As it stands, the “stock market” is a very concentrated group of tech stocks with some banks sprinkled in.

Positioning is still extremely crowded, and the derivatives on these assets continue to drive the markets, showing that volatility is still cranked.

But there’s a group of stocks that could do exceptionally well as institutional capital rotates away from those mega-cap tech names – especially if the Fed is forced to cut faster than they expected, which appears to be increasingly likely.

The trick is to look for well-run, stable companies that have a ton of debt.

That debt is often a “floating rate” instrument, similar to an adjustable rate mortgage, and the rate is based on what the Fed sets.

When rates are at 1%, you’re doing great.

When rates are at 5%, you’re forced to use more of your cash flow to service your debt. That’s the price of leverage. But leverage runs both ways.

Take a stock like Lumen Technologies (LUMN).

I started getting bullish on LUMN in March, because when I dug into the company, their main problem was a debt millstone tied around their neck.

Then there was a drastic shift in expected Fed policy. The expected year-end rate fell from 4.75% to 4.25%.

That may not seem like a lot, but if you’re a highly leveraged company, that would be a massive relief. Your free cash flow could start seeing major improvements.

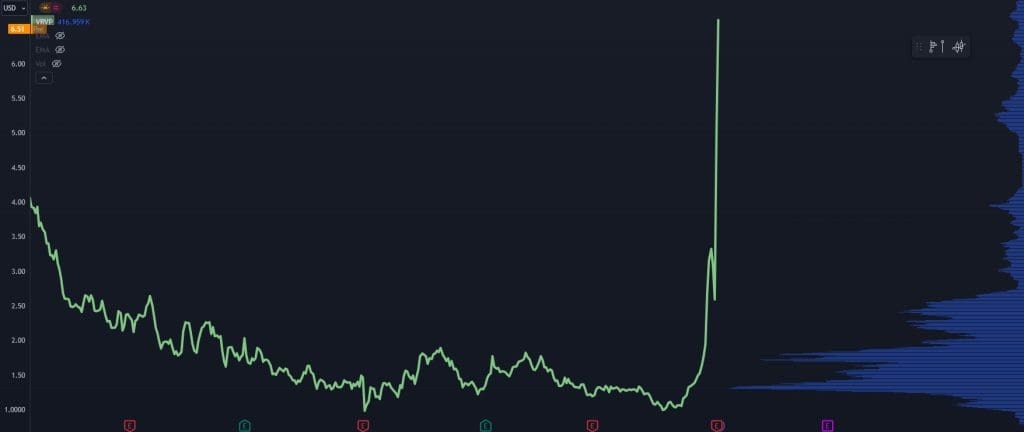

That’s what happened with LUMN:

They come out and report earnings with improved cashflow and a restructuring of their debt. If rates come down, their outlook significantly improves – and you get a squeeze in the stock.

It just went on a 530% run!

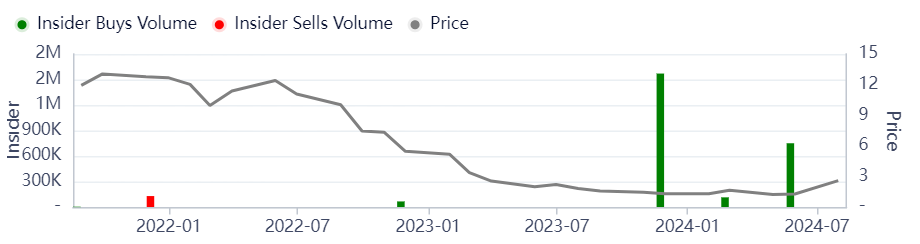

What gave it away for me all those months ago was that corporate leadership was so bullish on the stock, they started putting serious skin in th game.

The CEO put $950k into the stock in May. She’d previously picked up $970k worth of shares in November, right near the dead low of the stock.

There were also four other insiders buying during this time.

That’s exactly why I recommended it to our clients several months ago.

Right now, I’m monitoring three new opportunities that insiders are piling into…

Click here and I’ll tell you all about them.

Original Post Can be Found Here