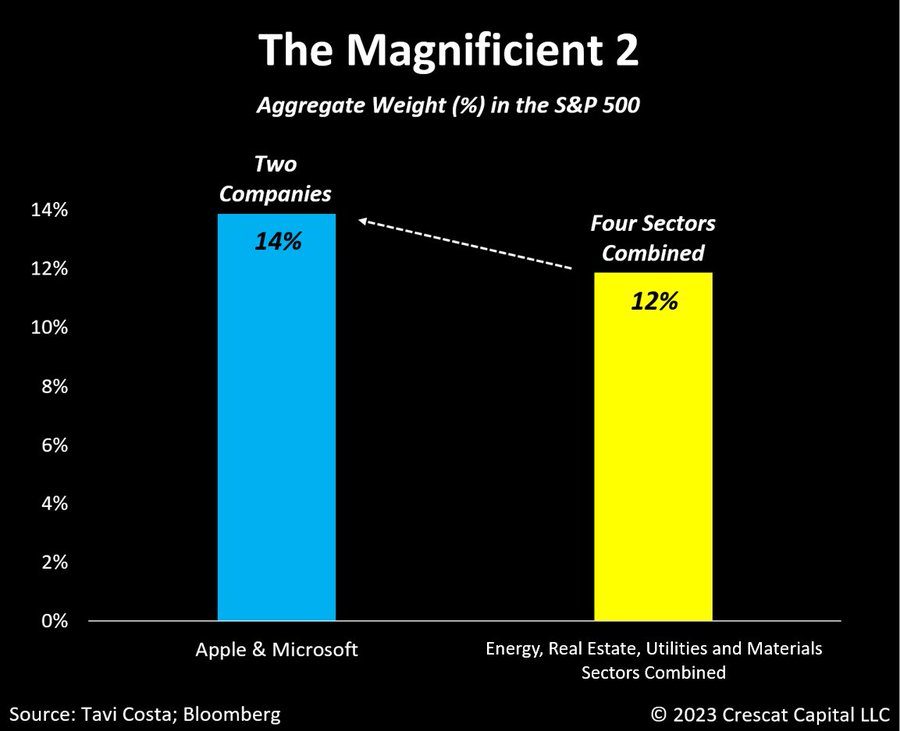

This chart crossed my desk this morning…

Fresh from the “we are entirely too top heavy” department:

How We’re Leveraging the Largest Misallocation of Capital in Modern Finance

Two companies, Apple and Microsoft, are currently worth more than four entire market sectors.

Combined.

That means mammoth companies like Chevron, Dupont, and Simon Property Group are minnows compared to the tech sharks.

This is not a sustainable environment… but it doesn’t mean it’s bearish.

The S&P and Nasdaq are market-cap weighted indices. That means when companies are big winners, they increase the weighting in the index.

When you have passive index flows combined with an options market that’s in the driver’s seat, it’s how you end up with this dynamic.

Instead of expecting these two tech stocks to sell off, consider this:

We are witnessing the largest misallocation of capital in modern finance, and you can take advantage of it.

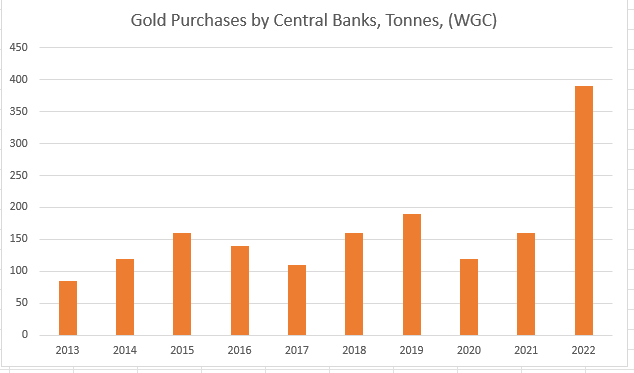

With the geopolitical risks across the globe, it should be obvious that owning “stuff” is a valuable edge to have.

And other central banks know it:

How We’re Leveraging the Largest Misallocation of Capital in Modern Finance

It’s not just gold. Countries are trying to shore up their financial health by storing commodities fuel, wheat, and base metals.

Think about the four industries:

I have a feeling that these are worth more than what the market is telling us. Because the market is collectively focused on the next movement from the Federal Reserve, so few are actually diving down into these names and looking for solid investments.

Which means now is the time to do that.

I’ve got a simple selection criteria to find the “best in breed” stocks in these categories…

Original Post Can be Found Here