While the markets are well off their highs, it's been a bloodbath under the surface.

I'll give you an example from yesterday — UPST after earnings:

UPST Chart

Six months ago, this stock was trading above $380 per share.

It had earnings yesterday…

And now it's down to $33.74.

It’s simple: the market has been working off excesses developed by the post-pandemic mania.

In fact, we could be approaching a full washout in the market.

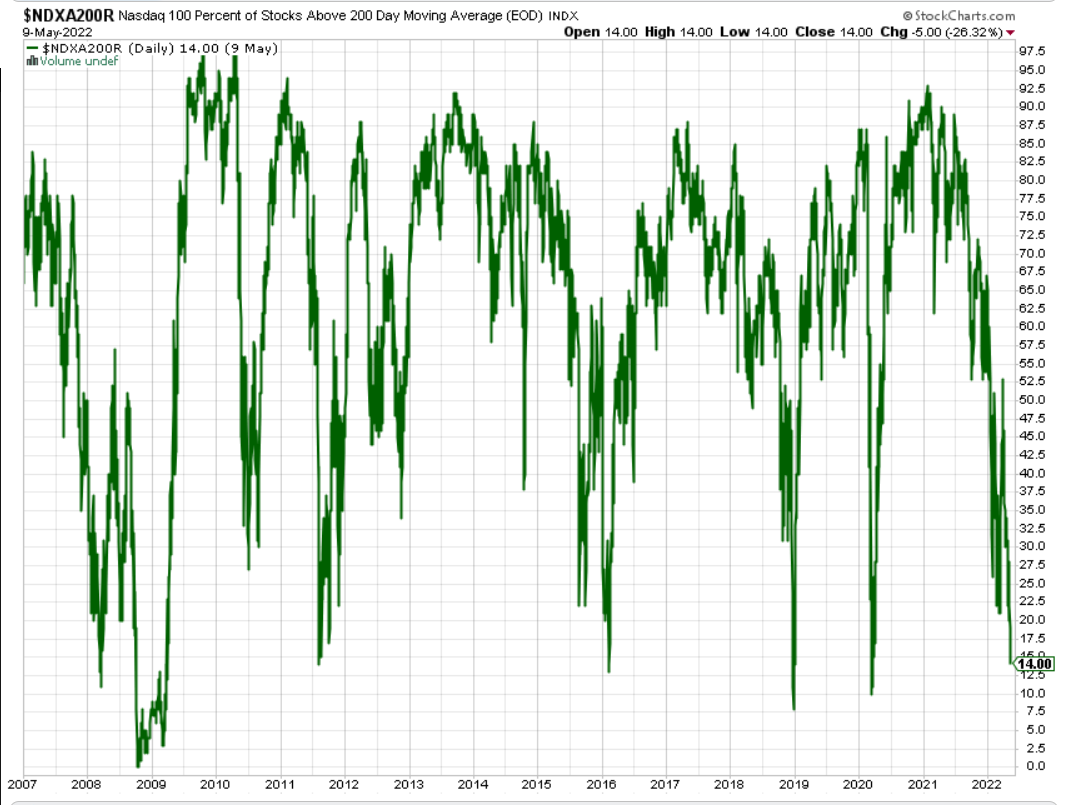

One of my favorite breadth indicators is NDXA200R.

It shows us the percentage of stocks in the Nasdaq above their 200-day moving averages.

In a bull market, it will hover near the highs. Once enough stocks go sideways or sell off, the 200-day moving average will catch up with price… and then the signal shifts.

Here is what the indicator is showing us right now:

NDXA200R Chart

This shows us that 14% of the Nasdaq 100’s stocks are above their 200-day moving averages.

This doesn't happen very often. And as I wrote near the end of April, anything under 20% (and sometimes slightly above) has typically correlated with a MAJOR market bottom.

Let's go through some of the times this signal has been super low like this:

2008 - the Nasdaq rallied 25% before the crash hit.

2009 - Great Financial Crisis lows

2011 - Fiscal Cliff lows

2015 - August Chinese Currency Crisis

2016 - Taper Tantrum lows

2018 - Tech Crash lows

2020 - Pandemic lows

Yes, I know. This time could be different. Maybe the market bottom won't hit for another 10%.

Yet this washout indicator has a pretty good long-term track record.

Along with that, some of our key levels from Monday were hit, so we’re leaning towards a bounce.

At Precision Volume Alerts, we’ll be much more aggressive with our trades now that we’ve hit these levels.

In fact, we recently issued two trade alerts on names set to benefit big-time if the market bounces.

If you want it:

Watch this free presentation to get the details on Precision Volume Alerts.

Original Post Can be Found Here