Maui could end up being the worst wildfire that’s ever happened to the United States.

A combination of bad weather and extreme government incompetence have left the west side of the Island devastated.

It’s hard to get a straight answer from anyone nowadays. Government officials are stonewalling, legacy media is ignoring, and social media is blasting out a million different hot takes all at once.

We probably won’t get a straight answer out of this, but I’ve got a few ideas on causes.

And I can tell you, those fires didn’t kick off because the Earth is “warming.”

They’re trying that line with the fires in Greece – that somehow fires are just popping up because we’re driving too many SUVs.

Then these headlines start coming out:

Maui Wildfires: Have We Seen This Before?

The arson is so bad, that local Greeks are forming private squads to stop people from lighting stuff on fire.

That’s a possibility in Maui… but it could just be one giant screw up.

Maui Wildfires: Have We Seen This Before?

The current accusation is that downed power lines started the wildfires.

This is a messy situation, and it’s going to get uglier… but that lawsuit headline brought me back to an old trade from a few years back.

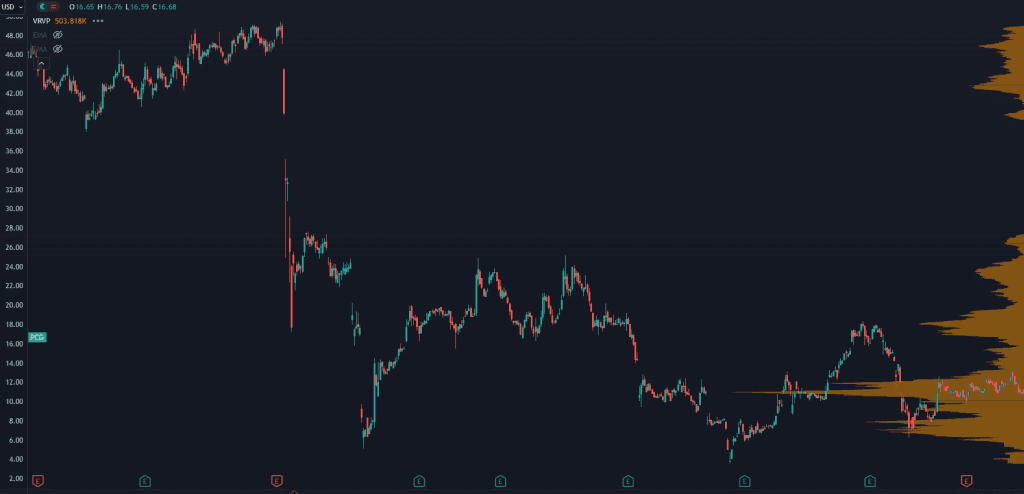

Back in 2018 there were some nasty wildfires out in California, and it appeared that Pacific Gas and Electric (PCG) was responsible.

It was the deadliest year for fires in California. When all was said and done, PG&E fessed up to being responsible for 84 deaths.

And someone made a ton of money into that trade.

Here’s a chart of how PCG traded during their 2018 crisis:

Maui Wildfires: Have We Seen This Before?

Ugly moves, right?

Yet at the dead lows of the market, someone made an absolute fortune buying shares and calls.

How did they know that the stock was ready to run?

A fund had a well placed source inside the court.

No dirty tricks here… they just had someone sitting in the courtroom — and the minute the verdict came down, that person relayed the information to the fund, which loaded up.

Millions of dollars earned in a single day. They took advantage of an information arbitrage, fair and square.

Now folks like us don’t have the same kind of resources as these funds. We’re not going to have well-placed sources inside courtrooms.

Yet I can tell you that I do have a few sources in the corporate world.

And when they tell me they’re buying shares, I just follow along — often to the tune of hundreds of percent in gains.

Again — nothing dirty here. It’s all 100% above-board.

I explained the whole thing in a free training video… and even gave the details of a few different stocks I’m watching right now based on these sources — just click right here to watch it now.

Original Post Can be Found Here