The election season is starting to heat up, and that means only one thing– time to buy some votes.

Political Profits: How One Regulatory Change Is Creating a Goldmine for Stock Investors

This past week it was confirmed that both the Food and Drug Administration (FDA) and Health and Human Services (HHS) want to reschedule cannabis to “Schedule 3.”

It needs to be confirmed by the DEA, but it appears that before the election hits in November, it’s going to be a lot easier to score some weed.

This is a clear political play. Biden’s team has had this in their back pocket for 4 years and are now looking to play it to try and shore up a voter base into November.

This catalyst is still very early, and it’s one where it will take a while before all the upside is squeezed out of the sector.

The cannabis sector has a ton of potential, but it’s still riddled with risks.

Illegal operations are still squeezing out market share. The cartels have set up illegal cannabis grows across the country, stealing water, and threatening farmers that complain.

Political Profits: How One Regulatory Change Is Creating a Goldmine for Stock Investors

There are still substantial banking barriers in the cannabis space. Due to dealing with a schedule 1 drug, these companies do not have access to traditional banking accounts and have to rely on cash payments.

This also means institutional capital can’t buy these companies due to that financial risk– that’s why these stocks may not move hard until the rescheduling is finalized.

One more issue: legal competition is fierce. It’s called “weed” for a reason, because it grows fast and doesn’t require a ton of maintenance.

Many cannabis companies only have an edge due to regulations, and once the shakeup happens then we will find out who are the true winners.

With these kinds of risks, the sector is a tough play… but there is an overlooked corner of the cannabis ecosystem that captures these upsides without any of the downside risks.

The smartest bet isn’t on the product, but on the ecosystem.

It’s like investing in Caterpillar (CAT) if you think industry is going to boom.

Or buying Cloudflare (NET) if the tech industry is about to spend cash.

In the cannabis space, there are companies that provide services to the growers. These are the “picks and shovels” stocks that will sell to everyone– that means they can ride the sector tailwinds early.

There are a few times when the cannabis sector was a “screaming buy.” March 2020 was one of those times– and corporate insiders knew it.

Innovative Industrial Properties (IIPR) is a cannabis ecosystem bet. They sell “grow space” to the cannabis companies.

Political Profits: How One Regulatory Change Is Creating a Goldmine for Stock Investors

In March 2020, two corporate insiders purchased the stock, and their timely investments led to a staggering 463% rally.

Those are the players you want to follow.

Using our corporate insider search, we’ve found another company in the cannabis space.

Political Profits: How One Regulatory Change Is Creating a Goldmine for Stock Investors

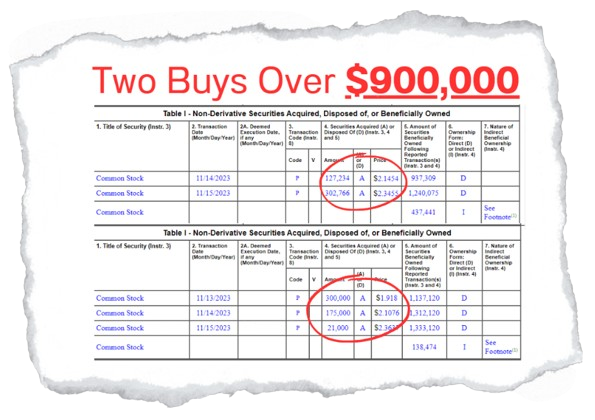

There are two insiders who have made their first open market purchases of the stock ever.

And both purchases were just shy of one million dollars.

This setup ticks off a few things we look for

If this stock sees a simple rally back up to the top of its trading range, then you could be sitting on a fast 34% gain.

Political Profits: How One Regulatory Change Is Creating a Goldmine for Stock Investors

If it hits my first target, you’re targeting 145% in potential upside.

If you’re looking for the very best investments this year, you can’t go wrong following the most informed people in the market– the insiders.

They’ve got the most knowledge about how their company is doing, and if they think it’s worth much more than what it is currently, they buy.

We’ve put together a free training that shows you how to read insider data, and the investment criteria you need to follow.

Dive Deeper into Insider Strategies: Reserve Your Free Training Seat Now

Original Post Can be Found Here