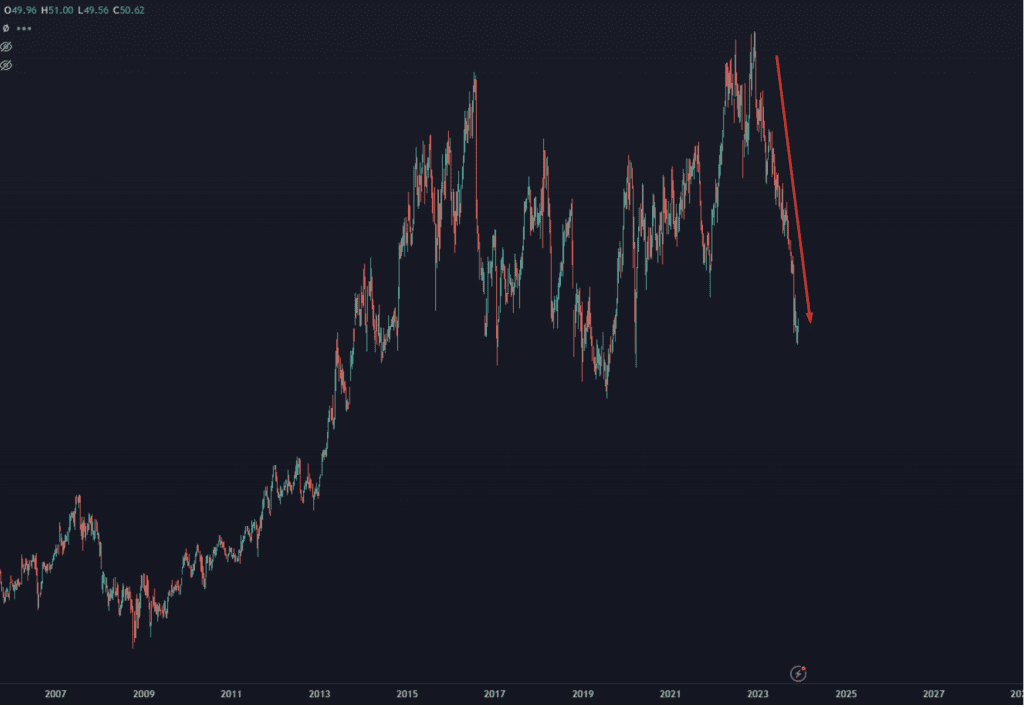

Take a look at this:

Insiders Are Buying the Blood in This Biopharma Stock

It’s one of the biggest names in the biopharmaceutical space…

And it’s down 40% off all time highs.

It’s not just this company, though. The biotech and pharma space has not performed well relative to the rest of the market.

And to add insult to injury, this company has been one of the worst performers among large cap pharma stocks.

There are a few factors driving this drop…

One is that fund flows and overall sector performance has created continued downside momentum, with the possibility that “tax loss” selling and overall positioning help drive the stock lower.

Another is interest rates.

With the Fed cranking rates above 5%, it becomes more difficult for companies to secure financing with debt instruments, which creates a poor macroeconomic backdrop for these names.

With this being a large, dividend producing company, the relative risk premium (RRP) for owning stocks relative to US Treasuries has absolutely come into play.

I do think rates have made a turn and will stabilize with potential cuts into next year, so I believe this risk for the company’s stock is decreasing.

Another potential drag on the stock is the FDA’s recent announcement of an investigation into cancer risk from CAR-T therapies.

A recent press release mentioned several specific drugs under scrutiny, including two from this company.

Finally, another of the company’s products faces patent expiration in about a year or two, which will pull down revenue as other companies release competitive formulations. I believe this is also being priced into the stock.

The macro and single stock backdrop look terrible – a conflagration of risks and rolloffs that have led to the stock’s decline.

But all of that is in the rear-view mirror, and markets are pretty good at discounting bad information, especially near the end of a selloff.

Plus, there are several upside catalysts that could help this stock springboard back to life.

First, the company just authorized a $3 billion stock repurchase program, which increases their buyback authorization from $2B to $5B.

If they were to spend all that cash in a single buy at current prices, it would be about 100 million shares. The total shares outstanding are around 2 billion, so that would be a 5% buyback. Not a ton on a percentage basis, but enough to move the needle… and it allows the company to defend their stock if it drops to lower prices.

The board also recently authorized a dividend increase, putting its dividend yield on the stock at 4.8% annualized. This doesn’t matter as much in the current rate environment, but if rates start to drop, then the RRP improves and can bring more cash into the stock.

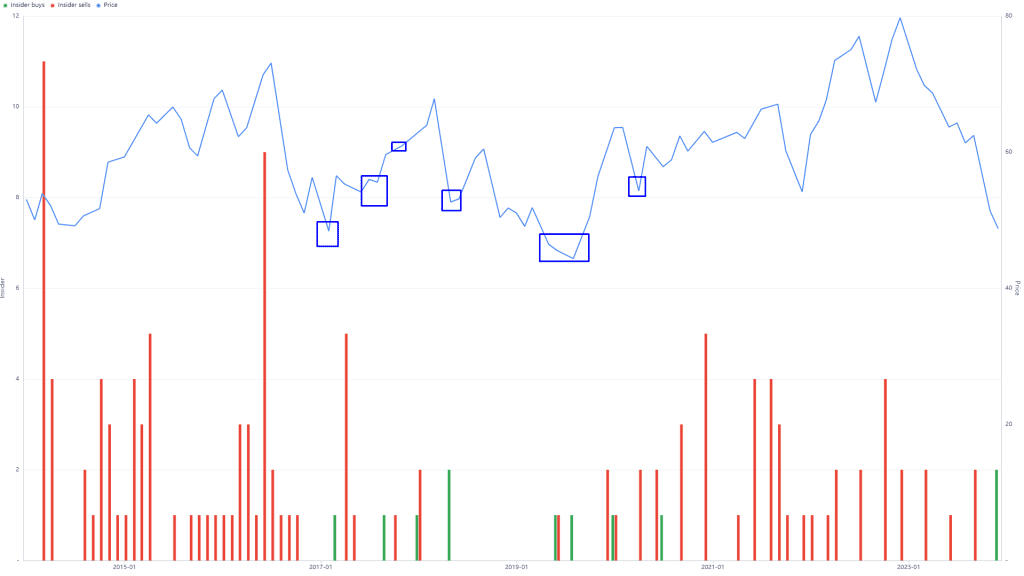

Finally, the most telling sign is the two company insiders buying shares right now.

One is the CEO, who was previously an executive vice president at the firm.

He just made his first open market purchase, scooping up over $146,000 worth of stock.

The second buy is from a company director. He’s in for $423,000.

The fact that both of these guys are buying at the same time – and that it’s the first time for either of them making personal stock purchases – is a huge tell.

It’s the first insider activity we’ve seen at this company since 2019…

And take a look at how previous insider purchases have worked out:

Insiders Are Buying the Blood in This Biopharma Stock

This is exactly what we want to see when we scan for insider stock activity.

I’ve already sent the full buy alert to my members…

So if you want to learn more about this strategy – including the legality of it all, how we track these insider purchases, and how we’ve done with this strategy in the past…

Click here to watch a full interview where I explained the whole thing.

Original Post Can be Found Here