After much hand wringing and speculation, the Federal Government finally gave the green light for bitcoin ETFs recently.

Many “rookie” market participants thought that this would lead to a massive rally. Before the news officially hit, bitcoin would run just on rumors.

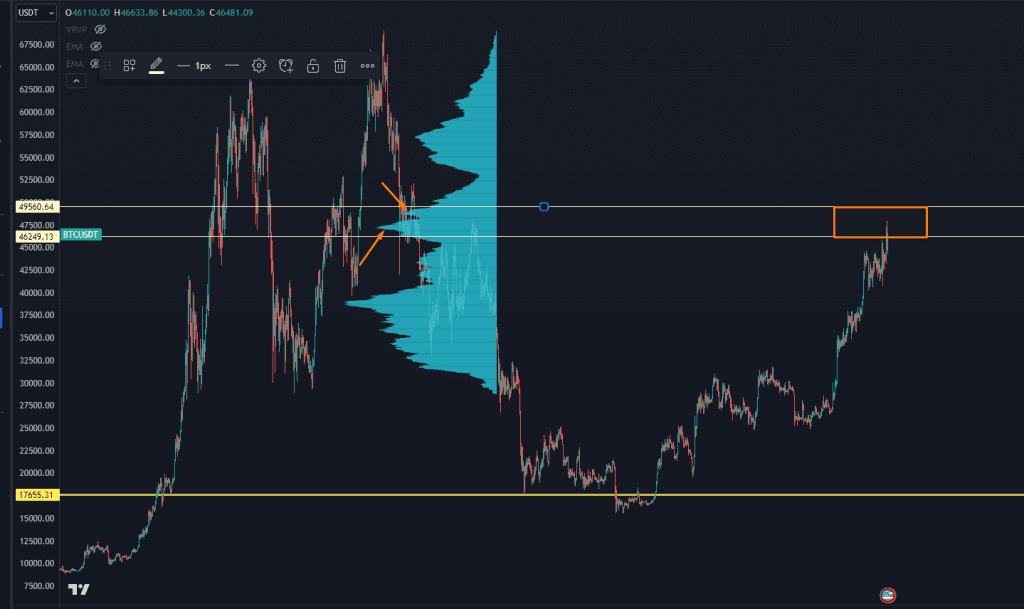

Once the ETFs were listed and tradeable, bitcoin took a huge hit.

bitcoin bloodbath

It was a classic “buy the rumor, sell the news” kind of event.

Now, everyone is scratching their head to figure out why.

The cryptocurrency world witnessed a remarkable event with the liquidation of FTX’s holdings in the Grayscale Bitcoin Trust (GBTC), an occurrence that sent ripples across the market.

Investors sold over $2 billion worth of GBTC, and a significant portion of this exodus was due to FTX’s bankruptcy estate offloading 22 million shares. This massive move coincides with the launch of several spot bitcoin ETFs, including major players like BlackRock and Fidelity.

That didn’t help things, but you didn’t need to know that in advance. In fact, we had these levels called out well ahead of time.

When I shared the bitcoin news with you last, I called out a “bagholder zone” that was identified with our Trading Roadmap.

bitcoin bloodbath

Here’s what I wrote:

If you create a Trading Roadmap using the topping pattern from 2021-2022, you can tell what prices had the most buyers.

And as those buyers go from massive losses back to breakeven, they may want to sell some of their position.

That’s how you can get a hard pullback.

This is about as close to a crystal ball as you can get. You don’t have to follow the news or even know what a “bitcoin” is – as long as you know where the institutional footprints are, you have a method of generating solid trading and investing returns.

We’re rolling out the red carpet for a free training on our Trading Roadmap.

Want in?

Sign Up Here to get the training and finally create an edge in your trading and investing.

Original Post Can be Found Here