The recent introduction of Bitcoin Spot Exchange-Traded Funds (ETFs) marks a significant milestone, offering investors a new avenue to participate in the digital currency market. With Bitcoin’s value soaring above $60,000 and showing signs of a parabolic rise, it’s crucial to understand how to navigate these waters effectively to avoid common pitfalls and capitalize on potential gains.

Bitcoin Spot ETFs are a financial instrument that allows investors to gain exposure to Bitcoin’s price movements without the need to own the actual cryptocurrency. This is made possible through ETF custodians who purchase Bitcoin outright, offering a more direct and potentially less volatile investment option compared to crypto ETFs that are tied to the Bitcoin futures market.

Futures-based crypto ETFs, while innovative, come with their own set of challenges, such as the degradation of the ETF’s value over time due to the futures roll curve. A prime example of this phenomenon can be observed in the volatile futures market, where instruments like VXX exhibit a tendency to decrease in value due to contango. In contrast, Bitcoin Spot ETFs aim to offer a straightforward investment path by directly reflecting the spot price of Bitcoin, bypassing the complexities and potential value erosion associated with futures contracts.

With the SEC’s green light for Bitcoin Spot ETFs, investors now have plenty of options, including the Grayscale Bitcoin Trust (GBTC) and other creatively named ETFs that capture the essence of the crypto market. However, not all ETFs are created equal. Liquidity, bid-ask spreads, and market maturity play critical roles in determining the efficiency and potential profitability of these investment vehicles. As the market evolves, these factors are expected to improve, but investors must remain vigilant, focusing on the most liquid and established ETFs to mitigate risks.

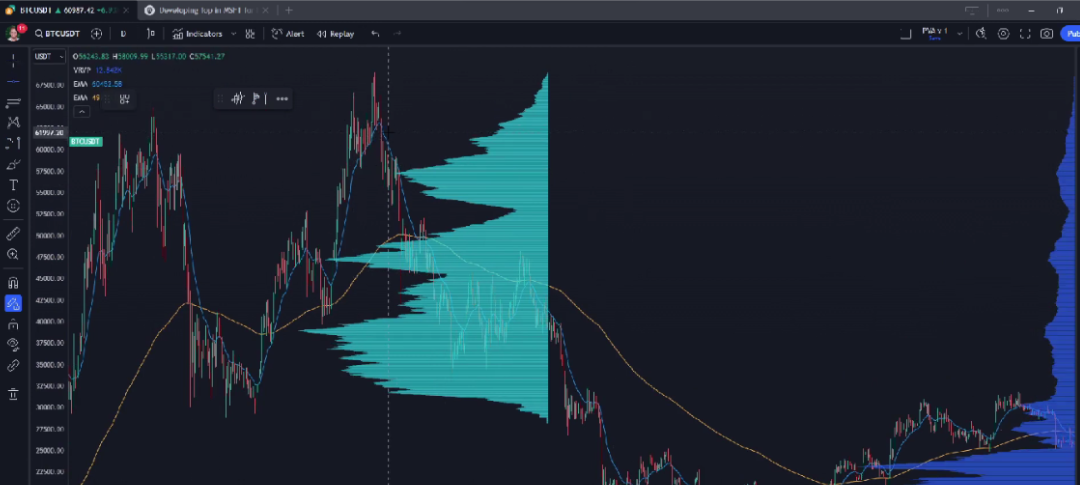

Liquidity analysis emerges as a pivotal tool in the trader’s arsenal, offering insights into market dynamics that are not immediately apparent through traditional technical analysis. By examining the liquidity profiles of major exchanges and understanding the underlying asset’s behavior, traders can identify potential price movements and make informed decisions. This approach is especially relevant in the decentralized nature of crypto markets, where focusing on exchanges with high liquidity can reveal significant trading signals.

The structural dynamics of Bitcoin Spot ETFs have introduced a momentum circle, where increased investor interest leads to higher ETF purchases, necessitating custodians to buy more Bitcoin, thus driving up its price and attracting even more investors. This cycle can amplify price movements, but traders should be wary of its sustainability and potential for abrupt corrections.

A crucial piece of advice for traders is to analyze the underlying asset rather than the ETF’s price action alone. This is particularly true for cryptocurrencies, where the decentralized market structure necessitates a focus on liquidity and price movements across various exchanges and stablecoins like USDT and USDC, offering a more nuanced view of the market.

To navigate the complexities of Bitcoin Spot ETFs and leverage liquidity analysis to your advantage, we invite you to access our free training. This comprehensive guide will equip you with the knowledge and tools to utilize our trading roadmap effectively, enhancing your trading strategies in both the stock and crypto markets.

Watch Our Free Training on the Trading Roadmap and Liquidity Analysis

Embarking on the path of trading Bitcoin Spot ETFs requires a nuanced understanding of market dynamics, liquidity, and the structural aspects of these investment vehicles. By focusing on liquidity analysis and the underlying asset, traders can navigate the market with greater confidence and precision, unlocking new opportunities for profit in the rapidly evolving world of cryptocurrency trading.

Original Post Can be Found Here