The markets just had a stellar first quarter.

Long-term portfolios are hitting all-time highs as the indices continue their march higher.

Investors should be fat and happy, right?

Well, that’s true if you owned a semiconductor stock going into the start of the year.

But there’s one group of investors that’s getting grouchier as the year drags on…

Apple shareholders.

These poor schmucks have a YTD return of -11%, while the Nasdaq is up over 8%.

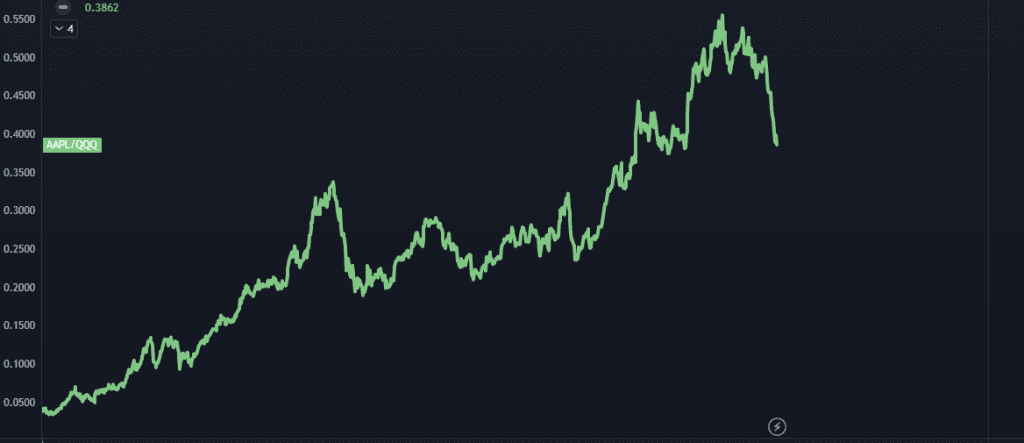

Here’s how AAPL has performed against the Nasdaq 100 over the past few years:

Sour Apples: What’s Next for AAPL Stock?

This streak of underperformance is the worst since 2012 when the stock was down 40% off its highs.

The company has a few things going against it.

First, they seem to be behind the curve on the AI front.

Second, they’re currently facing some legal problems you may have heard about…

Sour Apples: What’s Next for AAPL Stock?

Apple acting like a monopoly? Color me shocked.

I mean, when the largest cell phone maker also controls the app store, it carries some terrible incentives.

But here’s the thing: The headlines don’t matter.

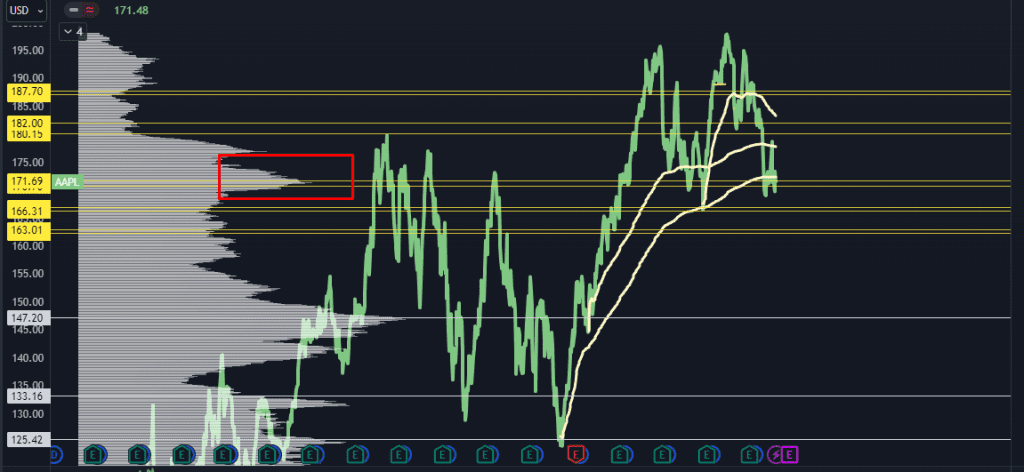

It was almost as if Apple was ready to pull hard into these levels.

Sour Apples: What’s Next for AAPL Stock?

See that red box? That’s where the most volume has traded from the 2020 low to the recent highs.

When a stock fails to push higher after an obvious breakout, there’s a tendency to revert hard back to the biggest liquidity zone.

This is a monster level for AAPL, and for the past two weeks, the stock has seen a “stick save” from buyers coming in and holding this level.

It’s a decision point for the stock. If buyers can keep persisting through the headlines, then this stock is due for a hard snapback rally.

But if it doesn’t, there’s a lot of stuck longs who are going to be wanting a way out.

If AAPL loses this level, the next big liquidity zone would be at 147.20. That’s an additional 13% lower from current prices.

I’m stalking a trade right now in the name, and if we do start to see signs of a bottom in this name, we will load up with some calls to participate in the upside.

In the meantime, I invite you to learn more about these liquidity zones, and how we use them to find monster stock opportunities…

Original Post Can be Found Here