The biggest news for financial markets isn’t anything that’s going on with Trump or Biden.

It’s the concentration of institutional capital into just a few pockets of the market – specifically the Magnificent Seven, short strategies, and leveraged US Treasury holdings.

Nvidia’s (NVDA) market cap is over $3 trillion. Imagine that the stock sees a 5% pullback.

That’s $150 BILLION dollars, just from a “normal” pullback. That’s larger than the value of most of the companies in the S&P 500.

I am increasingly worried there could be a liquidity break in large-cap tech, but so far it’s been tame. And it can lead to bullish setups across the rest of the market.

What if some of the capital that’s been pushed into the Mag 7 goes hunting for other deals in the market?

Maybe some fund managers who are underperforming their benchmarks are going to try and hit the gas in the second half of the year…

It sure feels like it.

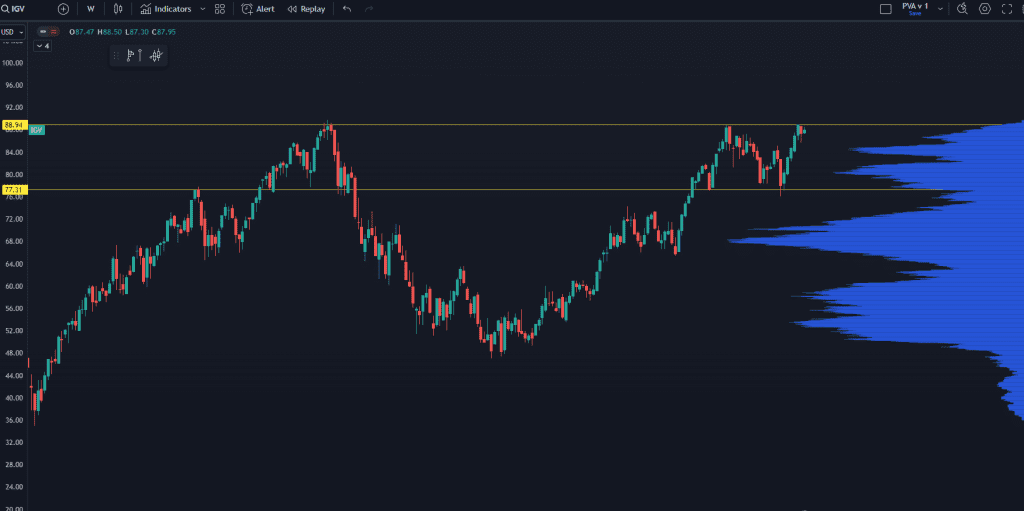

Like this setup in IGV, and ETF that tracks the software space:

It’s clear there’s institutional interest here. Many of the software names have not yet had their “AI moment,” as it takes a while for tech to move through larger companies. But it could be showing up soon in their earnings reports.

I found one that piqued my interest: ANSYS Inc., ticker symbol ANSS. Take a look:

I’m not going to pretend to have some unique insight into the company. It looks like some enterprise software firm.

The reason I’m following it is the yellow rectangle I’ve marked on that chart.

That’s what we call the “point of control.” It’s a critical price level for the stock – and it’s signaled some of the biggest wins we’ve ever recorded here at Market Traders Daily.

We put together a free training video that shows exactly how it works, step by step… you can watch it 100% free on this page here.

Original Post Can be Found Here