Last week, the market had a nasty crash off the CPI print.

And even through all the instability, our Roadmap levels worked out great.

When the market becomes deeply oversold, getting “cute” with the options market can be tempting…

But I’ll prove to you the best strategy to play for a bounce.

The options market is a risk market. That means an option’s price depends on the perceived risk in the market.

When the market’s crashing, option premiums skyrocket.

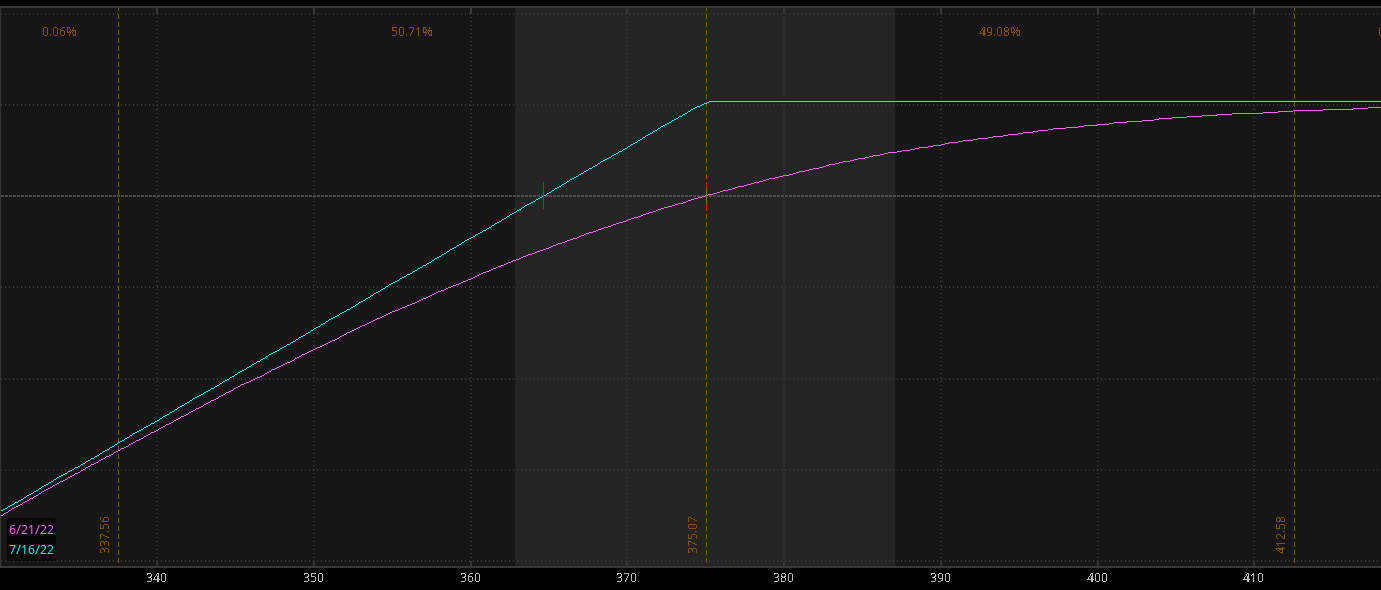

Here’s a look at the S&P 500’s implied volatility:

SPY Chart

Implied volatility measures the premium available in the options market.

See how implied volatility moves higher when the market sells off?

That’s because people are willing to pay up for insurance when they’re scared.

As an options trader, you can take the other side of that and sell the premium to them.

The options market has a lot of players saying you should be a net options seller in environments high in implied volatility.

That’s not always the best bet.

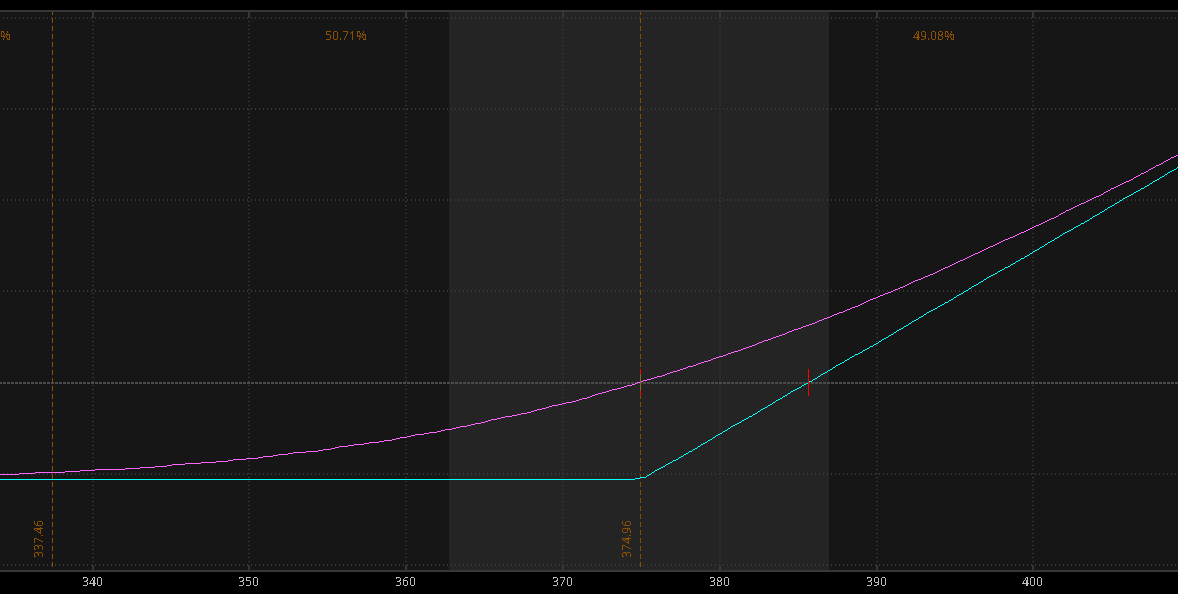

Consider two trades — a put sale and a call buy.

Both are bullish bets but have different payout structures.

This is a put sale:

Put Sale

It has limited upside and a ton of downside. If market volatility is less than what the options price in, you have a profitable trade.

This is a call buy:

Call Buy

Limited downside and a ton of upside. If the market moves more than what the options price in, it’s a profitable trade.

There are many different ways to think about this tradeoff, but for me, it’s about whether you want to own convexity or sell it.

Now think about some of the outcomes…

If the market crashes further, you lose some money on the call buy and get absolutely smoked on the short put.

If the market rips, you get a huge payout on the long call…

And while you make a good chunk of change on the short put, it’s a fixed amount of profit.

If the market goes nowhere, you’ll have a much better outcome on the short put.

Some of my best long trades come in bear markets because volatility works both ways.

Massive moves lower signal that liquidity is trash in the market both higher and lower.

You have much better odds of a ripper of a rally after a deeply oversold market.

When you think about the tradeoffs between options buying and selling, don’t ignore the relative payouts in different market environments.

In this environment, price is not very sticky.

That means we rarely develop tight trading ranges around a current price level.

The “chop” scenario happens when put sales and other option selling strategies work well. In post-crash markets, we rarely see chop.

In fact, you’ll start to see the upside underpriced where call buys provide a much better risk-adjusted advantage relative to the put sales.

In another post, we will talk about the best strike price to buy.

For now…

Check out this free training on our Market Roadmap.

Original Post Can be Found Here