Ever heard of the “Dogs of the Dow”?

It’s a classic stock strategy that’s been around for a few decades at least.

The idea is that you pick the stocks in the Dow Jones Industrial Average that either have the highest dividend yield, or the lowest P/E ratio, or the worst price performance.

By ranking stocks like this, you can see the names that have underperformed the index.

Many times there’s a good reason for the underperformance.

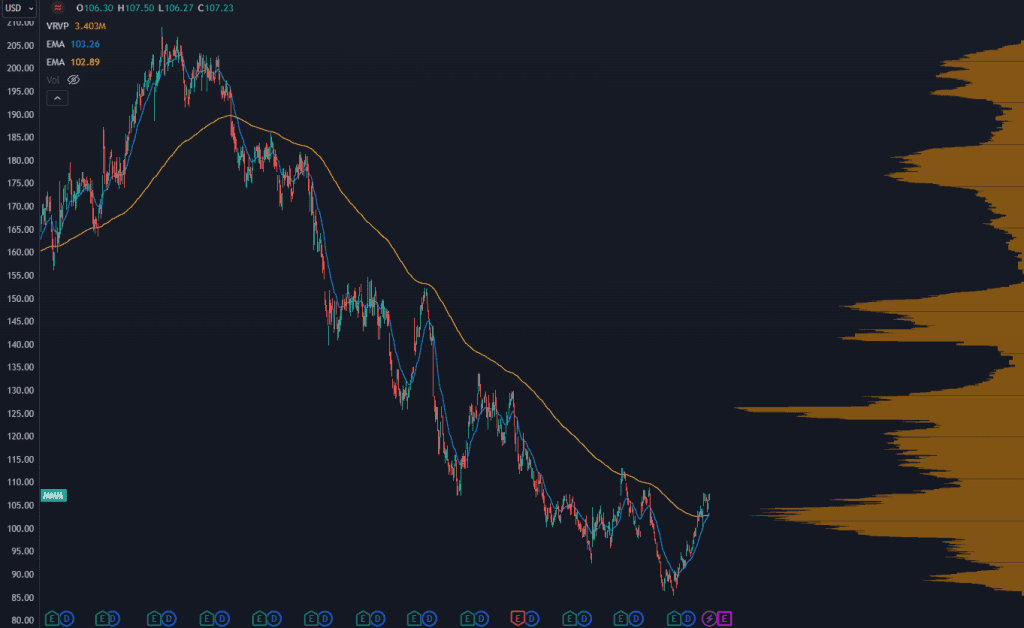

For example, 3M (MMM) has had a rough few years:

New Twist on a Classic Stock-Picking Strategy

There have been fundamental drivers behind this – they sold bad products to customers like the Department of Defense, and now they’re having to shell out $6 billion in a settlement.

You also need to consider how interest rate volatility has come into play.

If the 10-year Treasury is trading at 5% and a stock has a dividend yield of 3%, it’s not a very compelling investment for institutions and won’t attract capital flows.

But if you have the Fed signaling that they are going to cut rates, then these names could rally quickly into the first half of the year due to shifts in risk allocations.

There’s a better method for vetting these names – instead of trying to nail the bottom on a high dividend stock.

Instead, look for when the corporate insiders are plowing cash into the stock.

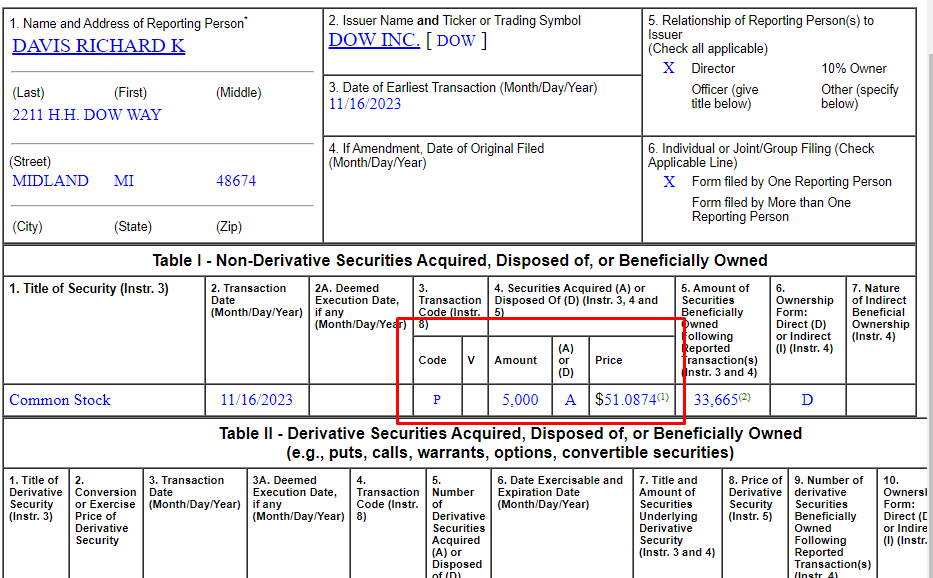

Guys like Richard Davis:

New Twist on a Classic Stock-Picking Strategy

He’s a director at Dow Chemical. On November 16th he purchased 5,000 shares of the stock.

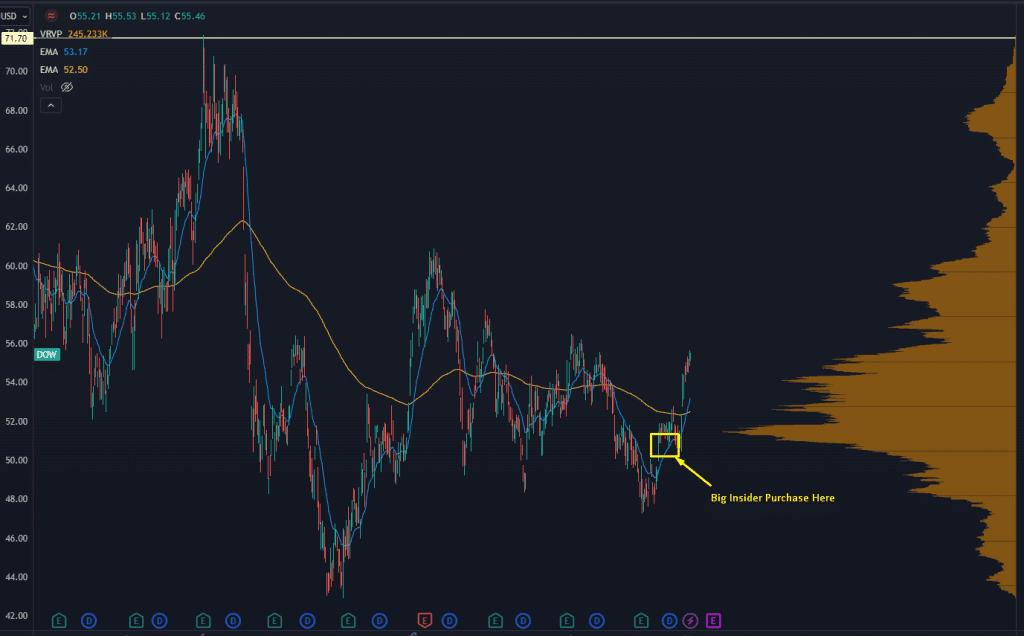

…Right before it launched higher.

New Twist on a Classic Stock-Picking Strategy

We’ve already picked up exposure in a healthcare and consumer stock in the Dow index using this very method.

If you want to see exactly how we do it, check out a free training video where I walk you through it step by step…

You can watch it for free right here.

Original Post Can be Found Here