I was speaking to one of my friends who is a very successful private equity manager. He’s got a son who is an absolute all-star quarterback, and he’s looking at some major schools.

We got to talking about some of the changes to the game recently, especially with the NIL (name, image, likeness) deals that 18 year olds are getting that turn them into overnight millionaires.

A lot of folks don’t like how the game of college football is shaping up… how it’s becoming more like a professional league.

Well, better get used to it. Because there’s a ticking time bomb about to hit the sport.

College Football’s Big Problem Reminds Me of the Fed’s Dilemma

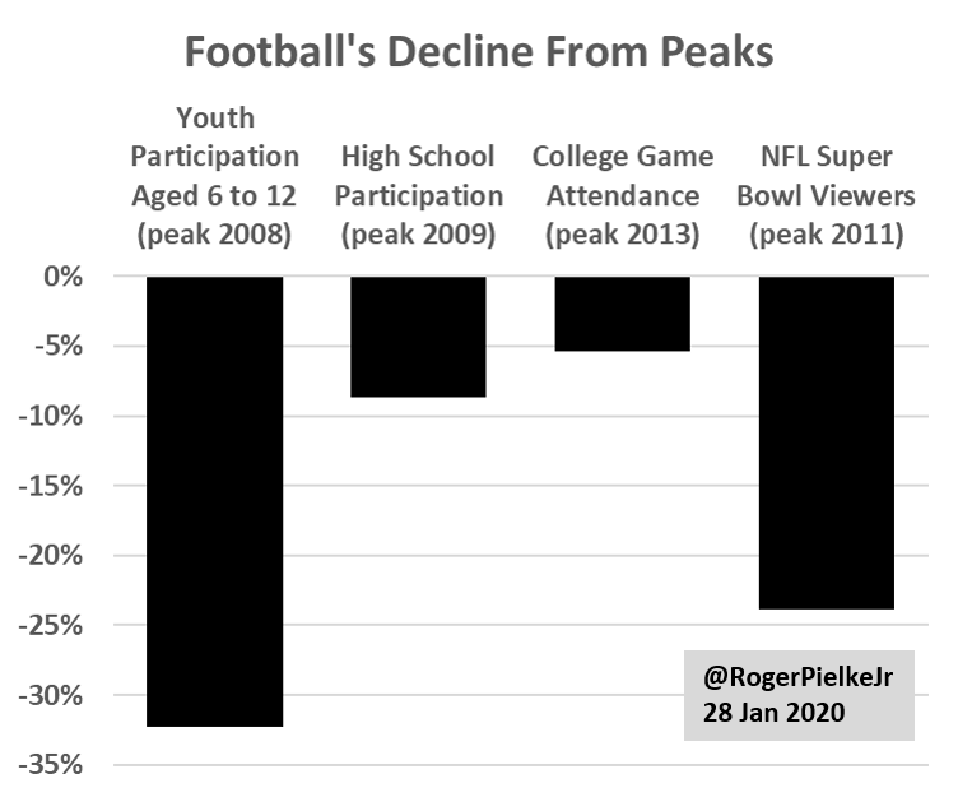

Let’s do some quick math. Youth football participation peaked in 2008 and is down well over 30% now, and it doesn’t seem to be turning around.

All of those kids?

They’re now in collegiate athletics… and there simply is not enough talent to go around.

That’s why you’re seeing all these shakeups recently. The Pac-12 is completely broken, there’s been last minute moves to the Big 10 or SEC for the schools trying to make the numbers work.

It’s just a harsh demographic reality.

So what happens now? College football will continue to consolidate. Many programs will shutter or will have to deal with teams with a LOT less talent. And the best teams will start to concentrate and only play each other.

It sucks. I don’t want it to be like this, but it is the reality of the environment.

College Football’s Big Problem Reminds Me of the Fed’s Dilemma

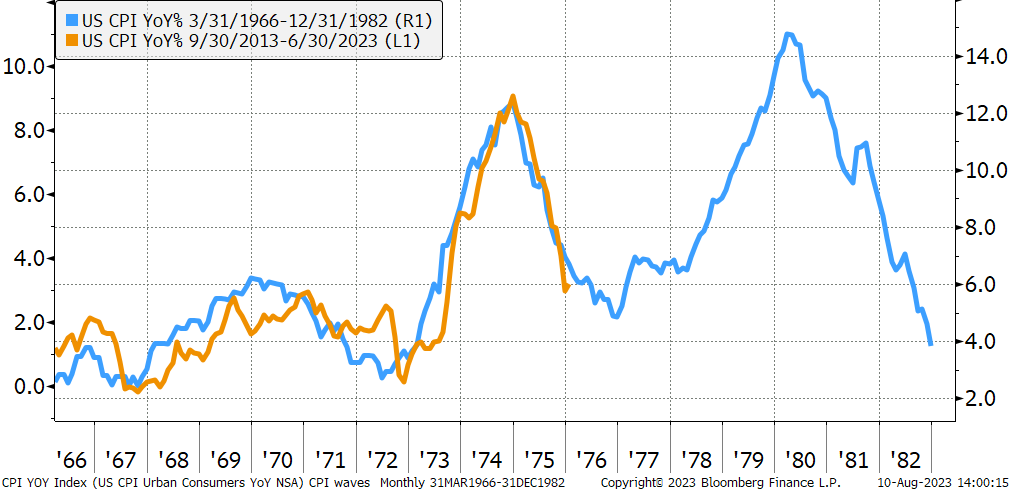

I saw this posted on twitter a few weeks ago. Now I’m not a huge fan of these kinds of charts because it screams of curve-fitting.

But this is the risk we’re dealing with right now.

Every fund manager on the planet is thinking about whether the Fed pulled enough liquidity to get inflation to calm down.

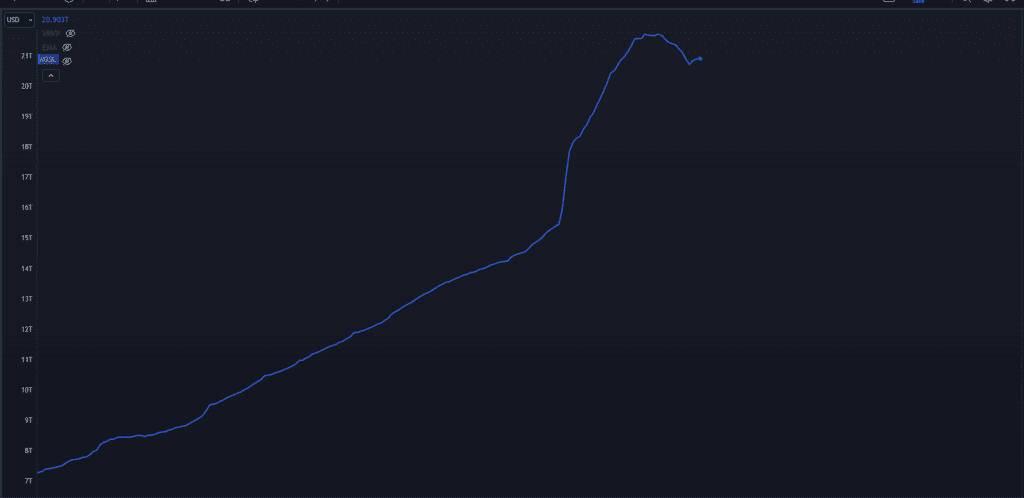

Here’s a chart of the total money supply available in the US:

College Football’s Big Problem Reminds Me of the Fed’s Dilemma

The actions of the Fed are an absolute blip compared to the amount of cash that was printed over the past few years.

And that blip caused a 35% drawdown in the S&P 500.

This is just like how college football is shifting. I don’t like it, I don’t want inflation, but we’ve got to trade the market that’s right in front of us.

Central bankers have trekked out to Jackson Hole this week to see if they can find a way to thread the needle.

Can they keep inflation down without breaking the economy? Will they need to accept a higher rate of inflation as we head into an election cycle?

It’s a tough call. They’ve been behind the curve since at least 2019 and they played catch-up in 2022 by completely blowing up the treasury market.

Only time will tell how the Fed tackles this dilemma…

In the meantime, we’ll keep following our profit roadmap — click here and I’ll show you some of the newest setups I’m monitoring right now.

Original Post Can be Found Here