 100

NASDAQ 100 Chart

2022 AVWAP with internal pivot level.

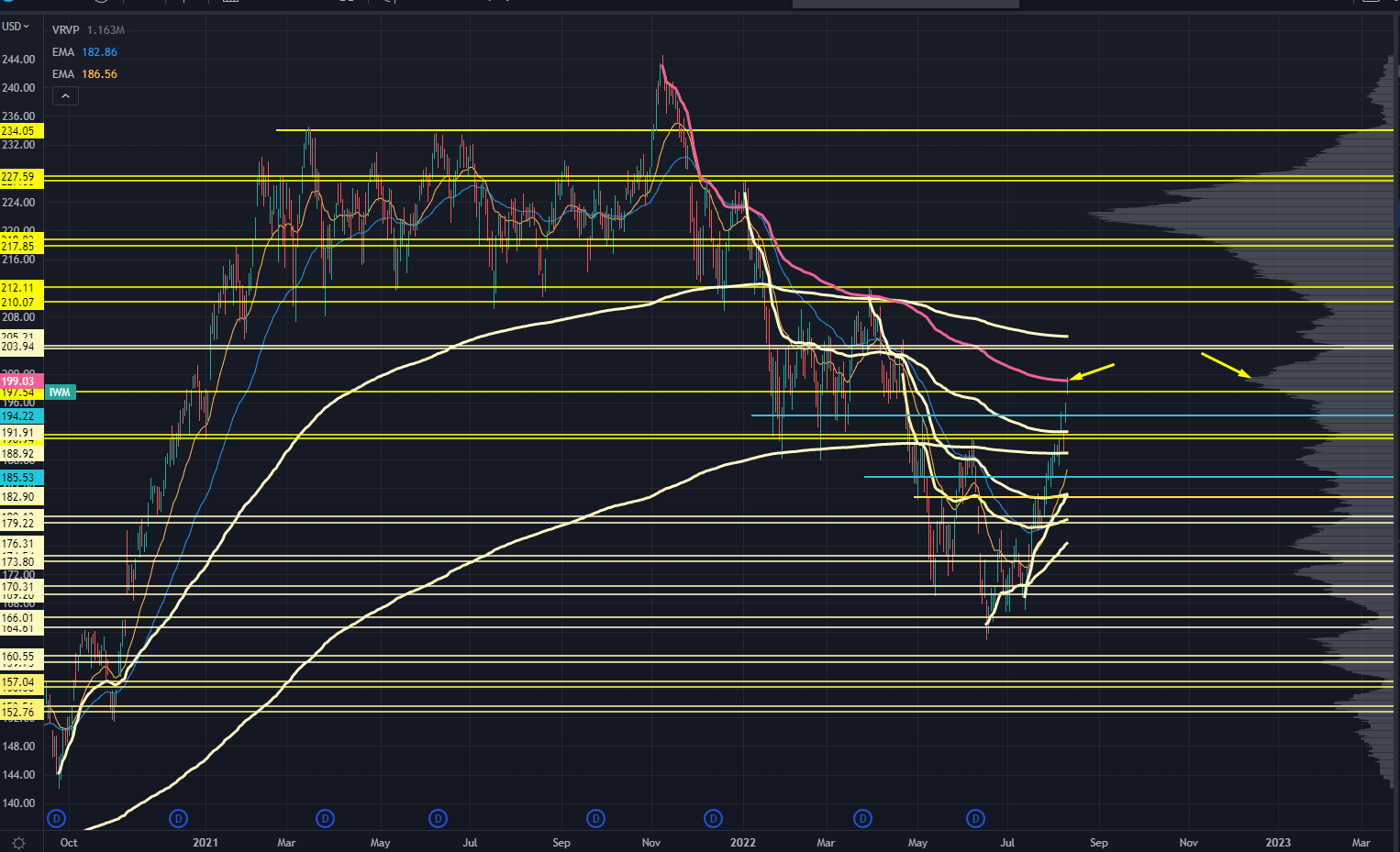

Russel 2000

Russell 2000 Chart

All-time-high AVWAP, into HVN from the first quarter’s trading range

Dow Jones Industrial Average

Dow Jones Industrial Average Chart

All time high AVWAP and into a massive volume shelf.

When you have all major US markets hitting huge levels on the same day, it’s time to pay attention.

This is your “tap on the shoulder.”

Do you have too much risk on? Do you need to throw on some hedges? These are the questions you want to ask when you can, not when you have to.

What about some sectors?

Materials (XLB)

XLB Chart

AVWAP from April highs, and a push higher gets us into some serious volume.

Banks (XLF)

XLF Chart

Prior support as potential resistance, with a low volume node and swing AVWAP on one more push higher.

Tech Growth (ARKK)

ARKK Chart

Just a little higher and we have a key LVN and AVWAP from the November highs.

So it looks like we’re coming into some risk levels right now…

And that’s not a call to dump everything and prep for another crash.

But, you should consider if you need to make any tactical changes so when (not if) a hard pullback comes, you’re prepared and in a better mental state to make decisions to the long side.

Think of it like golf, if you know the greens on the next few holes are running a little fast…

… you can adjust your approach to be a little less aggressive.

That way you’ve got a short putt for par instead of a long putt for bogey.

A similar thing happens when you’re eyeing rough zones in the market…

You want to rebalance your positions so you’re not totally offsides and praying for a big move to bail you out.

If you want to look ahead and find these “hot zones” in the markets…

>>> Follow Our Trading Roadmap

Original Post Can be Found Here