Original Post Can be Found Here…

Original Post Can be Found Here…

Marketwise is a trading education company that has (like so many other things) had a rough 2022. The stock is trading sub $3, and we’ve seen a second big insider buy on this recently.

Back in June, …

I live in a military town. When I walk the dog in the morning, I can hear the Reveille blast out over the speakers and the screech of fighter jets overhead.

Sometimes, I can even feel the windows shake when …

Ah, Elon. The master troll.

We covered Mr. Musk’s Twitter deal a lot when the news first broke earlier this year.

At first, the Twitter board was quite defensive. They tried to ward off Elon by implementing a poison pill…

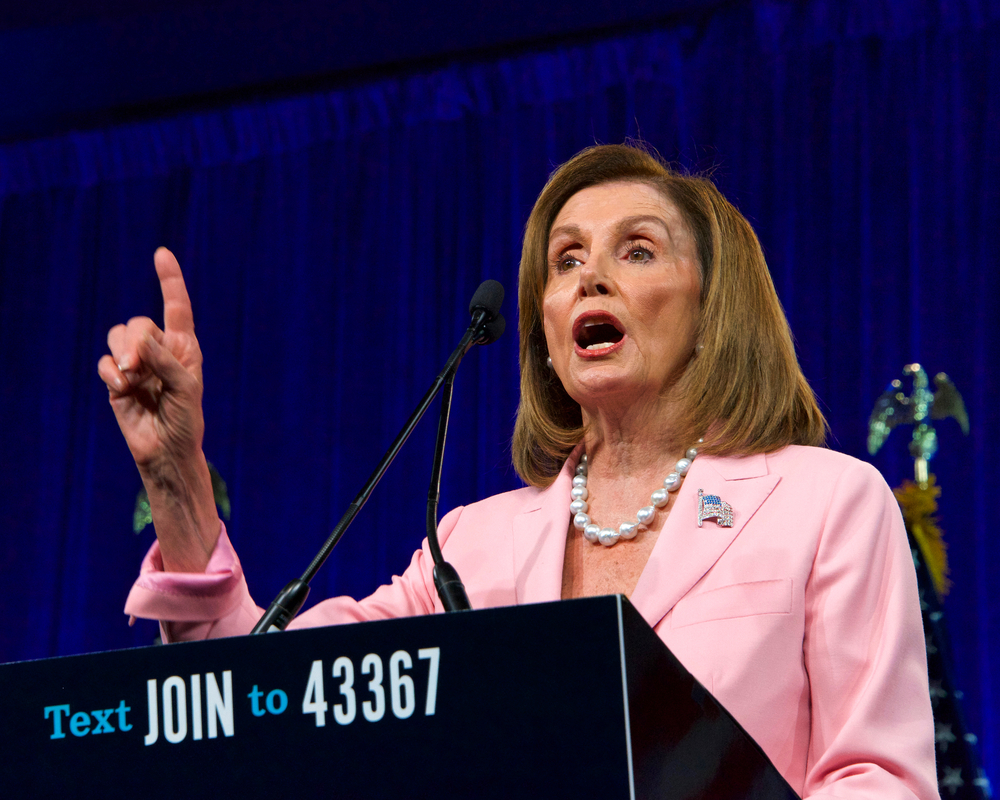

Remember when, throughout 2020 and 2021, all sorts of government officials came under fire for insider trading?

Rightly so — they told us to close our businesses, stay home from work, and lock ourselves inside…

While mailing us $1,200 checks …

Many folks think they remember the “Great Financial Crisis” but didn’t trade through it.

I did.

It was a wild ride.

One misconception from those viewing in hindsight is the idea that it all happened at once…

That Countrywide, Washington …