When a market is emerging from a downtrend, there’s often a lot of “false starts.”

This is when a stock appears to be emerging from a base, only to be met with aggressive sellers who want to get out into any kind of rip.

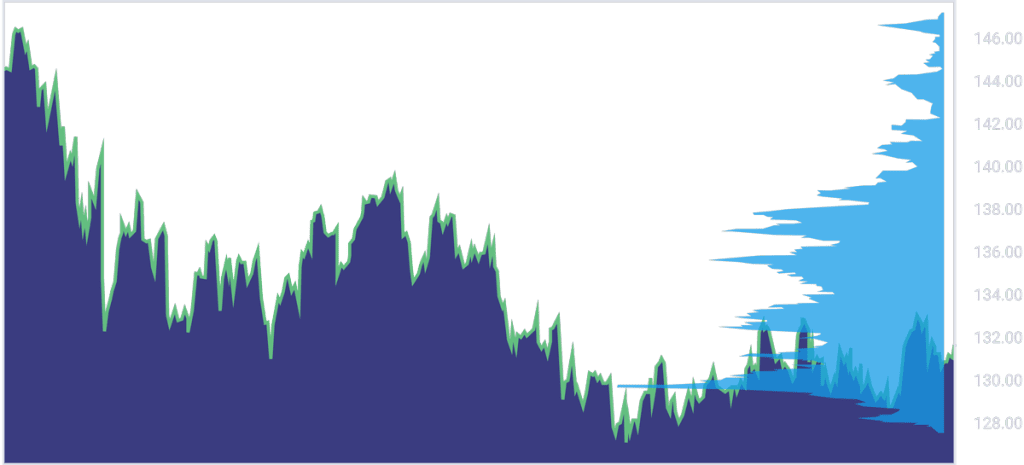

A great example is ARKK, a well-followed tech ETF:

It’s fakeout city! Every glimmer of hope has been knocked down by institutions bailing on the individual components in this ETF.

Yet at some point we run out of motivated sellers, and then you see a move that sticks.

And I think we’re getting close with Chinese stocks.

This is a chart of KWEB, a China internet ETF.

The fakeouts are clearly there, and any rip over the past two years has been met with sellers.

We’re coming into a decision point – which could be a critical turning point – as we test the point of control, the zone where institutions have been accumulating this index the entire time.

If price comes into that and we see signs of buyers again, I’d expect to see trades in this space that could provide serious upside.

And you may be wondering– China? Of all places?

What about Taiwan? Or the policies of Xi Jinping?

Remember: There’s only ONE thing that moves stock prices. It’s not the company’s P/E ratio, its return on equity, or its earnings. And it ain’t the fact that it is or isn’t a Chinese company.

(We recently discussed this in the context of GameStop and Keith Gill, aka Roaring Kitty, aka the Paper Billionaire – you can read it in full right here.)

The only thing that moves stock prices is LIQUIDITY – ideally institutional liquidity.

And if institutions want to buy Chinese stocks here, I will gladly draft off of them for the shot at some solid profits.

Let me show you how our stock roadmap helps us do that…

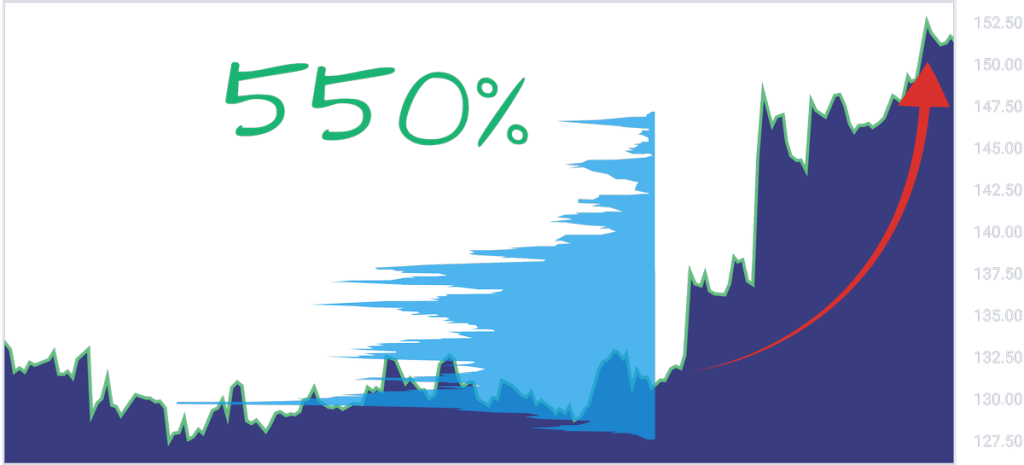

This Disney (DIS) trade is a great example.

As you can see on this chart, DIS was already trading around the point of control. It was chopping back and forth in a tight range within the acceptance area.

That was the institutional movement we wanted to see. They were building out their positions. So we waited patiently for the breakout.

As soon as it happened, we sent out a buy alert on a specific option to take advantage of the move higher.

Now, over the next few weeks, DIS did move. The stock gained about 24%.

That’s a nice move for Disney, but it ain’t gonna make you rich.

But because we “juiced” our trade with that particular option, our subscribers had the chance to catch a 550% gain:

This is the bread and butter of one of our top-performing strategies. And we’re monitoring several setups right now (outside of Chinese stocks), too.

If you’d like a more in-depth look at it and more details about what we’re seeing, just click here to view our free webinar.

Original Post Can be Found Here