Learn how to follow insiders into stocks with explosive potential (full details here)!

Let’s talk meme stocks…

Remember GameStop, AMC, and the “meme stock” frenzy from early 2021?

They effectively created the market top and caused the initial push into the bear market that followed.

Well, we’re coming out of it, and a lot of those meme stock names are seeing moves in a way that’s not often discussed.

(Side note: I watched the first 30 minutes of “Dumb Money,” the movie based on the meme stock saga, on an airplane.

Interestingly, I was one of the few who actually called the GameStop squeeze before it happened based on what I was seeing in the options market, and a few days later, I talked about GameStop topping out, which made me quite unpopular online.)

I bring it up because one of our key strategies is following the purchases of corporate insiders.

CEOs, CFOs, directors, VPs – people who know better than anyone else what’s really going on inside the company.

We do this by looking for significant buys – high-conviction buys – where they clearly expect the stock to go up.

We then identify potential catalysts that could spark such a move, like an FDA approval, an earnings beat, or a potential merger.

We also see thematic plays too, like if a lot of energy executives start buying up energy stocks.

One name worth looking at is Beyond (BYON), a combination of Overstock and Bed, Bath and Beyond.

A company director, Marcus Lemonis, started accumulating a position beginning around October 2023.

He bought shares between $15 and $17…

And the stock has climbed 113% since his purchases.

Here’s another name that came up recently: Blackberry (BB).

But I’m going to show you why it’s a bad trade.

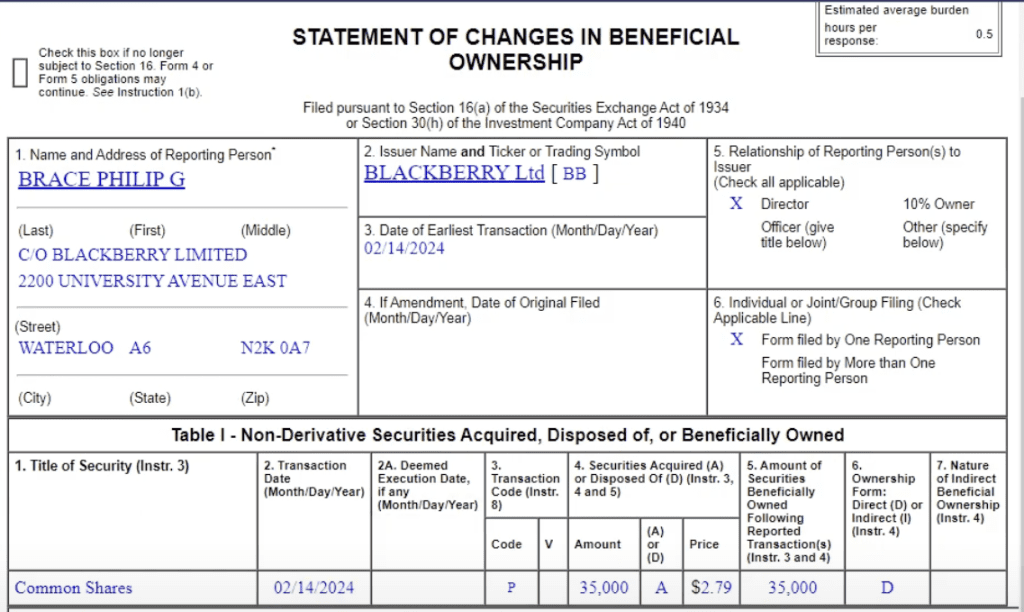

Philip Brace picked up 35,000 shares at a cost basis of $2.79 this past Valentine’s Day.

Check out the Form 4:

Lessons from the Meme Stock Frenzy: An Insider’s Perspective

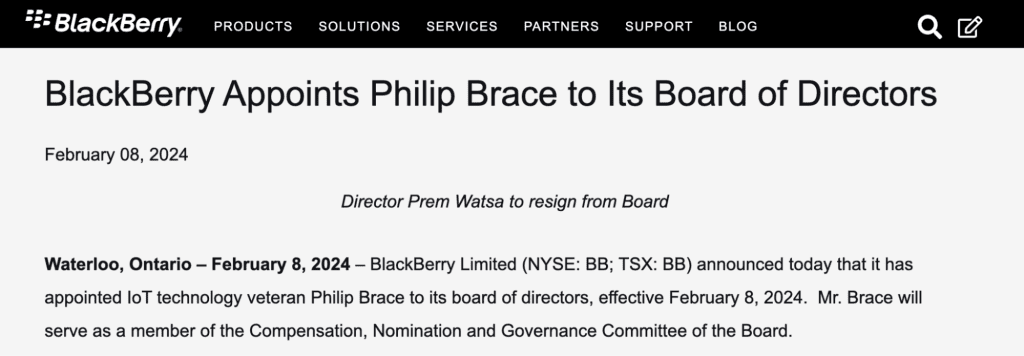

Now there was a piece of news associated with Blackberry that hit on February 8th.

Here’s the press release:

Lessons from the Meme Stock Frenzy: An Insider’s Perspective

An insider buying company stock shortly after joining the board of directors, or becoming CFO, is pretty common.

But when you see someone whos been at the company for years suddenly loading the boat, it’s usually a much stronger signal that something big is coming.

Here’s another example: Big Bear Ai (BBAI).

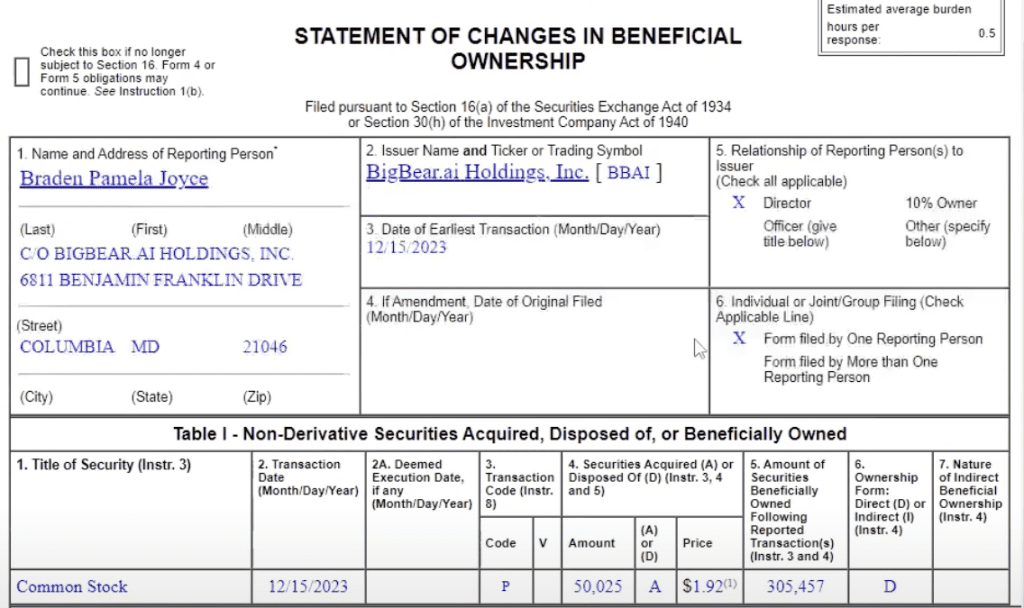

Company director Pamela Braden made her first open market purchase ever, picking up 50,000 shares at a cost basis of $1.92 a share.

Lessons from the Meme Stock Frenzy: An Insider’s Perspective

In my premium alert service, we picked up shares based on this activity and recently closed down half the stock position for an 87% return.

Our call options did even better, gaining 275%. We closed half of that position as well, so we’re still riding this trade for more upside potential.

I’ve recently put together a complete masterclass that shows my entire process for finding these types of opportunities.

I break down how to find these Form 4s, what to look for, plus my process workflows, key performance indicators on individual stocks, scanners, screeners, and even some bonus training on value investing and trading options.

(And, I think you’ll be pleasantly surprised when you see the price.)

Click here and I’ll explain all the details in a brief video.

Original Post Can be Found Here