Remember BudLight’s Dylan Mulvaney marketing campaign that sparked a nationwide boycott and shaved $26 billion off parent-company Anheuser-Busch‘s market value? Yes, the BudLight Boycott.

BudLight Boycott

There’s more to the story.

On the one hand, Bud Light sales are down 26% year over year. Their U.S. sales tanked significantly, and they’ve had to make good with their distributors.

The boycott worked, and Bud Light has itself to blame. They took a storied brand and nuked it from orbit, and I’m not surprised the social stigma is sticking around.

However, on the other hand…

Bud Light’s parent company Anheuser-Busch Inbev still has a market cap of about $90 billion. Don’t get me wrong. I’m not saying a $26 billion market loss doesn’t hurt.

Still, for a multi-billion-dollar behemoth that’s been around for over a decade…

It shouldn’t be too hard to do some reshuffling.

They’ll likely try a few rebrands or acquisitions and eventually claw their way back.

But, as I said on a client briefing about the BudLight Boycott…

Two words — social credit.

Many of us are horrified at the “social credit score system” that China implemented.

If you’re unfamiliar with the story, here’s the short story short.

In China, the Government knows what phone you use and keeps track of your behavior.

If you aren’t where you are supposed to be, act in an “anti-social” manner, or even inhale more oxygen than you’re supposed to, then, at any point they deem fit, they could pull the trigger, and you lose access to your bank account and communications.

It’s terrible, but most Americans don’t realize that China’s social score system is…

Facial recognition BudLight Boycott

Look at it like this:

Imagine you’re the CEO of a Fortune 500 company.

Under normal circumstances, your investors can vote to…

The vote goes to all the investors of your company.

But remember I said, “Under normal circumstances?”

That’s important because the circumstances are different today.

Many shareholders are owners through ETFs or mutual funds. And with investors continually flocking to indexing, they remove themselves from the political power of being part owner of the most powerful institutions on the planet — corporations.

So who votes?

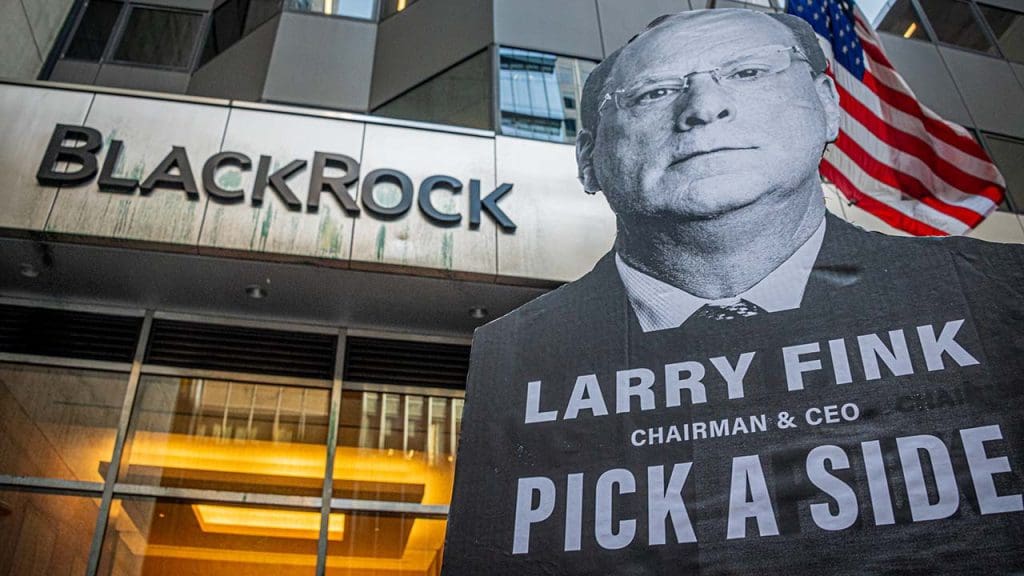

BlackRock BudLight Boycott

Blackrock — the world’s largest asset management firm.

They control trillions of institutional capital in politically influenced funds…

And they can starve your company of capital if you’re not “ESG-compliant.”

As the CEO, this means you have to let the BudLight Marketing Director create funny marketing campaigns that trigger a nationwide boycott, resulting in a 26% drop in sales.

Either that, or you could travel to Mars to look for new shareholders.

It’s a massive drag on the economy and needs to be stopped.

Hopefully, after this next election cycle, they overturn the rule incentivizing ESG policies.

It passed Congress earlier this year, but it was vetoed. Imagine my shock, haha.

If you’ve never heard of PSQ, it’s not a company.

It’s an ETF that is bearish on the Nasdaq 100.

And Senator Thomas Carper recently purchased $8,000 of PSQ.

That’s right; a sitting U.S. Senator is fading the market, and in case you’re wondering…

Senator Carper has an impressive track record of cashing out on his bearish bets.

The good news is you can gain a similar edge following the paper trail of insiders.

Learn more in this episode of Insiders Exposed.

Original Post Can be Found Here