Back in 2002 I went on study abroad to Australia.

Not the cool, hip part of Australia with beaches and bikinis…

Instead I went about six hours inland to a small town surrounded by sheep farms.

To say it was a culture shock is an understatement… a kid from Florida went to the Australian equivalent of Kansas.

The field trips were fun. One time we drove a few hours to a gold mine – the very same gold mine that provided the metal for the 2000 olympics.

Company Insiders Reveal Gold’s Dirty Little Secret

(Actual photo of me at the mine)

It wasn’t a decade later until I discovered the dirty little secret about gold mining…

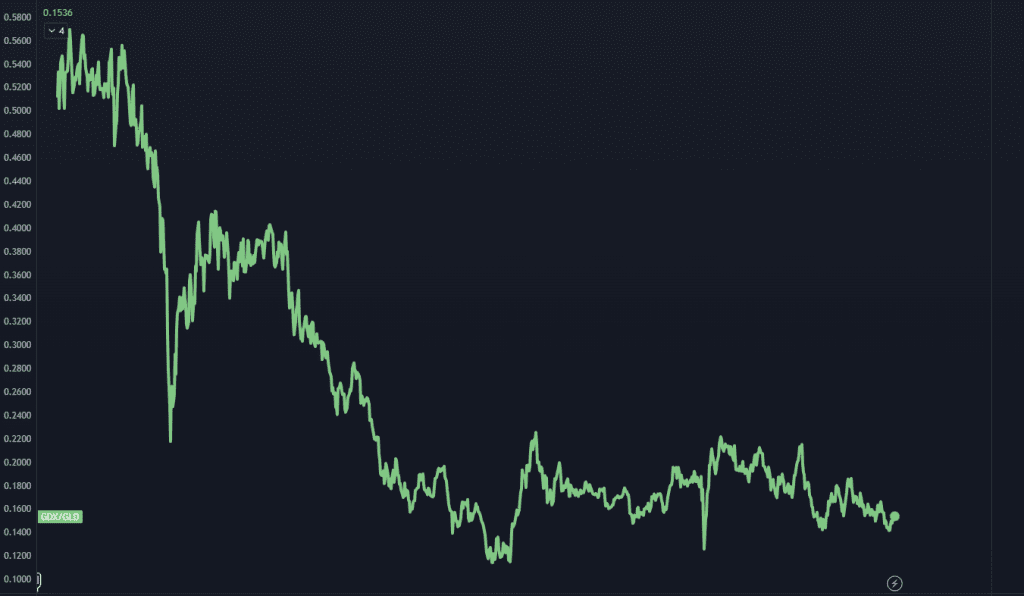

Here’s a chart of the performance of gold miners relative to the performance of gold:

Company Insiders Reveal Gold’s Dirty Little Secret

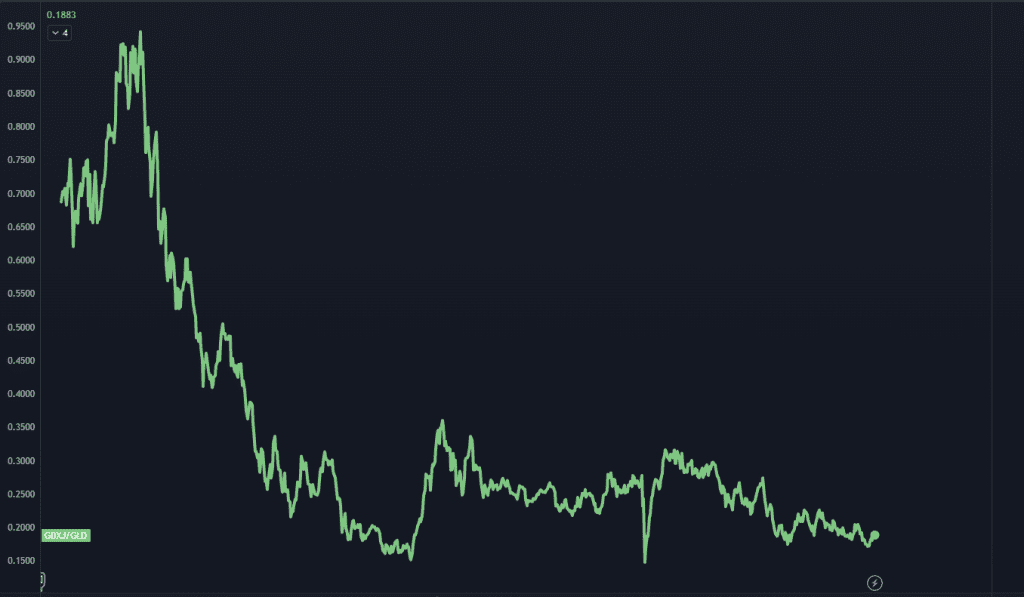

And here’s a chart of junior gold miners relative to gold:

Company Insiders Reveal Gold’s Dirty Little Secret

These charts go back to 2010. That means we have seen 14 years of dismal performance by the gold miners.

Why?

The answer is straightforward… these aren’t well-run companies. It’s like a clown car of mediocre executives fell into a mine shaft.

Gold mining should be straightforward.

You find a line, start digging, refine it and then sell it. Set aside the risks involved in digging in the wrong area… just think about the execution of it all.

You have to hire the right people, get assayers you can trust, have all of the equipment lined up.

That means your corporate leadership needs to have the pedigree and experience to run a mining operation.

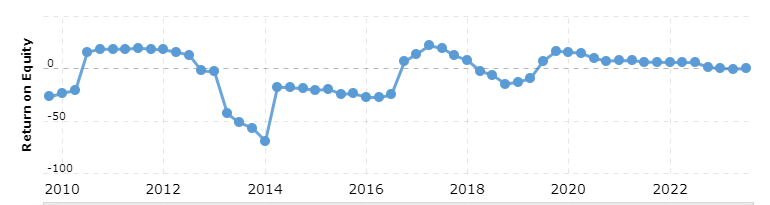

Take Barrick Gold for example, with a current valuation of $30 billion and one of the more well-run shops in the space.

Here’s a look at their return on equity, which shows how efficient a company is at getting profits:

Company Insiders Reveal Gold’s Dirty Little Secret

It’s barely positive right now, and has been through several periods where shareholders didn’t see a return for multiple years.

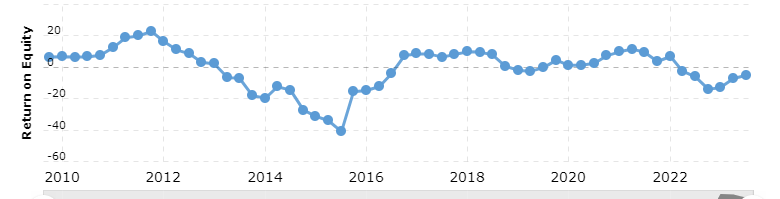

It’s the same with silver miners as well. Here’s a look at the RoE for Pan-American Silver:

Company Insiders Reveal Gold’s Dirty Little Secret

For executives of precious metals companies, their goal is to sell stock in the company, not try and get the most efficient operation. It’s a cynical take, but that’s the game.

And it’s also why you don’t find many gold companies that see aggressive insider buying.

These companies are simply tied to the price of gold action and they take a little off the top to pay for operations.

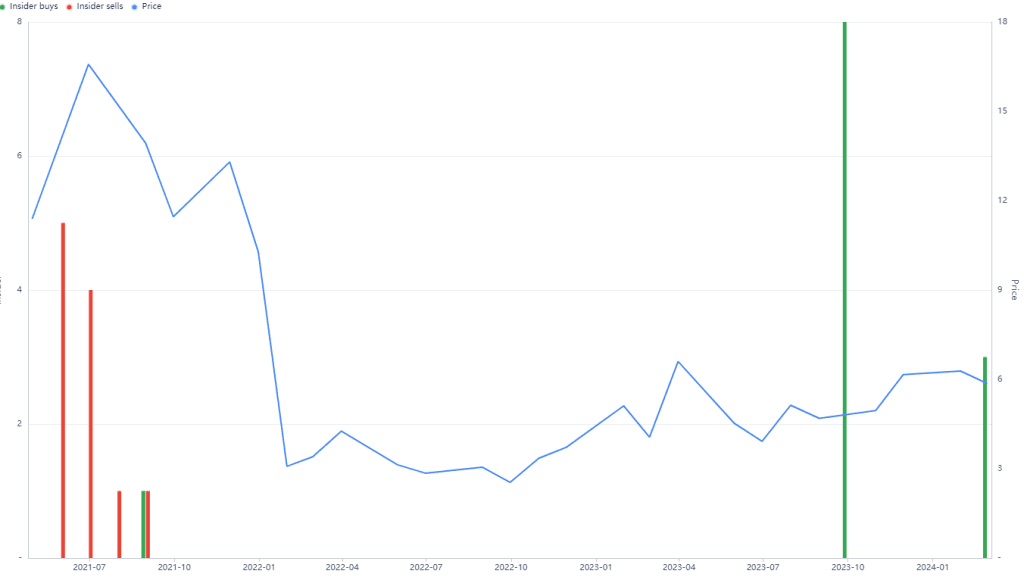

Which is why it came as a surprise that we started to see a swath of insiders picking up shares in a small silver mining company based in Mexico:

Reveal Gold’s Dirty Little Secret

Gatos Silver (GATO) started to see aggressive insiders picking up shares in the $5 range.

They started buying in size in September of 2023, then added more shares in February 2024.

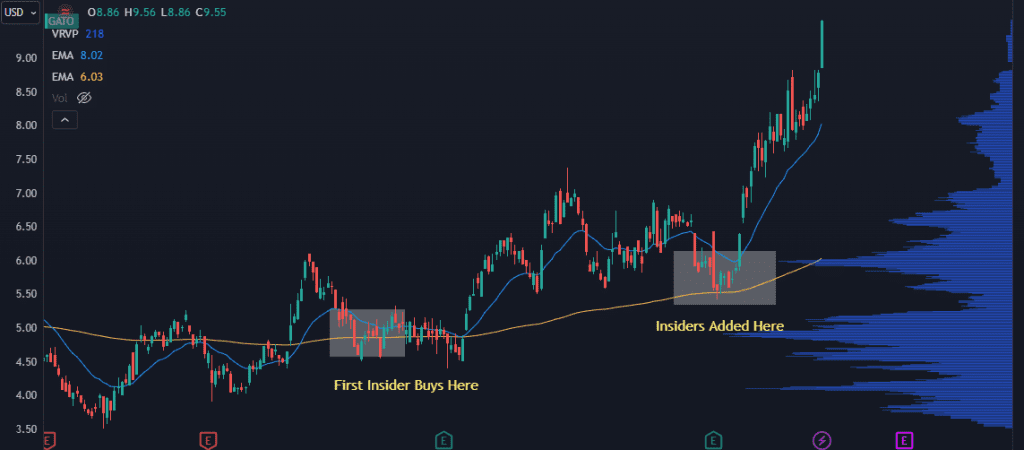

Here’s what the price of the company has done since then:

Reveal Gold’s Dirty Little Secret

Our clients at the Insider Report were keen to these hidden buys – and we sent out a buy alert when the stock was trading at 4.89.

The stock is now trading 95% higher, and we’re looking for even further upside as the precious metals market heats up.

We also just issued a brand new buy alert on a different opportunity with the same kind of setup…

A rare, high-conviction purchase from a company insider.

So if you’d like to learn more about our approach to following insiders to huge stock opportunities, click right here to view a no-cost training webinar where I’ll show you exactly how it works.

Original Post Can be Found Here