You’ve heard of the S&Ps, the QQQs, even the VIX…

But you’ve probably never heard of the One Index To Rule Them All.

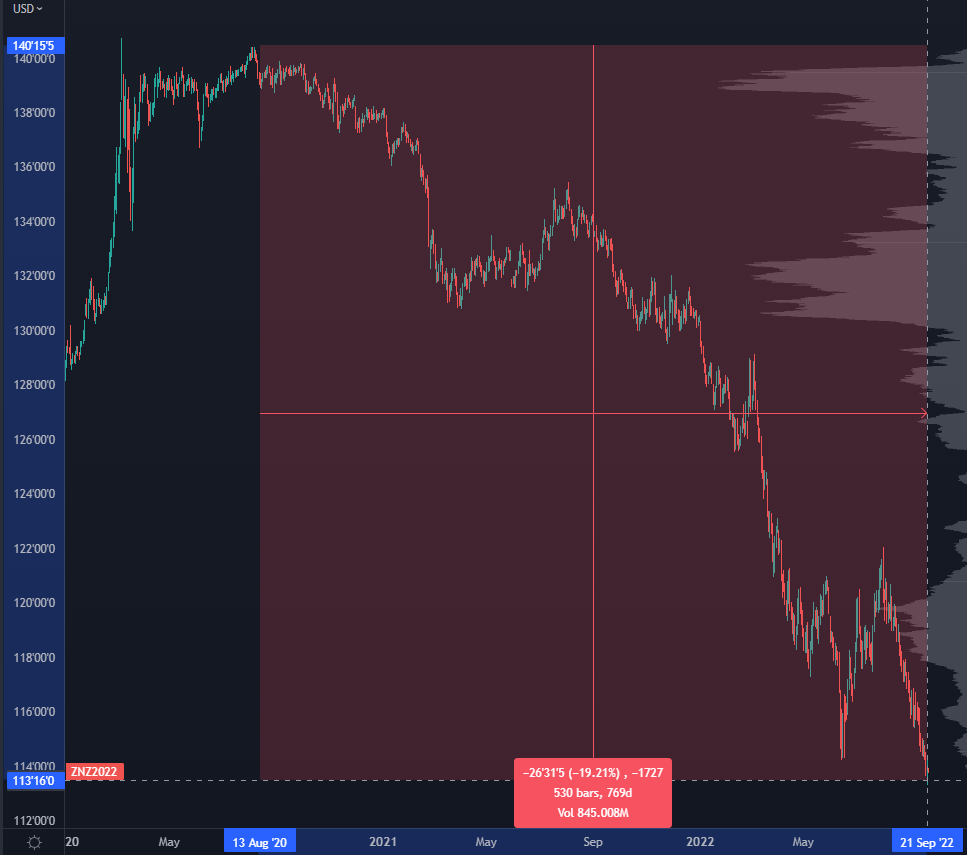

It’s where literally all the really spooky risk is -- the bond market:

Bonds are the plumbing of the financial markets… if they spring a leak… we could be in trouble.

That rot can spread to the foundation and if it knocks over anything big enough… well, you get the idea.

Right now, the 10 year treasury is down 19% from it’s highs -- that’s a BLOODBATH!

And a good chunk of that volatility is because the Big Boys (Institutions, Pension Funds, Market Makers, etc) can’t price in the cost of money in the future.

It’s too fuzzy out there with inflation going nuts and the Fed giving rates a beating…

We’ve seen that bleed into the markets and volatility has been up.

Which brings us to the MOVE index…

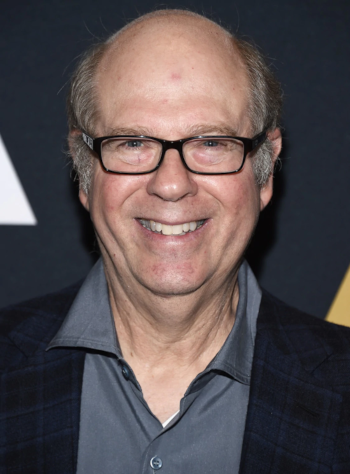

It’s sort of the Stephen Tobolowsky of the financial markets…

And if you’re scratching your head and going “Stephen who again?”

Here’s his familiar face:

If you watched TV or movies in the last 20 years… you recognize him.

He’s famous but you’ve never heard of him… like the MOVE.

You can think of this index as being the “VIX” of the bond market...

And looking at the chart:

You can see that the demand for protection in the bond market has continued to stay bid since the beginning of the year.

But here’s the thing– the Fed has clearly laid out its plans… which makes it easier to figure out where the terminal rate will be, and institutions will be more comfortable putting risk back on the table.

This is the index I’m watching.

If MOVE breaks back under 120, then we’ve got the potential for longer term stabilization in bonds, which should induce improved liquidity in stocks.

Of course, some of the best setups right now are in “dark value” names.

If you’re trading at 1x cash, odds are you don’t need to raise capital to fund operations, so you don’t have to worry about yields.

To get alpha in the Stranger Things version of markets in 2022…

Where there doesn’t seem to be safety anywhere you look…

You need to focus on stocks that are pre-catalyst.

They’re on the verge of breaking out but just haven’t gotten that first push they need.

And secondly, they need to have some “fingerprints” on them…

Signs that a certain savvy class of investor has put their hands on it and scooped up shares for themselves…

If you want to see the names that have insider’s greedy fingerprints all over them:

Original Post Can be Found Here