Wishful thinking is a powerful drug…

It makes you daydream all sorts of “gum drops and cotton candy” futures that often don’t come to pass.

I am just as guilty as the next trader (yes, even after all these years).

I honestly thought the “macro trade” would have cooled off by now.

But it looks like it’s not in the cards yet…

The Fed is going nuts and causing a major short squeeze in the dollar.

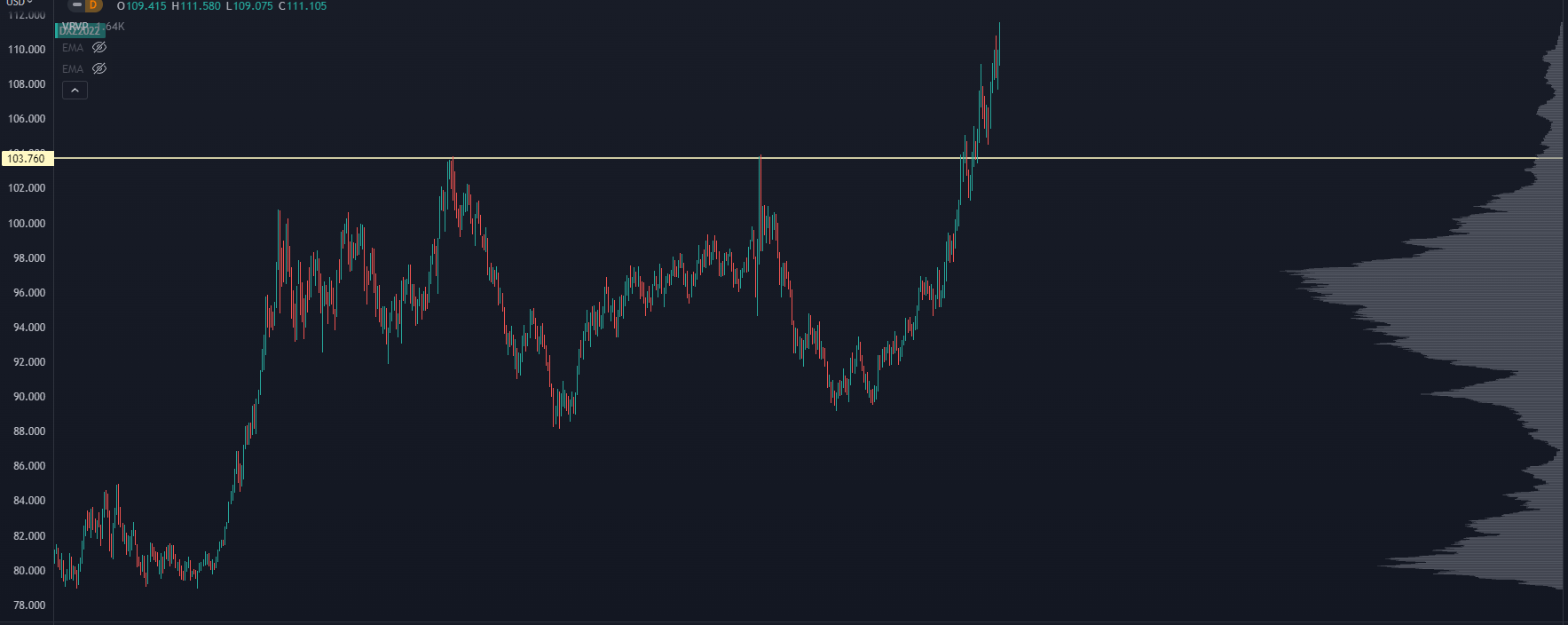

Fed Funds Chart

This is causing a lot of stuff to break across multiple markets…

The Chinese Yuan is seeing massive devaluation:

Chinese Yuan Chart

And we’re seeing similar moves in other major currencies.

Meanwhile, we’re seeing bonds getting trucksticked.

This chart gives you a peek at the ZT, the 2-year Treasury future:

ZT Chart

That’s a very ugly prom date, and it’s exactly the reason why I think the bond market is the thing that could easily break the markets.

It’s why I’ve advised you to follow the Move Index

If bond volatility can cool it, then you’ve got the stage set for a hard bear market rally.

But that also remains a daydream for now… we’re seeing 4% yields on shorter durations:

U.S. Treasury

I never thought I would see that again!

If you want to trade this market right now, you want to consider trade setups that don’t march lockstep with stocks.

For example, we could see bonds head close to the “terminal rate,” and get bid into heights unknown as they serve as an oasis of safety in a nasty tornado of deflation.

Fortunately for you, our Trading Roadmap works on all liquid asset classes.

As we speak, we’ve picked up a trade in the Forex, and are taking a gander at a few bond setups.

These are trades that can turn a profit no matter what equities do.

These are what we call Lodestone Trades, they’re drawing in cash because investors don’t have anywhere else to go…

And there are specific levels that draw more liquidity than others.

Want to know what they are?

>>> Watch This Right Now To Find “Magnetic Trades” That Suck In Cash

Original Post Can be Found Here