Watching your money vanish during a market selloff will make your stomach turn.

But you can avoid getting caught unaware using liquidity zones to prepare and profit.

For example, the current selloff in semiconductor stocks (like Nvidia, AMD, and Micron) has forced the tech-heavy Nasdaq into its second consecutive losing week this year.

If you were heavy in tech and didn’t see the selloff coming, you likely lost some money.

Still, as I said earlier…

Let me explain.

If you’ve attended any of my trainings, you may have heard me mention “Lodestone levels.” It’s a high-volume liquidity zone that determines price levels and when you know where the lodestone is, it’s easier to determine where prices are headed before a selloff.

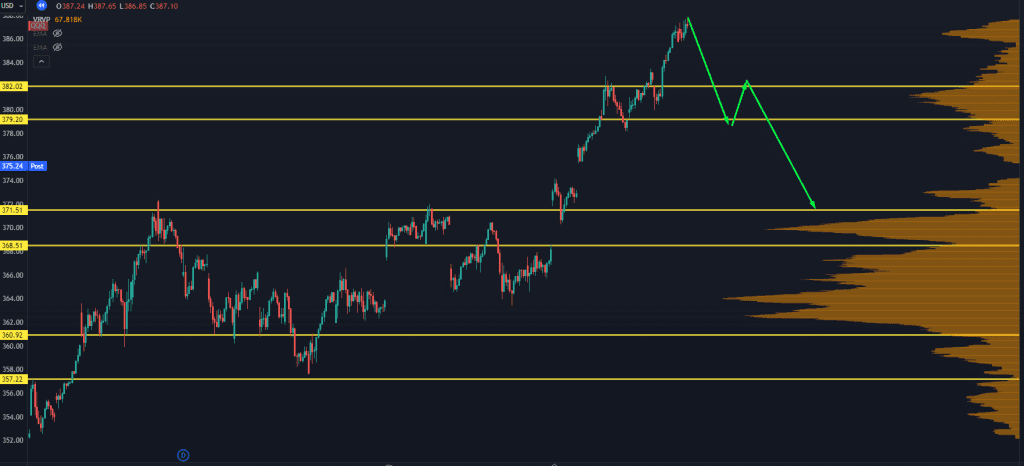

Here’s the Nasdaq at the recent highs before the selloff.

Target Extra Cash During Selloffs

You can see one Lodestone under the current price level (first red line in the chart)…

And a larger one underneath (second red line in the chart).

So if the market wants a deeper correction (like the kind of selloff we’re seeing now)…

It will look for new buyers at the lower end of the Lodestone (lower prices) and retest the upper end of the same Lodestone level (to see if more buyers will accept higher prices).

If more shares are offered at prices that buyers aren’t willing to accept…

It looks something like this:

Target Extra Cash During Selloffs

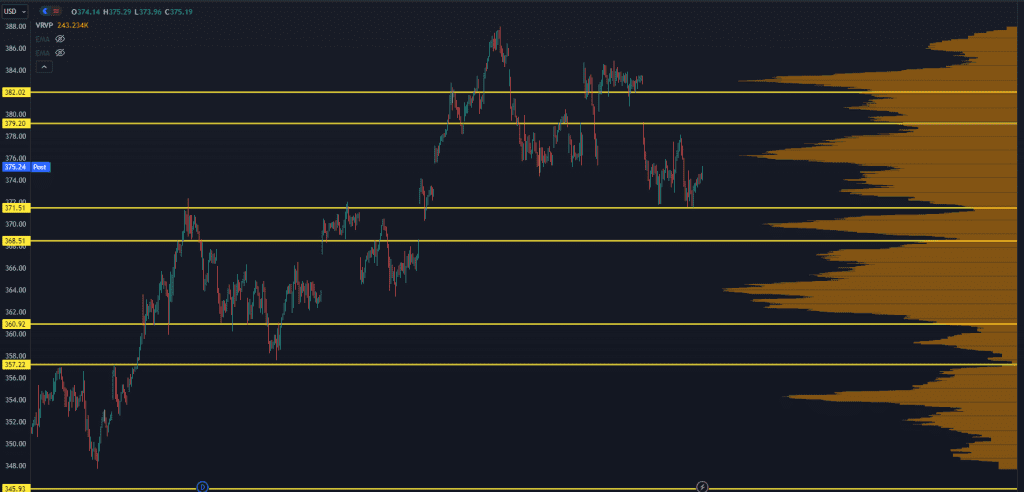

That’s precisely how the market has traded over the last two weeks.

Target Extra Cash During Selloffs

And if you saw this coming, you could’ve structured your trades to leverage the upside for a possible 102 percent gain. Enough to hand you $555 on a $250 position.

Just like we did in our last trading session.

If you need more guidance, I shared more details in my latest workshop.

Watch it here to see three examples of how use this strategy in your next trade.

Original Post Can be Found Here