Inflation is falling…

At least, that’s according to the latest CPI report, which noted a 0.1% decrease in the month of June.

I know, I know… 0.1%? It doesn’t sound like much of anything at all.

But it does help the Fed’s case for a rate drop at some point later this year.

I don’t know how it’s going to shake out. But there are a few narratives at play, and in the next couple posts we’re going to break them down.

The first thing to understand is that the Fed is always late to the rate cutting cycle.

Every. Single. Time.

But it’s not necessarily their fault. They tend to look at lagging indicators, and sometimes the “bad news” hit six months ago and is only now starting to make its way through the system.

Similar to what we saw in 2021 – when the Fed kept insisting that inflation was “transitory,” because they were looking in the rearview mirror rather than what was happening in front of our faces.

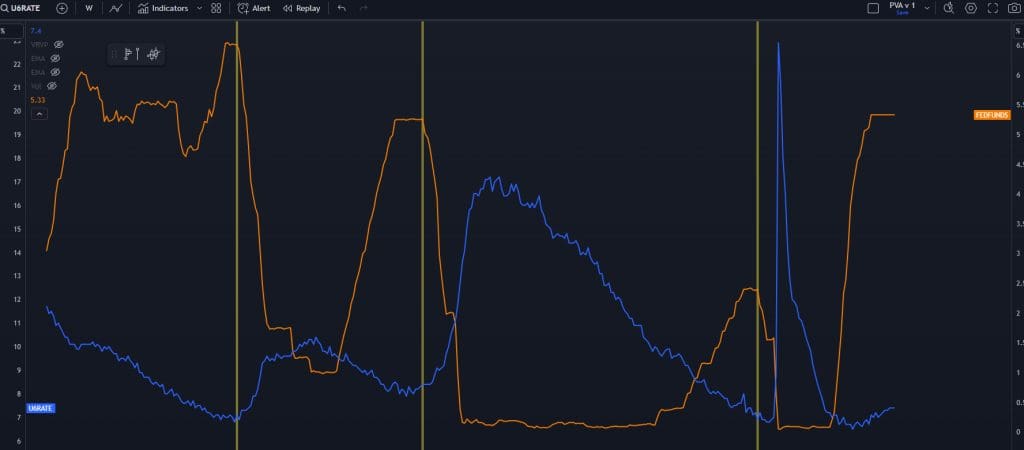

This chart shows the Fed funds rate (orange) and the unemployment rate (blue).

Note that in most of these instances, unemployment started to curve up before the Fed began its cut.

And after they started their rate cut cycle, unemployment moves higher and has been coincident with recessions.

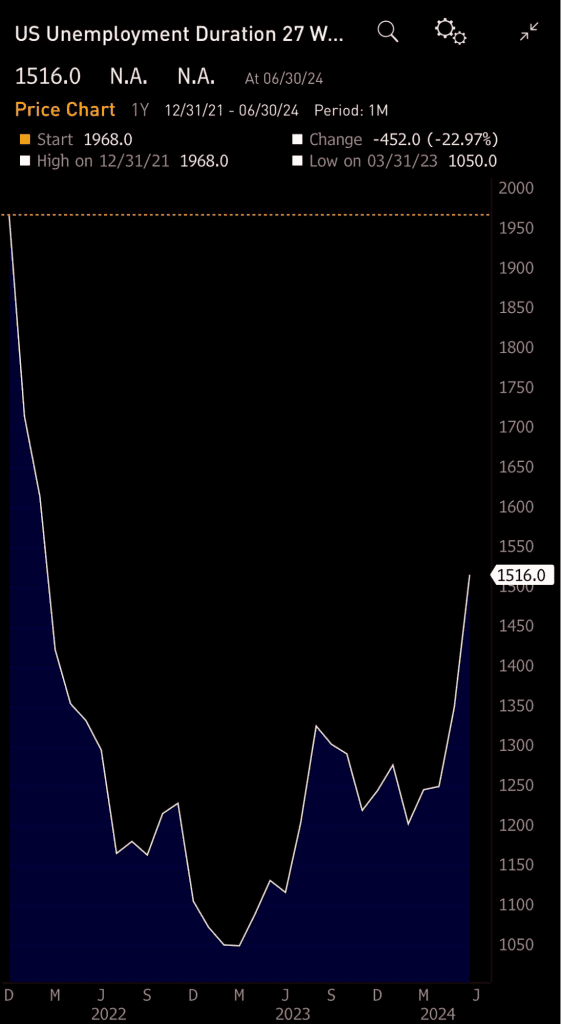

There are already some warning signals showing up in unemployment. Here’s a chart that gives us the number of people who have been unemployed for 27 weeks:

And here’s another indicator called the “Sahm rule.” It was created by Claudia Sahm, who was an economist at the Fed and just about as clueless as you’d expect.

Nevertheless, it’s starting to perk up a bit:

It also doesn’t help when a good chunk of the gains we see are from government employees:

Stagflation is the last thing that the polity wants. It’s what causes regime changes of different kinds of magnitude.

After looking like idiots in 2021, the Fed is trying its best to keep rates high until they break inflation…

But they can’t.

Because this inflation is NOT from monetary policy.

There is a little bit of fiscal at play; everyone knows that debt as a percentage of gross domestic product (GDP) is unsustainable and we will need to figure something out.

(Prediction: The actual solution will not be the solution that hits.)

Here’s the rub: The Fed can’t fix fiscal policy.

When you have an administration that has a dementia patient at the helm, you see rule by the court eunuchs.

The Federal Government has bailed out student loans, which was a debt transfer from private to public. It’s a clear way to buy votes for Democrats… but they don’t control the narrative, so you’ll have plenty of pissed off voters.

But it goes further than that.

Because you can look at Treasury breakevens to show what the inflation expectations have been over the past few years.

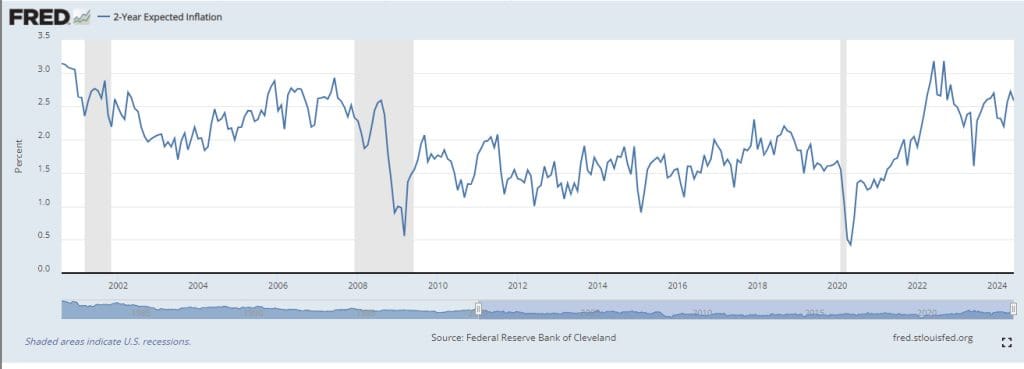

Here’s a FRED chart of the two-year expected inflation:

A clear spike into 2022, and it continues to be sticky, but it’s not a hockey stick.

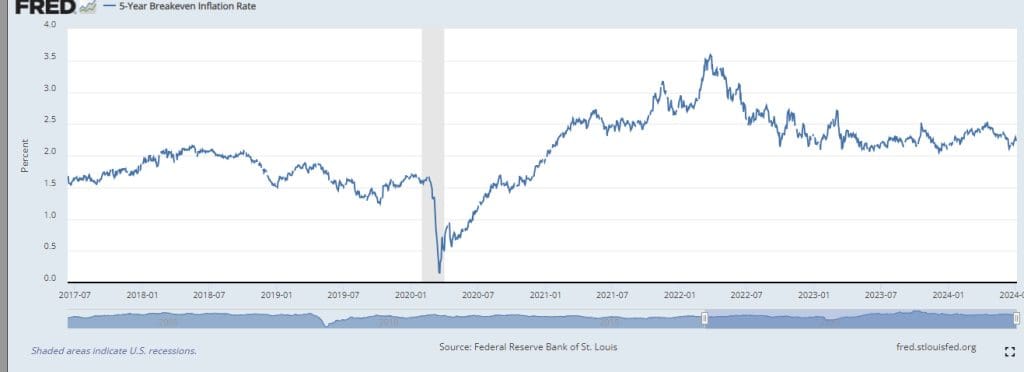

Here’s another one – this is the five-year breakeven chart, which looks at the yield spread between the five-year Treasury market and the five-year TIPS (Treasury inflation protection securities) market.

Again, it’s still higher but it hasn’t budged.

Looking at breakevens is a clean way to view fiscal inputs into inflation.

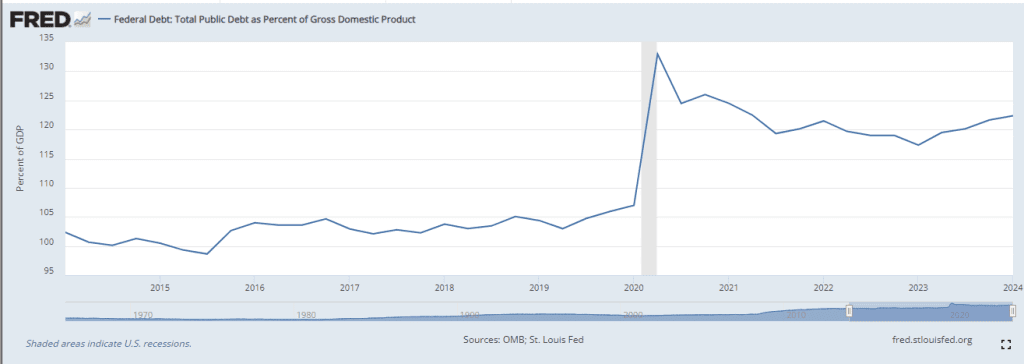

This is confirmed when looking at debt as a percentage of GDP:

Is it high? Yes. But there’s enough growth under the surface to help reset some of this.

Again, no hockey stick.

So if the Fed can’t control inflation with monetary policy, and the fiscal issue is still a big one… but you can’t exactly “overweight” that when it comes to inflation.

The real reason inflation is so high is because there is a lack of trust in our institutions – and justifiably so!

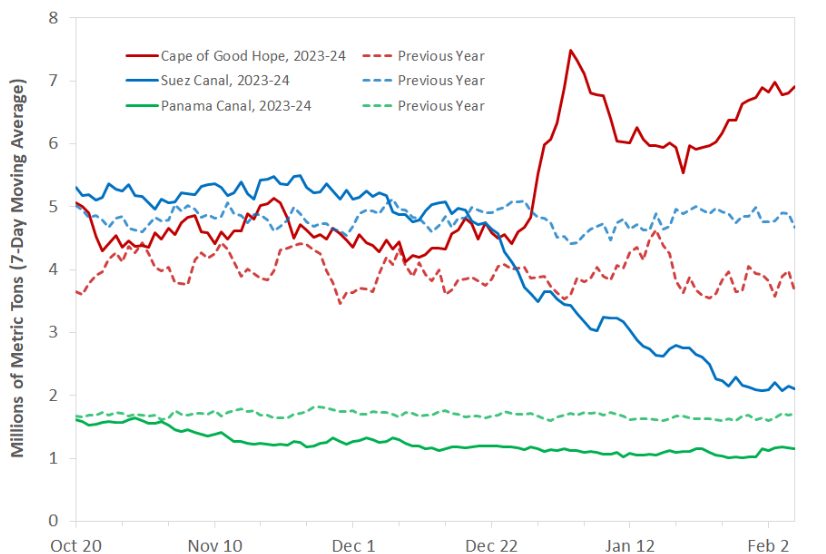

Ships still can’t get through the Red Sea to the Suez Canal due to the Houthi ship interdiction.

The U.S. Navy doesn’t have a clean response even though they’ve been fighting the Houthis for a decade.

It doesn’t help that in February 2021, the Biden administration removed the Houthis from a designated terrorist list.

It also doesn’t help that the Houthis’ primary benefactor is Iran, and the Biden administration’s lead negotiators for Iran turned out to be spies.

If the Red Sea is closed, then ships have to take the long way around the Cape of Good Hope in Africa:

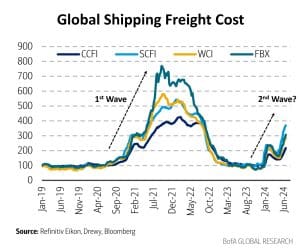

And that’s how you end up with a second wave of shipping costs after the 2021 push:

The Fed’s discount window is not going to fix this. The only thing that can is U.S. military power projection.

There are plenty of other inflationary stories like this going on. We are seeing industrial sabotage inside the U.S.

Streets are being flooded with opiates and illegals, which is a kind of inflation because you now have to pay more money to stay out of crime-ridden hellholes.

So the Fed is stuck because they really aren’t in the driver’s seat in all of this.

Sure, they want to get inflation down… but they aren’t going to move the needle. The best they can do is accept a higher inflation number and try to cut rates before things really get weird.

These are two of four primary narratives I see playing out around inflation right now. We’ll talk about the other two in the next post.

In the meantime, if you’d like to learn about one of the key stock strategies we’re using to navigate this market, click right here to watch a no-cost training video.

Original Post Can be Found Here