I just sent out a new buy alert on a small logistics company where everything appears to be going very, very wrong…

Coming into August, the stock appeared to be breaking out, showing relative strength not just in the market but in its sector as well.

The stock had gapped up and was coming close to new all time highs.

Then… things got ugly.

Check it out:

Buy Alert: Insiders Call the Market’s Bluff

This is where the stock sits after an earnings miss sent shares off a cliff.

The fact that another company in this sector announced bankruptcy a few weeks ago didn’t help the cause.

Management followed up the earnings catastrophe with a merger announcement that the market absolutely hated.

“Whaddya mean you’re diluting shares to buy a company right when the logistics biz is blowing up?! Rates are above 5%, a competitor just went bankrupt, and you want to spend over $3 billion in stock and cash? Are you gonna cut the dividend?”

It got so bad that the company had to put out a press release on a Sunday, reassuring investors the deal is solid.

For the record… it’s NEVER a good sign when a company is writing statements over the weekend.

It reeks of desperation. And nobody believes the message because of it.

Investors start smelling smoke and are now looking for fires. It can cause a cascade lower, with institutional capital moving on to greener pastures.

And 99 times out of 100… that’s the right call.

But every once in a while, this happens:

Buy Alert: Insiders Call the Market’s Bluff

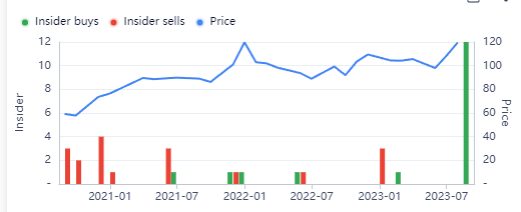

You’re looking at the insider buying volume on this stock. It’s the highest it’s been by far over the past decade.

Twelve separate insiders – including the chief executive officer, chief operating officer, chief logistics officer, and multiple directors – are all buying shares hand over fist at these depressed prices.

To me, this is a no-brainer… which is why I sent my full analysis, including the company name, ticker symbol, buy-up-to price and more to my subscribers yesterday.

Original Post Can be Found Here