It’s the time of year where every sell-side analyst gives their clients a “crystal ball” into what’s going to happen next year.

You’ll hear about interest rates, sector themes, and hot stock picks. And then your local stock broker will just forward the PDF along to your inbox thinking they’re helping with research.

It’s all too complicated. You don’t have to worry about the macroeconomic environment or some price to earnings ratio.

It all comes down to a single question…

Are there enough institutional buyers set to drive the stock price higher?

That’s it. There’s no way your opinion will be enough to move a stock. You first need to see evidence that institutions believe a stock is a great value and is ready for a push higher.

We use our Trading Roadmap as a way to identify those stocks, and a big component of that is the “point of control.”

The point of control is the zone where the most amount of shares have been traded. If that is clear and overwhelming on a chart, and price is trading above it, then you have very high odds that the stock is about to rocket higher.

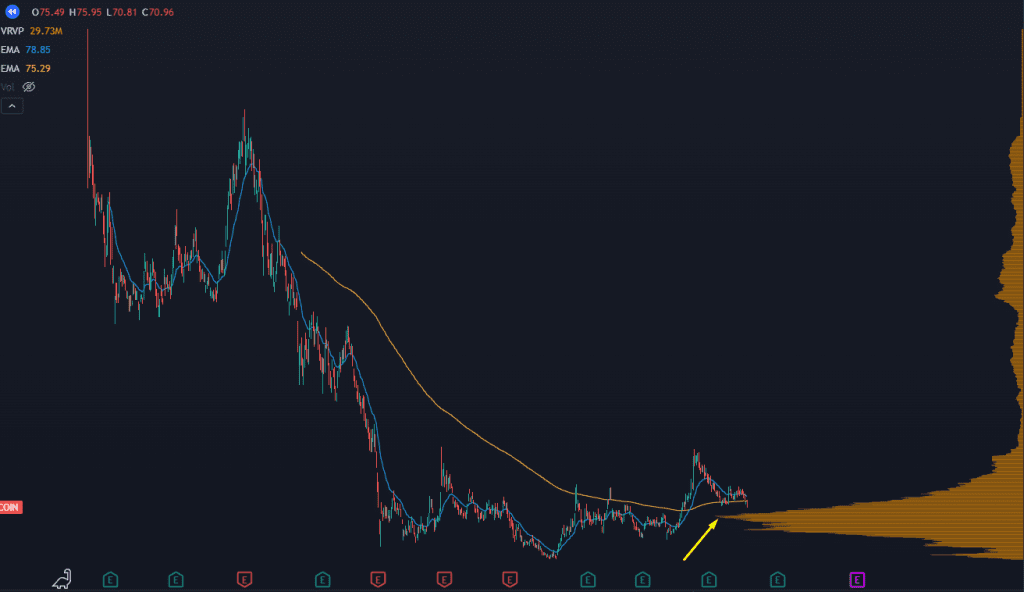

Let’s use a case study on COIN:

The Best Investing Strategy into 2024

A few months ago, COIN was retracing a push higher, right back to its point of control.

Don’t think too hard about this – if the majority of shareholders own the stock at a good price, then they don’t have an incentive to sell. They’re sitting pretty and can simply hold onto the stock.

If there aren’t enough sellers, then the price of the stock has no choice but to go up.

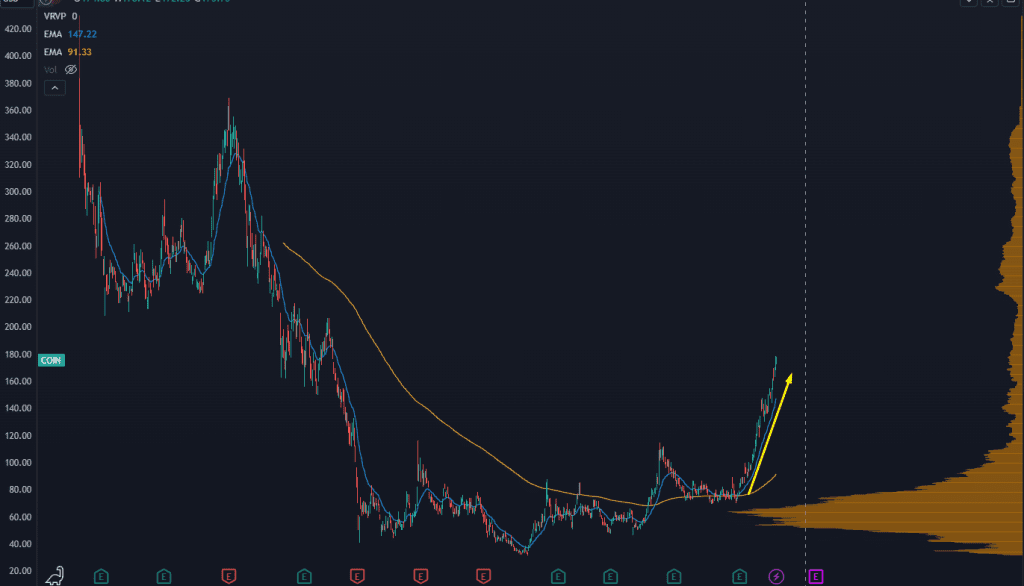

The Best Investing Strategy into 2024

We managed to ride this trend and exit out of some timely call options for a 503% winner.

If you’re looking for solid names to trade into 2024, then find the stocks that have an investor base that has built out positioning and the stock is starting to turn up.

And if you’d like to learn more about the point of control and our Trading Roadmap strategy, I’ve put together a video training that breaks it all down step by step.

You can watch it for free right here.

Original Post Can be Found Here