After a quiet 2021, the market finally saw a hard reset in risk assets.

In hindsight, we know what drove this move:

Continually sticky inflation numbers are forcing central banks to adjust their expectations on future interest rate actions, leading to a selloff in tech.

The war in Ukraine added fuel to the fire, sending stocks plunging and commodities through the roof.

The S&P pulled back about 15% from the highs, and the Nasdaq 100 had a 20% reset.

Attractive bullish setups start showing up into those kinds of moves. These are the kinds of levels you only see once a year.

For example:

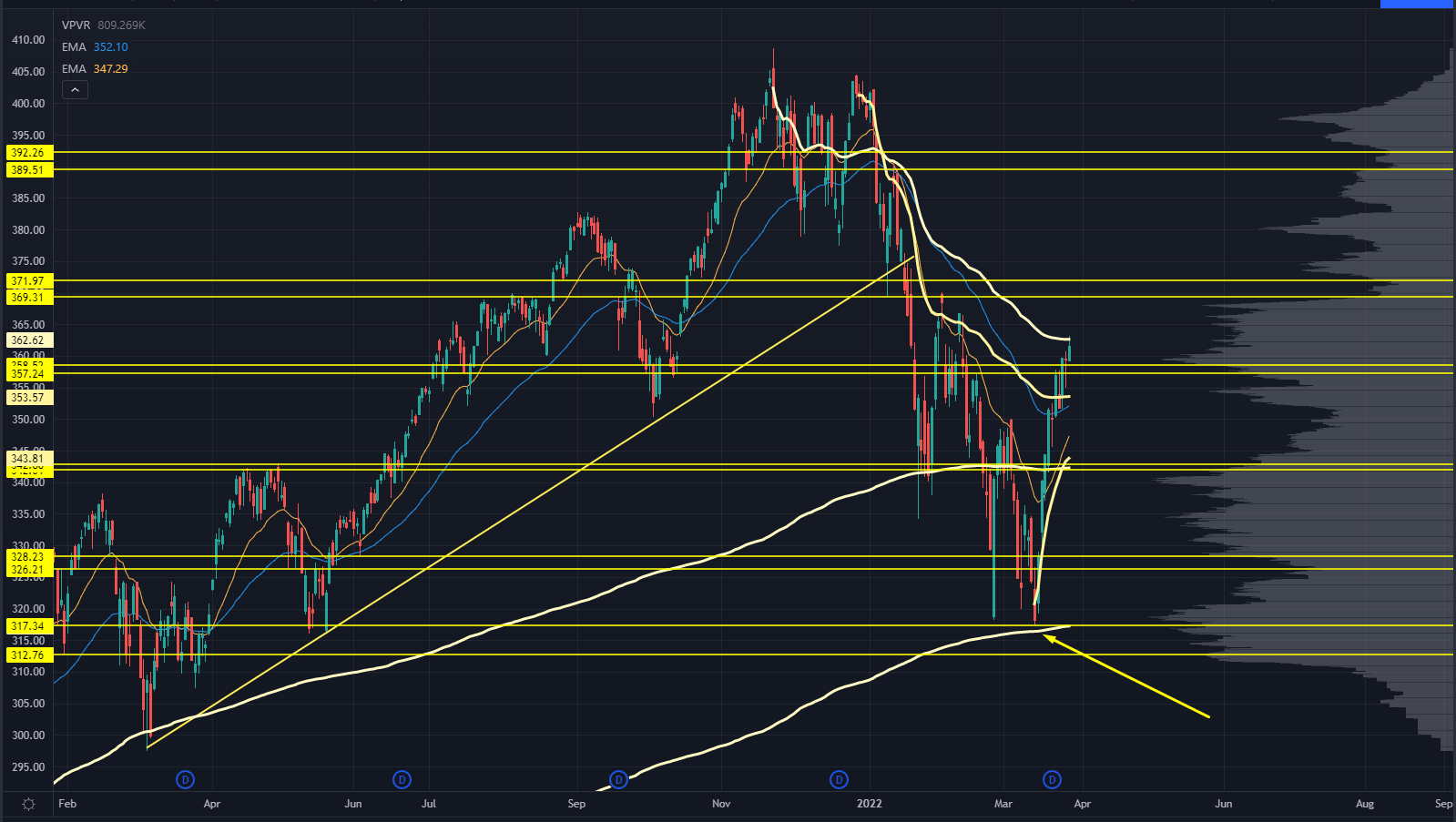

The QQQ ETF, which tracks the Nasdaq 100, saw a successful test of the Anchored Volume Weighted Average Price (AVWAP) from the March 2020 lows:

But boy, is it tough just throwing money into the market when it feels like the entire world is going to hell in a handbasket.

(And yes, the food in the handbasket costs 20% more than last year.)

This is where call options come in handy.

I know options can seem risky for many, but when the market moves at a clip of 2-3% a day…

They can often become a better choice than buying the stock itself.

There are some advanced considerations regarding options premia and realized volatility, but here's some common sense:

Bear market rallies are the most vicious rippers you'll ever see.

If you look at the market’s strongest rallies in history, it's always in bear markets. That's because price movement runs hard in both directions, and the lack of liquidity is on the upside and downside.

So at Precision Volume Alerts, we've spent much of our time focusing on call option ideas.

Take this one in First Solar, Inc. (FSLR), for example:

In mid-February, I noticed FSLR was heading toward some monster long-term levels on our Trading Roadmap, and was worth a shot to the long side.

If you recall, mid-February wasn't even the worst part of the market selloff.

We had a massive gap down on the Russia invasion news, which caused the Nasdaq to hit a bottom…

But that was still a few weeks off.

That means we didn't perfectly time the bottom, but we knew we were close.

We also knew the call options we bought were a better bet than buying straight stock because the options were cheap enough relative to the potential upside vol.

Now, imagine you own straight stock, and then Russia invades. The market gaps down hard and you puke up your shares…

Only for the market to hit its low when you do so.

Not very fun, is it?

Compare that to owning some calls where your risk is fixed, and you can just let the bet play out.

Sure, the market might still shake you out. But if you sized your risk right, you’re just letting it play out.

That way, when your position hits your first profit target, you can close half the position for a fat profit. This is how we booked a 114% return on capital on FSLR in a mere 6 weeks.

That's the power of options.

It's not just about leverage, but risk management — especially when the market is trying its best to shake you out of positions.

Now, here’s the thing:

We couldn’t have nailed this trade without our Trading Roadmap. It let us know that FSLR was heading towards a massive level, and that the name was turning bullish…

Helping us buy the calls near the bottom and reap the rewards when FSLR bounced back upwards.

And now, I want to show you how the Roadmap works in more detail:

Original Post Can be Found Here