At the beginning of August, the market crashed:

It’s been well dissected, but the basic idea was this:

The Bank of Japan decided to hike rates while U.S. data came in soft. This led to a massive unwind in multiple trades at the same time.

You may have never traded the AUD/JPY cross, but it shows the extent of the damage:

Now that is a crash.

The BoJ learned its lesson, and it told the market it would be using more data to dictate decisions.

Because when it all comes down to it, the Dollar still rules – and the Federal Reserve is the Praetorian Guard.

The Bank of Japan policy wasn’t bad. It was just poorly timed.

The Chinese know how to do it better.

They’ve waited the entire year for the Fed to cut rates. This has implications across the currency market as it gives other countries leeway to move without seeing their local currency getting murdered.

Now that the Fed has signaled to the market they’re going to be accommodative, the Chinese can use their elephant gun.

The Wall Street Journal prefers the term “bazooka,” but the effect is the same.

FXI, a ETF that tracks key Chinese stocks, is having a moment:

The index is up 18% in a five-day window. That does not happen often!

This shows the five-day rate of change for FXI. only one other time has seen this large of a rally, and it was a hard bear market bounce.

I think this rally is going to stick because of how the structure is setup for FXI.

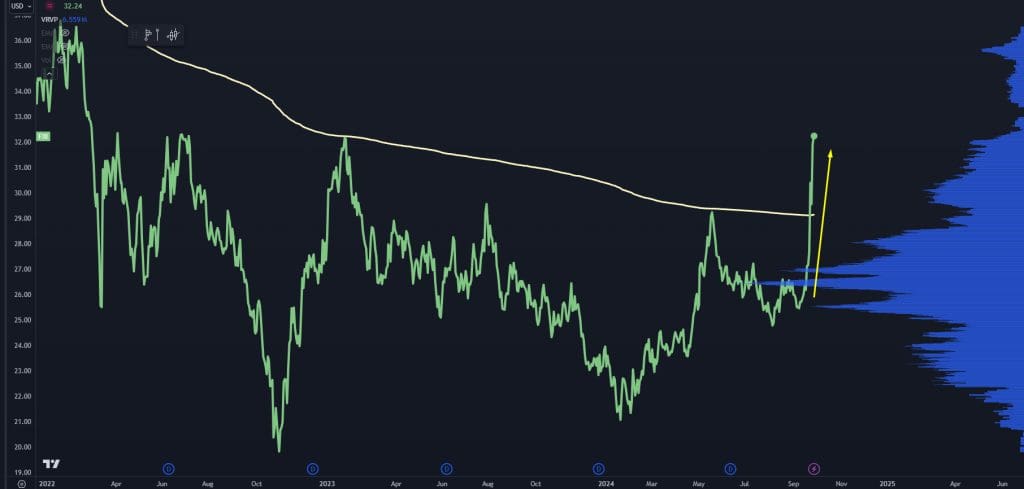

Here’s a chart with the swing AVWAP against the 2021 highs:

Note that this level has been shown respect until this massive gap higher.

You also had a point of control develop over the past two years:

And the fact that the market held the lower end of that range with the recent pullback tells us the sellers had disappeared:

Now we have a market where the average buyer of the index is now “in the black,” which means they don’t have much incentive to sell.

Do I trust the Chinese markets? Absolutely not – but I do trust the institutional trade flow that has come into the index.

And I have a system that will show me the ideal entry points where institutional capital is likely to come pouring back in… click here and I’ll show you how it works step by step in a free training video.

Original Post Can be Found Here