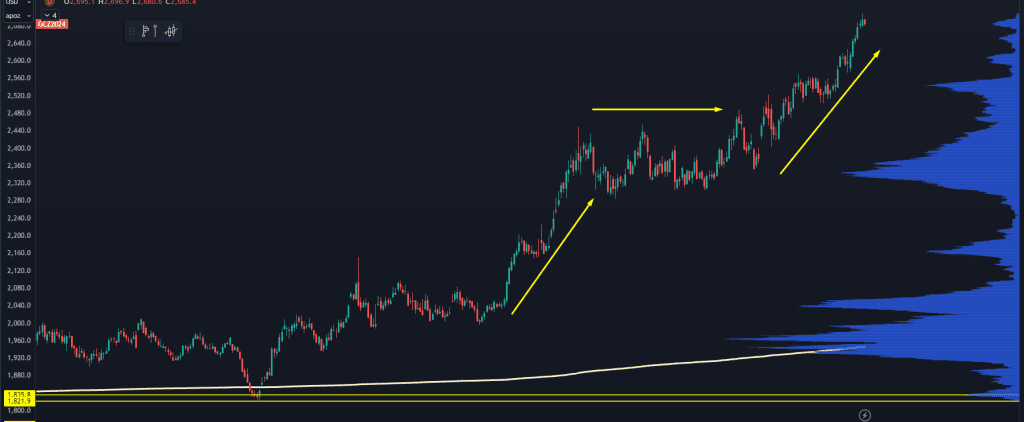

Gold has been a solid performing asset class this year:

It’s up nearly 30% year-to-date.

Gold investors have been bidding up the shiny metal in anticipation of the Federal Reserve easing policy by way of rate cuts.

It’s a trade that has done well in the past:

When the Fed starts to cut, gold rallies – and tends to continue for the next few years.

And it could have some serious legs.

This is a chart of the price of gold indexed to the M2 money supply (basically all the cash that exists).

The money supply exploded in 2020, leading to a ton of dollars and not a lot of assets. This led to a bubble in equities and other risk assets, but it left gold alone.

We’ve got a clear target off the highs from 2011 and 1987. If gold were to rally up to that level, it would be another 40-60% returns for the gold market.

The bull case is clear, but boy is it tough to chase right now.

Instead of focusing on gold itself, maybe start looking at gold miners. Many of these are leveraged to the price of gold, and now that we are seeing disinflation, they may start seeing improved margins.

Case in point is the whale of the industry: Barrick Gold.

It had a much larger “moat” back when gold was ripping in 2008- 2011.

You can dive down even further and start looking for names that the market has passed over.

We’ve got a silver play just like that in Gatos Silver (GATO).

We saw a ton of corporate insiders buying the stock, and we made the call to pick up shares at $4.89.

As I write this, the stock is at $16 – a solid return of 227%.

We’ve found another precious metals play with massive upside.

The company has about $150k in debt on their balance sheet and a decent chunk of cash:

So: Why hasn’t the stock lifted as gold has run?

It’s a great question, and it’s why the stock has so much untapped potential.

This company hasn’t started production on their mines yet. In fact, I don’t think they’ve even announced the capacity that’s available on their discoveries.

No hedge fund or institution is going to load up the boat on a company so risky – that also means if you’re reasonably certain that the gold miner has good assets, you get in cheap before everyone else knows about it.

I’m not a gold mining expert. But do you know who is?

The Vice President of Exploration. And when he goes out and buys $50k of stock after not buying a single share for years… that’s a huge signal.

Why would the VP of Exploration, who knows every nook and cranny of their mine, load up on the stock unless he thought it was a sure thing?

The stock has triple-digit upside written all over it. And I’ve already sent the details to my paid-up members.

If you’d like to learn more about the strategy we follow and how you can access our premium research, click here to watch a free training video that explains it all.

Original Post Can be Found Here