A couple months ago, I was invited to Palm Beach for the “Free Speech Investment Summit.”

It was an opportunity to do a “deep dive” into the company Truth Social. I got to speak with the company’s leadership, interview the CEO, and get all my questions answered.

My better half and I at Mar-a-Lago

Unfortunately, the “field trip” was incomplete because Truth Social’s political leadership was forced to be in a courtroom in Manhattan, as they were battling yet another high profile lawfare case.

That court case ended with a “guilty” verdict against President Trump. Granted, the judge had to do some fancy footwork to secure the conviction, and it will be overturned in higher courts.

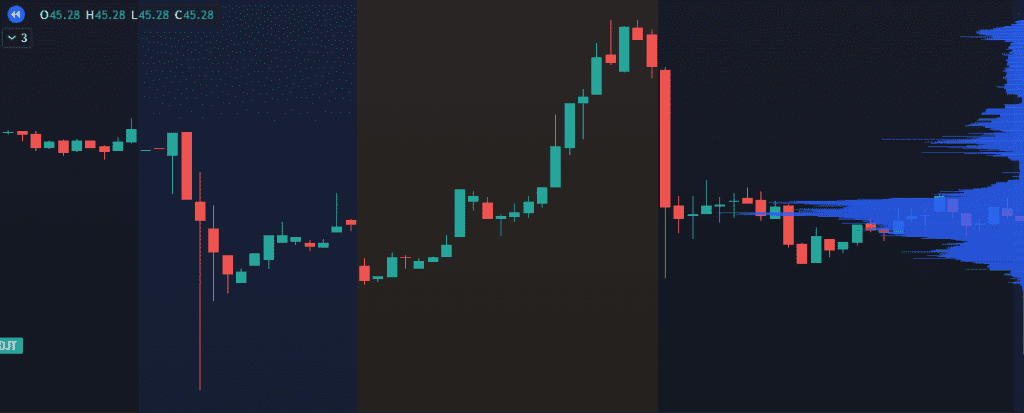

When that headline hit, here’s what the stock did:

Volume and volatility picked up in the after hours session. The stock sold off 15% aftermarket, then slowly climbed back up overnight before getting hammered on the open.

The price action confirms what we all know to be true: This company is directly tied to the largest shareholder of the stock, President Donald J. Trump.

And I’m bullish on the company.

In this analysis, I’ll lay out the stock’s long-term case, with the risks and rewards fully laid out.

The official name for the company is “Trump Media & Technology Group.” The company owns Truth Social, and the stock ticker is DJT. (In this report, we’ll refer to the company as DJT.)

This is a hot button stock – virtually untouchable for institutional investors. They have zero analyst ratings.

A Financial Deep State absolutely exists, and anyone who brings a positive light to change the narrative on the company will be flooded with haters.

That’s fine. Financial speculation will always have an inseparable political component to it, understood by many but rarely vocalized.

To illustrate this, let’s go 20 years into the past…

In 2003, the United States was gearing up for the Iraq War. The markets were still on shaky ground after the tech bubble, and economists were screaming about how the war would crank the deficit higher, causing the markets to drop.

The S&P 500 kicked off a four-year bull market shortly after.

It’s impossible to profit from a political signal. What matters is the interaction between narrative and liquidity.

Currently, DJT has neither.

The liquidity is on the “net selling” side of thighs, and any bullish narrative to come out of the company will be smothered in its crib.

That’s going to change, quickly.

Institutional capital has solid reasons to avoid the stock. Here was my first pass into researching the company:

This is a multi-billion dollar company?

There’s two potential outcomes here. If the company stays as it is, it could be a huge short play as it eventually starts running out of cash and is forced to dilute the stock.

But if it finds a way to grow the business, the narrative changes. And I’ve discovered three hidden growth signals that chart a path to profit for savvy investors.

Those growth signals are Brand, Beachhead, and Bridge.

How much is a brand worth?

Not the company, but the actual brand?

It’s not an easy question! You could run comps, attribute sales, or back out equity pricing.

Yet it is possible.

Coca-Cola’s brand is an intangible asset. Everyone on the planet knows there’s goodwill baked into the company.

At the time of this writing, Coke’s brand value is $100 billion. And that seems justified!

What about DJT?

Remember, the largest shareholder is Donald J. Trump. His persona is a brand – one he’s been building for decades.

DJT gets a piece of that brand value to leverage in their company.

Here’s a quote from their annual report:

“[The Company’s] success depends in part on the popularity of its brand and the reputation and popularity of President Trump. Adverse reactions to publicity relating to President Trump, or the loss of his services, could adversely affect [the Company’s] revenues and results of operations.”

Let’s not kid ourselves: This company is the representation of President Trump in equity form.

And the market has no idea how to price it.

After the “felony conviction” we saw volatility in the stock pick up, because the current market liquidity is not large enough to adapt to shifts in the “brand” of Trump.

Here’s a chart of how DJT traded after the Butler assassination attempt:

The man gets shot in the ear, stands up, and screams “fight.”

That was a 50% rally in the stock in a single day! Because the brand perception shifted.

This is a massive edge. When the market can’t easily agree on the price of a stock, then you can trade those swings for profit.

And right now, the market is undervaluing not just Trump’s brand, but the ability to leverage it.

After all, this is the same brand that won a Presidential election, with the potential to do it all again this November.

This is also why there is a massive risk premium in the stock, because the fate of the company rests on the outcome of the U.S. election.

I personally think Trump will win the 2024 election. The margins are too wide, the external polls are looking terrible for Harris, and the internal polling is even worse.

Assume the election is over and Trump will be re-inaugurated in January.

What’s the value of Trump’s brand then? What’s the value of having exclusive rights to leverage that brand with DJT?

This brand is no longer about selling steaks and golf to consumers – it’s the key nexus of political and financial power.

Regulatory risks go out the window. Doors get opened.

The company will finally have the oxygen to grow.

In speaking with DJT CEO Devin Nunes, he kept using the word “beachhead,” a word that didn’t come into use until WWII.

A beachhead is an area of hostile territory that, when captured, allows a military to establish a logistical foothold to expand into the war.

Mr. Nunes considers his Truth Social users to be the “beachhead” of the company. They’re loyal to the brand, yet the company has yet to realize value from them.

But that’s because they aren’t exactly able to provide value to their users, either.

Again, a large regulatory and judicial cloud changes over the company because it is allied with Trump. That cloud disappears in January 2025, assuming he wins the election.

The company needs to keep growing the beachhead. They need to attract and hold onto their user base, and start thinking of ways to help them so they can drive revenue.

A company cannot run on brand alone.

And a multi-billion dollar company can’t justify its valuation with a few million digital users. The company needs to find a way to bridge the expectations of the company’s future into actual cashflow.

This is where the rubber meets the road. This is how we find out whether a multi-billion dollar valuation is warranted.

The road is a steep uphill grade, and company leadership is aware of this. In speaking with Nunes, I found we were on the same page with next steps.

The company has a serious war chest – about $350 million in cash that can be deployed to leverage both the brand and the beachhead. There are buyout targets that exist right now that would be massively accretive to DJT’s value… but it’s not going to be what you think.

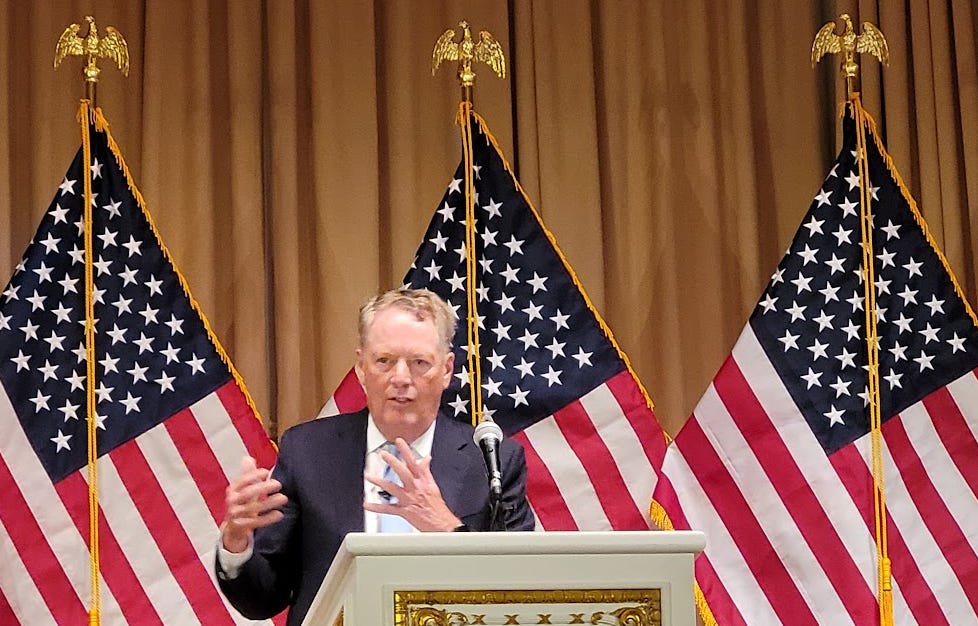

During my field trip to Mar-a-Lago, I sat down to dinner and listened to a talk from Bob Lighthizer, who was President Trump’s trade representative.

It was a lovely meal with good company… and the wine was pretty good.

It was, of course, Trump branded.

President Trump, through existing businesses, has several consumer product lines. Golf, steak, water, wine…

DJT expanding into the consumer space would be a mistake.

The margins aren’t there and there would not be an immediate “step up” in the valuation of the company.

What should they be focusing on? Look at the current mission statement:

“[DJT] is a social media and technology focused company whose mission is to end Big Tech’s assault on free speech by opening up the Internet and giving people their voices back.”

In other words, they want to protect free speech and get paid doing it.

It’s a good start – but the scope should be drastically expanded.

In the current political system, “free speech” isn’t shouting in the town square about how bad the King is.

Free speech is about power. This power controls the movement of capital.

When a social media platform bans your account because you said mean things about FEMA, it means you’ve lost control of your mimetic capital.

When a bank closes your accounts because you wrote some mean tweets they don’t like, it means you’ve lost control of your financial capital.

When you can’t hire the best players because they would be ostracized from their industry, then you’ve lost control of your human capital.

Each of these forms of capital controls can be a major profit center for DJT. And if they aggregate and control more capital, then they are undervalued.

In the battle of Gaugamela, Alexander the Great faced a much larger force led by King Darius III.

Instead of attempting a battle of attrition, Alexander chose to do a direct assault on Darius’ main forces. By threatening the King himself, the Persian forces were forced into a formation that allowed Alexander to drive up the middle and secure a decisive victory.

It would be easy for DJT leadership to try and dance around various regulatory bodies and narrative controllers, doing a piecemeal job of assembling a technology company.

This would be a mistake!

In 2025, the timing is right for a full frontal assault with as little nuance as possible. The political winds have changed to make this a possibility.

I had some fun with this, and I bet you will, too.

Imagine you’re a company with $250M and a tailwind from the Federal Government. What would you buy?

It goes back to who gets to control the flow of Capital, and there’s plenty of opportunities out there.

Truth Social is a platform that is political in nature– much of the content surrounds current events and domestic policies. Many of these users are internet refugees from other platforms that kicked them off in 2020.

The company is expanding its control of Mimetic Capital with a recent deal to stream live TV and video on demand with a new content delivery network (CDN).

This deal provides them the censorship-resistant infrastructure needed to grow their reach.

Their acquisition also allows e-commerce integration into their videos, a leverage point that appears to be glossed over by many.

What are some other plays in this domain?

Due to political risks over the past 4 years, DJT has been required to build out their own infrastructure from the ground up.

They can use that to their advantage by acquiring a data center or server farm. They would immediately have customers to fulfill in that space, and they would have some tailwinds with the current AI trend as the value of server space could get more expensive over the next few years.

All of your emails are being read by Big Tech and Government– which is what you get with a “free” product.

It doesn’t have to be like this. DJT could create a privacy-focused email service and tie it back into their current Truth Social users as a premium feature.

Proton Mail is open source and wouldn’t even require a full acquisition, just a few very capable individuals that could build out the platform.

US cell phone providers are an effective monopoly. There’s no privacy and no competition.

Creating a Truth Social white label around a cell phone service would do exceptionally well.

For example, Consumer Cellular targets older Americans, and was sold to private equity in 2020 for 2.3 billion.

DJT could take it a step further, partnering with Erik Prince who just created a privacy-centric smartphone.

The past decade is littered with stories of people who were fired from their jobs because they didn’t have the right politics.

In response to this, people have been grouping together and forming parallel structures to the current ones in power.

DJT could use that as a tailwind to expand into areas that would allow their user base to thrive.

The jobs marketplace is full of bad incentives that make it difficult for quality candidates to find the best opportunities out there.

If DJT can find a way to disrupt a part of this industry, then they have the potential for some serious revenue.

The CEO of Linkedin just reported that they earn about $7 billion a year from hiring and learning.

DJT can take a slice of that and enhance the results for both job seekers and headhunters who want to operate in a more permissive environment.

An emergent trend across the U.S. is to create areas where your neighbors become your network.

Gather enough like-minded people together, pool your resources, and look to buy land in an area that has good governance.

This is no pipe dream– here are a few examples:

DJT could start grouping people together and looking for ambitious real estate projects in Red States. I don’t think the timing is right yet, but into 2026 there may be some opportunities to expand into this space, especially if President Trump moves on his plan to create 10 new “freedom cities.”

A year ago I would not have even suggested this. The regulatory landscape has been a tough one as various government agencies attempt to crack down on financial institutions that threaten their power centers.

Now, it seems to be a straightforward bet. Gary Gensler is going to be thrown out of office, and the pool is open again.

The Trump campaign is now a pro-crypto campaign. We are now seeing “whales” in the crypto space openly donating to President Trump’s campaign as they are fed up with current leadership in the SEC and the uneven nature of enforcement from Chairman Gensler.

DJT should build out a crypto ecosystem inside of Truth Social. It could either be done through decentralized crypto protocols, or from acquiring a crypto firm that already has AML-KYC protections built out.

A target I’ve thought of would be WonderFi, a Canadian crypto exchange that is associated with Mr. Wonderful, Kevin O’Leary. The company currently trades on the TSX with a market cap under $150M and would be an attractive target, especially if equity financing were used.

Small business owners are a source of strong support for President Trump in the 2024 election, and they can become just as loyal a client base.

As the company has already acquired a video CDN with e-commerce capabilities, that can be rapidly expanded.

Individual brands could get sponsorship deals inside of Truth Social where there is an option to buy directly on the site.

An expansion of this idea would be to create a competitor to Shopify. You provide businesses access to merchant accounts and order forms that can be deployed directly onto their site.

This is where the value unlock could accelerate with the pre-existing network effects from the Brand and the Beachhead.

There’s a new form of company funding available that gives regular folks access to the private equity market without requiring to be accredited. These funding structures are known as RegA and RegCF.

It is still a new ecosystem, but it’s starting to show signs of growth as it allows companies to get funded without dealing with the constant demand for liquidity from larger players.

DJT could create or acquire an equity crowdfunding platform that would be a massive value add for the company.

DJT could take a stake in the company and help raise capital through their equity crowdfunding platform. Given the profile of Truth Social users, I wouldn’t be surprised if they could quickly raise tens of millions from that user base.

The companies could then use that capital to grow, raise more money, then go for an IPO, allowing early investors and DJT to earn a serious return on their capital. These companies could interface with the rest of the DJT ecosystem. If DJT owns the infrastructure, the audience and the payment rail, then each part becomes much more valuable when they are combined as a whole.

DJT has plenty of upside that is not being priced into the stock, and I think it presents a compelling case to place some long bets.

The large company risks are straightforward. If they do not execute on a plan that grows revenues, then they will not earn the narrative that attracts investors.

There’s also risks to the brand. If the election doesn’t turn out like I predict, or if a Very Bad Thing happens to the President, then that creates serious risks for the company.

A big Lie on Wall Street is that the Company and the Stock are the same thing.

That’s simply not true!

A stock is in a marketplace with a limited number of buyers and sellers. Sometimes there are dislocations between the perceived value of the company and the actual value of the company.

We’re going to wade in the weeds of the markets for a moment.

If you have a large owner of stock and they want to sell, they will drag the price of the market lower until there is enough demand from new buyers. There was a perceived risk that President Trump would dump his stock, yet that has been put to bed.

This can also happen if a collective group of stockholders wants to get liquid at the same time. It’s why we have lockups after an IPO.

In June, the company filed an amended S-1 that allowed for more shares to be created through the exercise of their warrants. In July, the company announced the cash conversion of warrants, providing an additional $105M to the company. This can help the company be more acquisitive, yet the tradeoff is it dumps supply on the markets.

And unless there’s enough demand to soak that supply, the stock will auction lower.

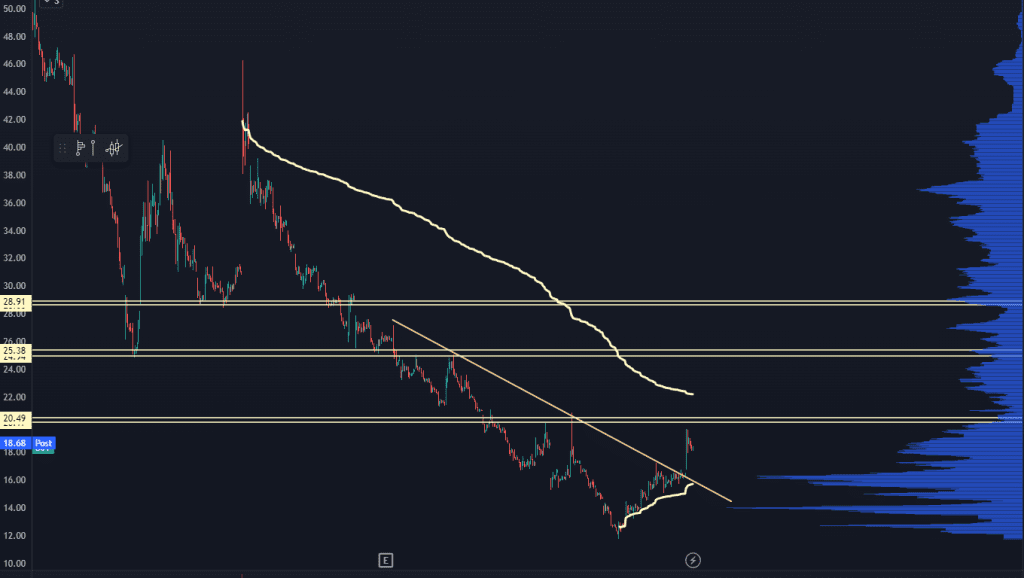

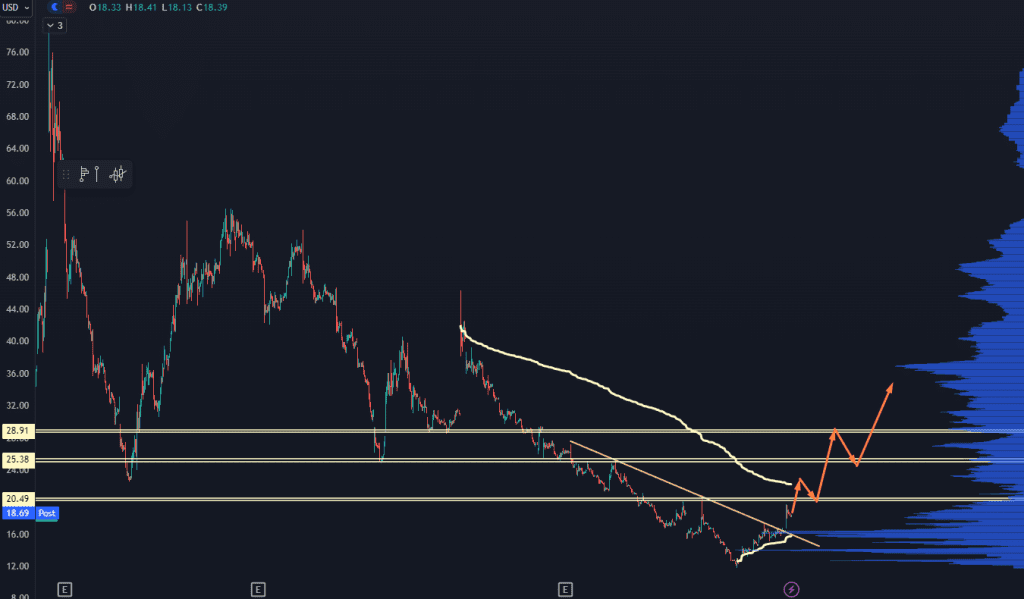

Which is what happened:

After the gap up on the Butler news, shares flooded the market as warrant holders got out with a massive return. Good for them, but it introduces psychic damage onto the stock and causes it to be in a downtrend.

During the market bubble in 2021, dozens of new firms became public through the use of Special Purpose Acquisition Companies – SPAC for short.

Instead of using a traditional IPO, you pool investor capital into a “blank check” company and perform a reverse merger by bringing a company online.

DJT was originally a SPAC called “Digital World Acquisition Company,” and they raised the initial capital through various Anchor Investors. Those Anchor Investors had a huge win on their hands, but their ability to exit is tricky as they will break the stock if they head for the exits.

So, like the warrant holders, they have been working their way out of the stock. Not a panic, just an orderly downtrend. Not much capitulation is needed as most of the sellers are operating from a basis much lower than the current price.

Coming back to the company… DJT’s team will need to execute. In 2025 they will have the wind at their back and a ton of cash to work with.

Success is not guaranteed! The markets are littered with dead tickers of companies that tried to buy their way into growth and failed. They’ll need to make sure the deals are clean and immediately accretive, and that the margins are good enough that they have room for error and don’t have to spend much on growth.

The cash gives them the runway. The clouds are clearing. But if they fail to launch, the stock isn’t going to budge.

By the time the Narrative has shifted and the good news is known, the stock has already priced it in.

To be a successful investor and trader, you need to watch for the shifts in Narrative and Liquidity. We’re now seeing that.

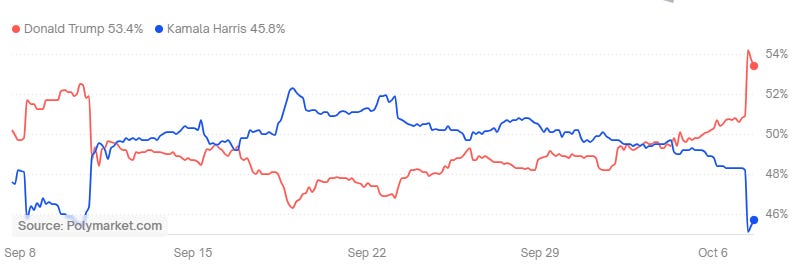

This screenshot is from Polymarket, a blockchain prediction site. Vice President Harris had a bump after doing the “hot swap” with President Biden, but that lead has been reversed and eliminated.

The vibe check is clearly pro-Trump. He hosted a second rally in Butler, where he was shot. Harris has bombed a handful of softball interviews, and there’s dwindling narrative control that’s held by legacy media.

The early voting numbers coming out of Virginia may decide the election before it even starts.

Of course, there’s always the possibility of another “anomalous” event like in 2020, but we aren’t locked down with COVID and St. Floyd protests. The GOP seems to have a decent get-out-the-vote campaign and legal infrastructure they desperately needed four years ago.

It’s always uncomfortable making a “call” in the political sphere. But this is trading, and you don’t have to be fully correct to make money.

There’s a phrase in trading that says “buy the rumor, sell the news.” And as President Trump’s momentum accelerates, you will start seeing a change in how DJT trades as more people buy in anticipation of good news.

It’s like when investors buy Apple aggressively into an earnings event— not because they know the outcome of earnings, but because the anticipation of it drives the stock price higher.

Again— what’s the value of the Trump brand leveraged with DJT operations?

How could that perception change over the next month?

We’re about a month away from the election. If we treat this like a “catalyst” event, then this would be a great time to start looking for a rally driven by the stock.

I’ve already mentioned the SPAC and warrant holders, and how that’s been a hangover in the stock.

And we have seen exactly that:

The top yellow squiggly line is the anchored volume weighted average price (AVWAP) against that high. If the stock price were to hold above that, it would signal a good change in trend.

The stock also broke back above a downtrend line on good volume on Oct 7th, holding those gains.

Sellers could show up at 20.50, then another big pivot level at 25, then another one at 29.

If the stock’s narrative shifts hard enough, then many of these prior resistance levels will not hold well, because the people that needed to sell— the SPAC and Warrant holders— have already done as much and they won’t be using those prior pivots as reference points.

A reasonable hypothesis for emergent price action would look something like this:

Given the volatility of the stock, it’s not unreasonable to see 25% – 50% swings in the price. If you do choose to invest, make sure you understand how to adjust your position size for the kind of volatility in the stock.

The DJT story is a fascinating one, like standing in a river eddy with different narratives swirling around us.

Even if you don’t touch the stock, I hope my thoughts about how stocks and markets operate give you some insight into how you can better approach the markets.

I’m sure you’ve seen the big legal blocks underneath any kind of stock research. We’ll just do a “Cliff’s Notes” version of it.

First, I’m not your broker, financial advisor, or mother. You’re responsible for the gains and losses you have in financial speculation.

Second, this stock is a wild one that can move big, and if you’re an idiot you can blow out your account.

Third, while I tried to make sure that all my research is accurate, I could’ve screwed up somewhere. Since you’re responsible for your own investing, I’m sure you’ll go do research to confirm my findings.

Fourth, I’m a trader, which means I’m not going to tell you my exposure to the company. I could be flat, I could be “all in,” I could even be short by way of options.

I wasn’t financially compensated to make this report.

I did receive “non-cash” compensation in the form of a flight, hotel, and meals to go look at the company. If you think you can bribe me with a free breakfast buffet, you’re absolutely right. I will give your company consideration but not endorsement. My research is my own.

Original Post Can be Found Here