Take a look at this:

We’re Buying a Legacy Brand With Legs to Run

That’s Abercrombie & Fitch (NYSE: ANF), a clothing retailer that’s rallied more than 180% on the year.

Abercrombie was huge in the ‘90s. So were these jeans:

We’re Buying a Legacy Brand With Legs to Run

Remember JNCOs?

Even these abominations are starting to make a comeback:

We’re Buying a Legacy Brand With Legs to Run

Of course, fashion is cyclical.

In Abercrombie’s case, the company also made some strategic changes to get back to what it’s good at…

And we’ve just found another legacy brand making a similar pivot that could send its stock soaring, too.

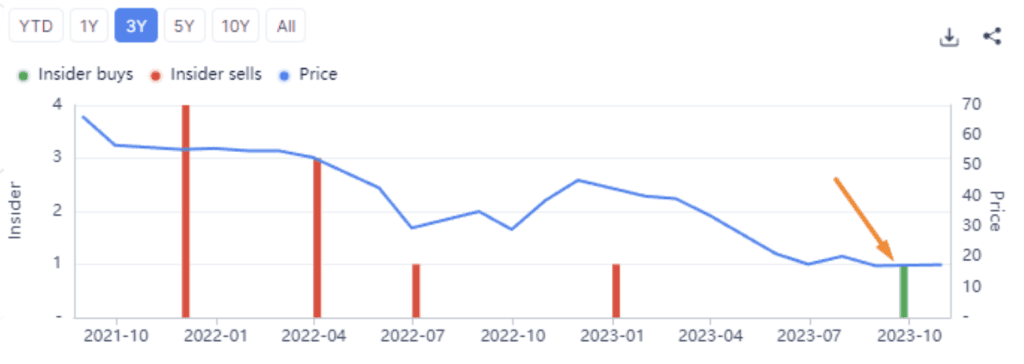

This long-standing favorite spun out of its holding company via IPO in 2021, only to watch its value get cut over 50%.

And we just saw the first insider buy since the company launched out on its own:

We’re Buying a Legacy Brand With Legs to Run

Out of nowhere, the Chief Financial Officer went in for over 20,000 shares – a roughly $343,000 stake.

When the CFO starts buying like this, it means a few things.

First, they tend to have quick access to all the sales data, and they have a good idea when things are taking a turn – and that the free cash flow generated from the company is a good deal.

Second, they know the company’s debt load and the ability to finance that debt in a high interest rate environment.

Given the tailwinds forming behind this stock right now, I believe we could quickly see a 100- 150% move on the stock…

And a potential 400% gain on a simple options play.

I’ve already sent the buy alert with full trade instructions to my subscribers…

So if you’d like to learn more about how we follow corporate insiders like our friend the CFO here to massive opportunities, click here and I’ll show you how to get started today.

Original Post Can be Found Here