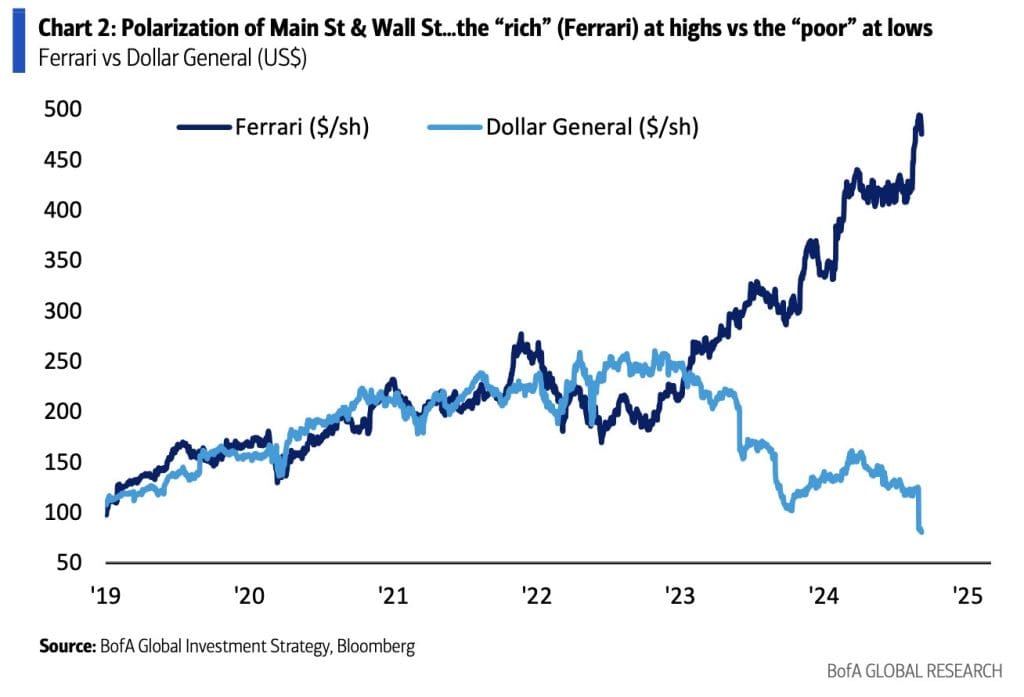

Have you seen this chart floating around your favorite internet haunts?

It shows Ferrari’s (RACE) stock price – which has soared 122% since 2023 and now sits near all-time highs – against Dollar General’s (DG) stock, which, well, hasn’t done so good.

Now, Dollar General is often the only retailer for miles in rural areas.

We’ve got one in my town. I only go there when I have to, because it’s always overstocked and just makes me sad. But man, they’ve got some screaming deals!

DG got absolutely nailed on its most recent earnings. Same store sales were underwhelming, and guidance got cut.

But what’s making headlines is the warning from company leadership about a strapped consumer base.

I don’t buy that narrative. With the flow I’m seeing, the recessionary play will be more consumers “trading down” to lower brands. Buying ground beef instead of steak.

Besides – there’s another angle at play here that nobody’s talking about.

Remember: There’s a difference between the company and the stock. And Dollar General’s management are experts in both.

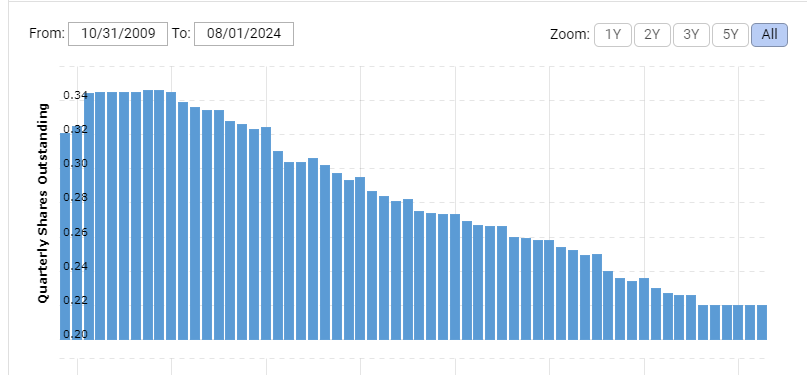

Here’s a look at their shares outstanding over the past decade:

This gets us closer to the real story. Half of DG’s success has been its operation.

The other half has to do with using debt as leverage to buy back stock. When rates are low, the game can keep running.

But when rates skyrocket from 1% to 5%, you get a “one-two punch” of a slowdown in the business operations, and the inability to prop up the stock with buybacks.

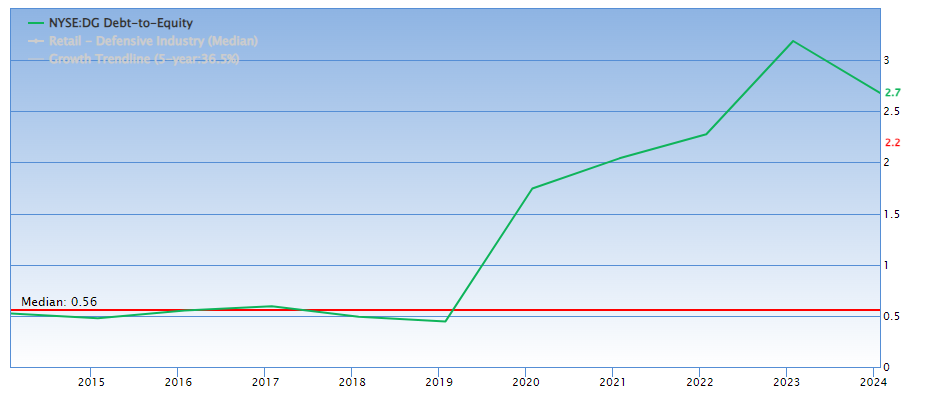

Here’s a look at their debt to equity:

Leverage, not the consumer, is what’s killing the stock.

Now consider the future. We know the Fed’s going to cut rates. That means DG will get access to cheaper credit, and if a recession does happen, their consumer base will expand and margins will improve.

We’re getting very close to a “back up the truck” moment on this stock… but I’ll be waiting for one key signal.

It’s the same signal that led us to a 157% gain on Viking Therapeutics, 728% on a Disney trade, and a recent 1,300% gain on a trade in Zumiez (ZUMZ).

We’ve put together a free training that shows you exactly what this signal is, how it works, and three stocks showing the signal right now…

You can watch it free on this page here.

Original Post Can be Found Here