This past week was wild for the crypto markets.

On Tuesday, the SEC’s Twitter feed dropped the news everyone was hoping for: a spot Bitcoin ETF.

If you’re not in the space, you may not think this is a big deal.

But it allows more institutional capital to flow into the system. By introducing a “spot” ETF, the fund custodians can go out and buy Bitcoin instead of relying on the futures market.

So we’re good to go, right?

Not so fast!

Gary Gensler, the head of the SEC, came out and said their Twitter account was hacked – no green light for these ETFs.

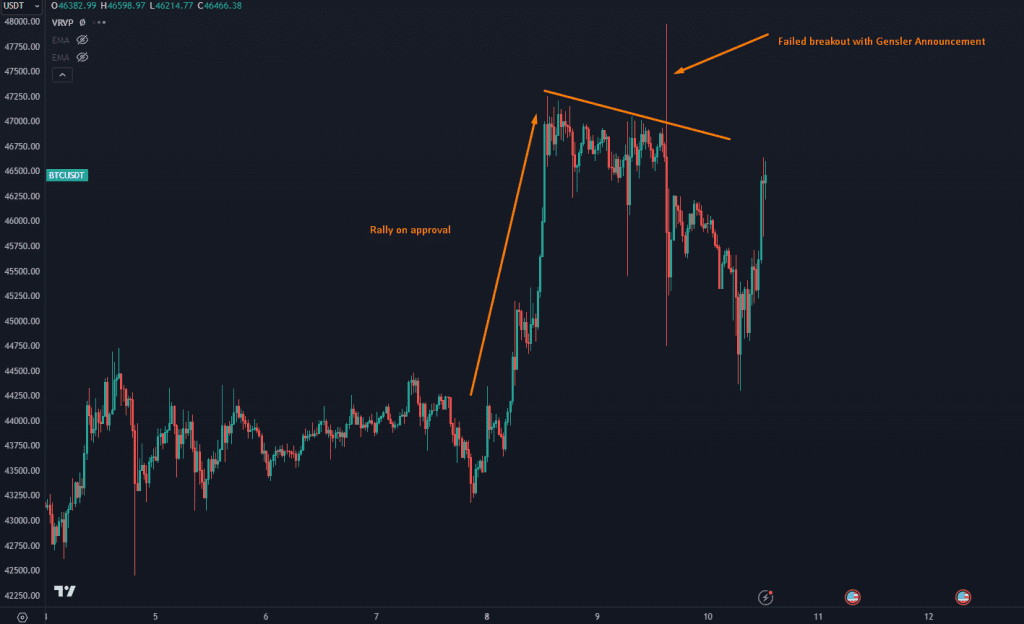

Here’s how the Bitcoin markets responded:

The SEC’s Big Bitcoin Fumble

The United States Government is not the biggest fan of crypto markets. It allows capital to “offshore,” which gives the owner the ability to bypass the SWIFT banking system that has done well to help the US Empire.

But you can’t hold back the tide forever.

The “real” approval finally came Thursday…

But be warned – that doesn’t mean the market will go parabolic on the news.

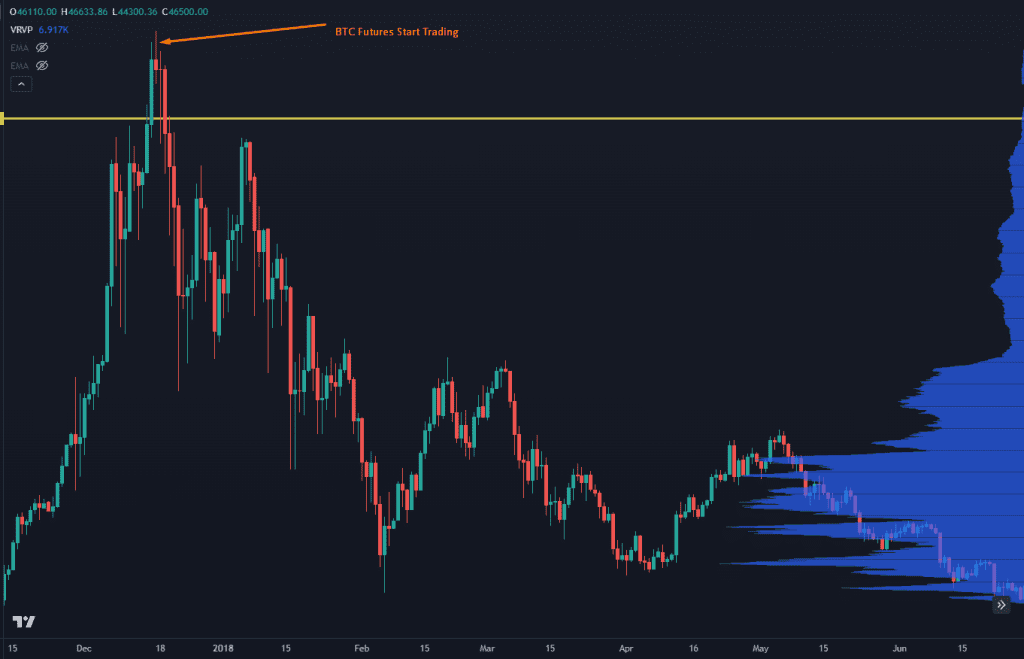

Back in 2017, everyone and their mother was going crazy over crypto. It was in a bubble, showing no signs of slowing down.

The Chicago Mercantile Exchange (CME) launched Bitcoin futures, and many market players thought this would bring in a bunch of sidelined money.

The opposite happened. Having the ability to quickly hedge off risk using futures caused a liquidity cascade, and marked the exact top of Bitcoin for 4 years.

The SEC’s Big Bitcoin Fumble

Now, Bitcoin’s on the move again, but it’s not shooting up like a rocket. It’s been as normal of a rally as you can get with Bitcoin.

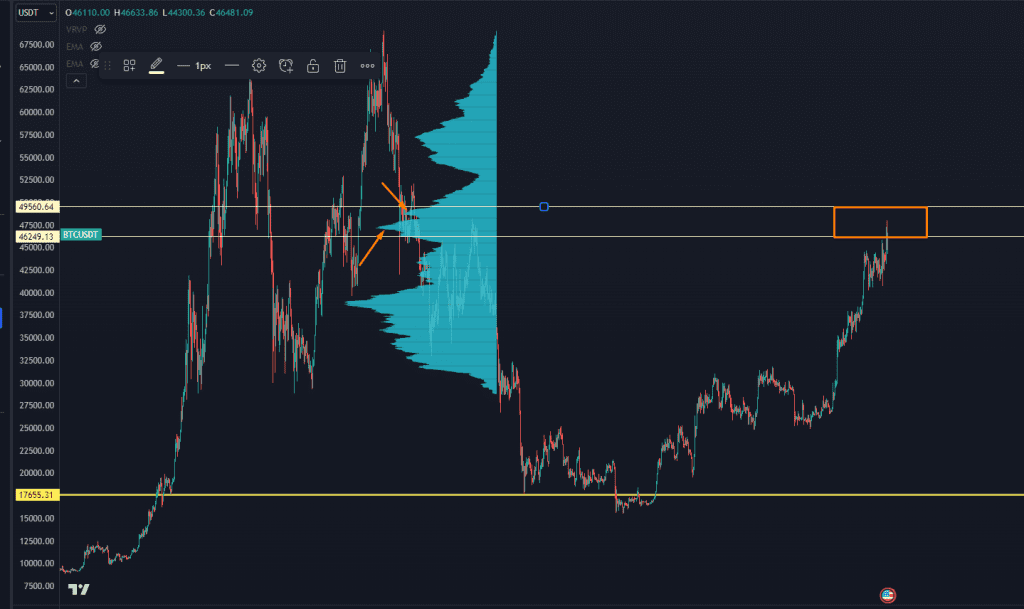

The big risk I see is not the ETF approval, but that the market is entering a “Bagholder Zone.”

The SEC’s Big Bitcoin Fumble

If you create a Trading Roadmap using the topping pattern from 2021-2022, you can tell what prices had the most buyers.

And as those buyers go from massive losses back to breakeven, they may want to sell some of their position.

That’s how you can get a hard pullback.

Even with all the newsflow and regulatory sabotage, I’m bullish on the space.

And just like with the stock market, our Trading Roadmap is ace at spotting those money-making moments in Bitcoin.

We’ve got an in-depth training that shows you how to use this Trading Roadmap.

Click here and grab your spot in our free training webinar. Let’s ride these crypto waves together!

Original Post Can be Found Here