As painful as the rise in energy prices has been here in the US…

It pales in comparison to what’s been happening in Europe.

It was truly stupid for leaders to sell their souls to Putin in order to look virtuous on the “climate crisis”...

And now those chickens have come home to roost.

But recently, we’ve been getting a bit of a break at the pump here in the US.

The Whitehouse has been rapidly drawing down the Strategic Petroleum Reserve…

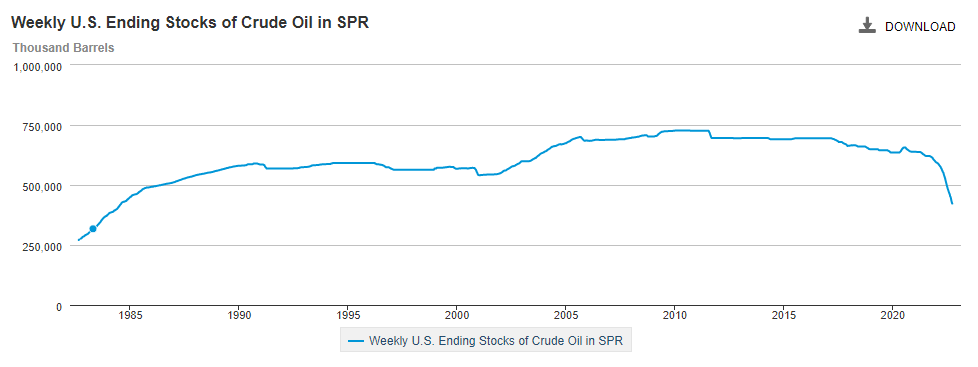

Here’s a chart of the SPR over the last 35 years:

SPR Chart

We’re at levels we haven’t seen since the 80s.

Now, part of this is to make energy prices look good for the midterms.

Another piece of this is the threat of escalation in Ukraine and the Geopolitical risks with China.

Holding the price of oil down and the Fed’s current hiking program is a shot at stopping the inflation trade…

The only question is, how long can they hold this beach ball underwater?

They can’t keep drawing down the SPR and if Powell breaks the markets too badly and too quickly… which seems to be likely…

It won’t be long before people will be coming to the Fed with pitchforks demanding they ease up.

If the Biden Admin gets to a point where they can’t keep drawing down the SPR…

And if the long dollar trade breaks… it would be a major boon for commodities.

Of course, there’s also this chart:

Stock Chart

Crude futures are responding perfectly to the swing AVWAP and could start putting in a bottom soon.

Which makes now a good time to start giving a long look to some of those energy plays that have been on the back burner.

We’re currently looking at Lodestone Levels in a few energy trades that show a lot of upside potential…

Don’t know what a Lodestone Level is… or how to trade it?

>>> Register For This Live Training

Original Post Can be Found Here