The only thing worse than the pit in your stomach feeling as the market goes into freefall…

Is watching it settle and start chopping around with no clear direction.

If the market showed a strong downtrend you could at least look for some decent shorts.

But a lot of traders buy up the dip, hoping for a surge to new all-time highs… only to watch it bounce around like it has in the later part of 2022.

What this means is a lot of inventory ends up getting “trapped”...

And the market can’t bottom out until all that inventory gets cleared.

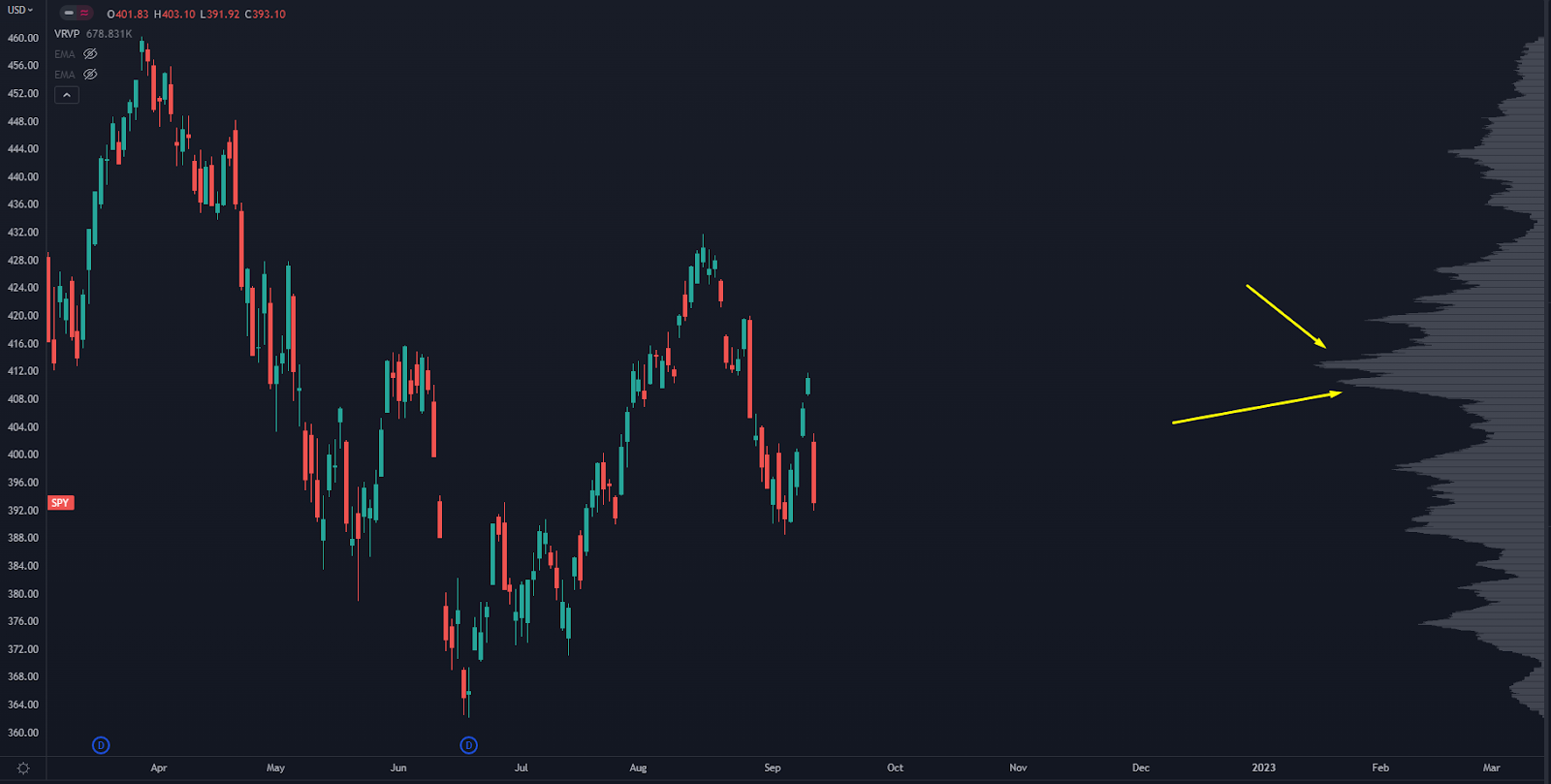

SPY Chart

This is the price action for the S&P since about March. You can see the volume build up on the right side of the chart.

Do you notice anything?

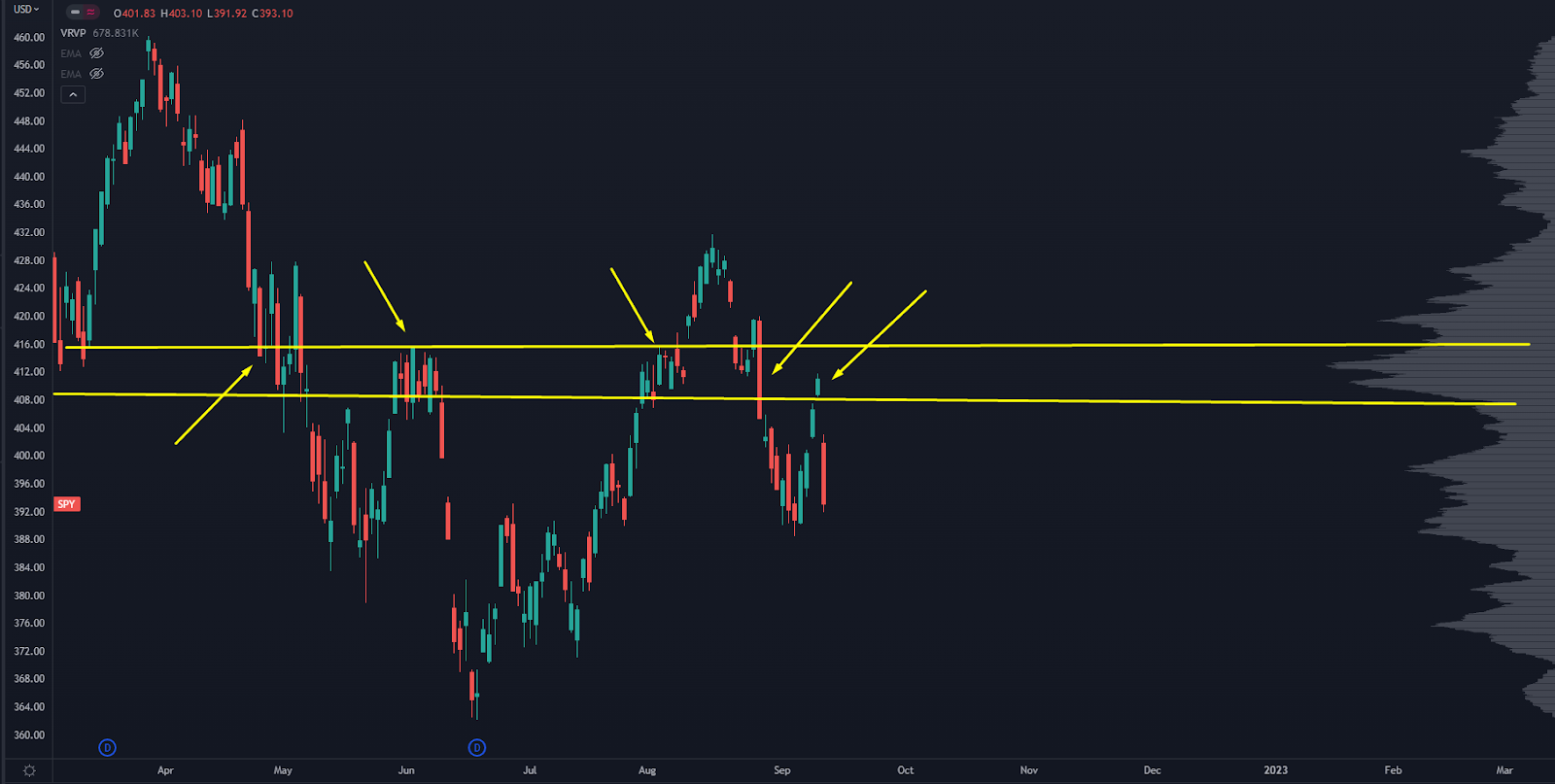

SPY Chart

We have a double high volume node - HVN.

This is where the most volume has traded over the past 6 months… and price is currently underneath it.

Think about how you’d feel if you bought in this zone:

SPY Chart

The first pull into that area looks like an obvious support level from the March low… but we knife underneath it.

There are a few bounce attempts on the bottom, then the whole thing falls apart.

We then get a nice bounce in May, and it almost looks like we can see daylight…

Then we see it trade sideways in June before the CPI crash.

The market builds out a proper bottoming formation, and we rally into that stall area again.

You get some churn, some prior buyers getting out at breakeven, and the market breaks out above it.

This is the first time, since March, that owners in that zone feel “smart.”

Then a gap down happens, and you have people buying the dip, only to have JPow run his mouth at Jackson hole and crater the market.

Then last week we had a hard rally… right up until an ugly CPI print.

It’s clowns to the left of you… jokers to the right… and here you are STUCK in the middle.

Once you see it, it becomes pretty.

That’s how you end up with more and more participants getting stuck in this level.

Odds are it’s going to take a ton of energy to clear that level– and I think the next time we do, it sticks.

But we may have to flush out some buyers first.

That’s how you can form a “Lodestone Level” which will be the price magnet for the next surge.

It’s been frustrating to ping-pong around in the channel… but I think the break above will be worth it.

If you want to know how we spot these “Lodestone Levels” in the market…

And get some clear strategies for how to play it…

Check this out:

>>> These “Lodestone Levels” Will Draw Capital Like Iron To A Magnet

Original Post Can be Found Here