It was the first cold snap in Florida, with temperatures dropping down to a chilly 55 degrees.

We had recently installed a gas fireplace, but hadn’t put it to use because we didn’t need to bring the sauna inside.

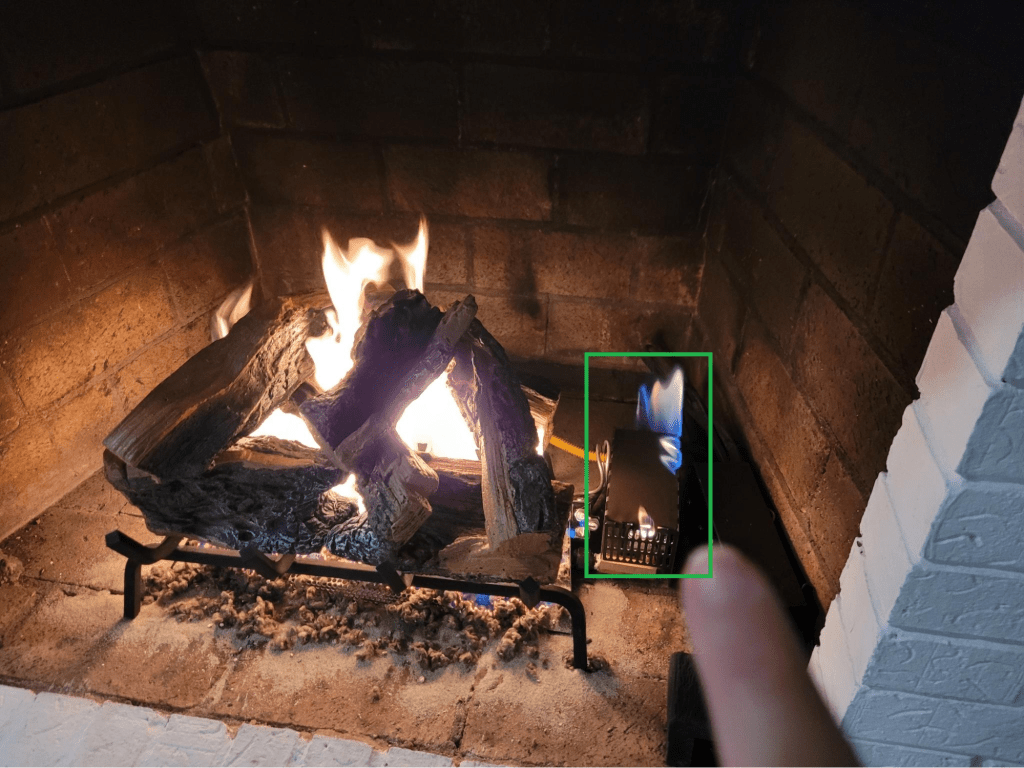

To make it warm and toasty this morning, I turn it on…

And my fireplace catches fire.

That’s what is supposed to happen right?

Not exactly…

Investing In the New Era of Conflict Pt. 2

That box is not supposed to have flames coming out of it.

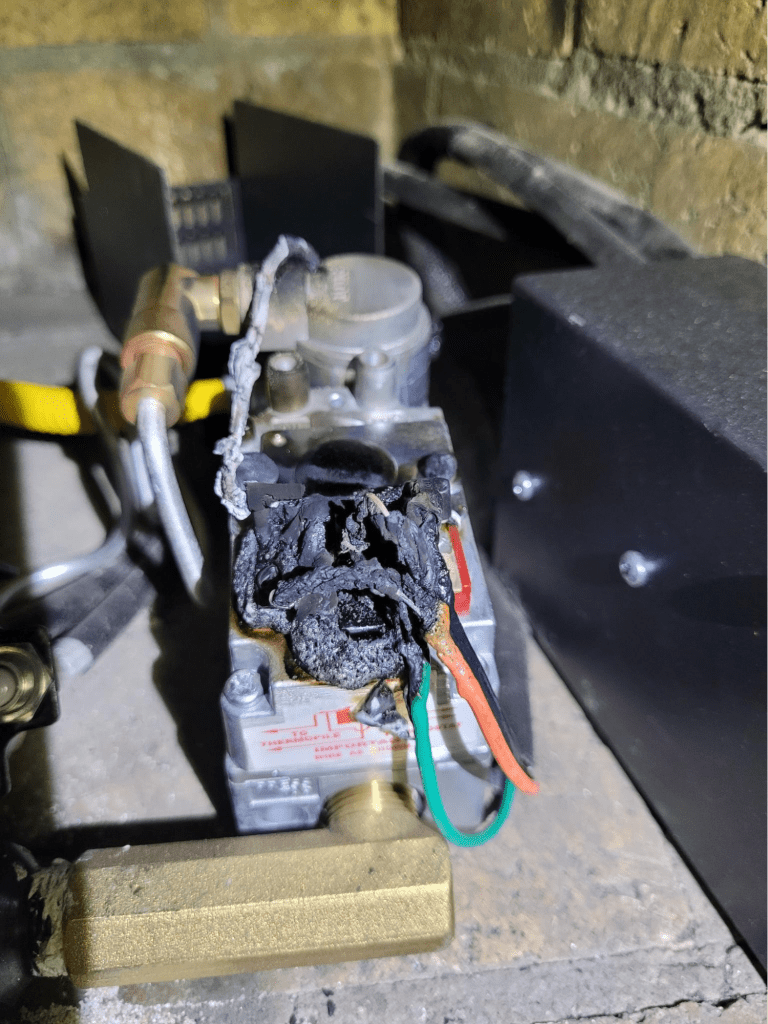

And this is the result…

Investing In the New Era of Conflict Pt. 2

The only way to turn off the fire was to shut off the gas main. So we’re out of warm water until someone comes around to replace the parts.

Geopolitics are also catching on fire right now…

Normally there’s a “slow burn” in areas like Syria and Palestine, but it now seems like the fire is showing up in places where it’s not supposed to.

And Western powers appear completely caught off guard by this move.

The US State Department seems to be run by a bunch of theater kids who think watching “The West Wing” reruns is a good introduction to geopolitics.

Now they’re getting kicked in the teeth, and US hegemony is being threatened.

As I explained in my last post (you can read it here if you haven’t yet), tensions are heating up around the globe, which makes it more difficult for the current financial system to be maintained.

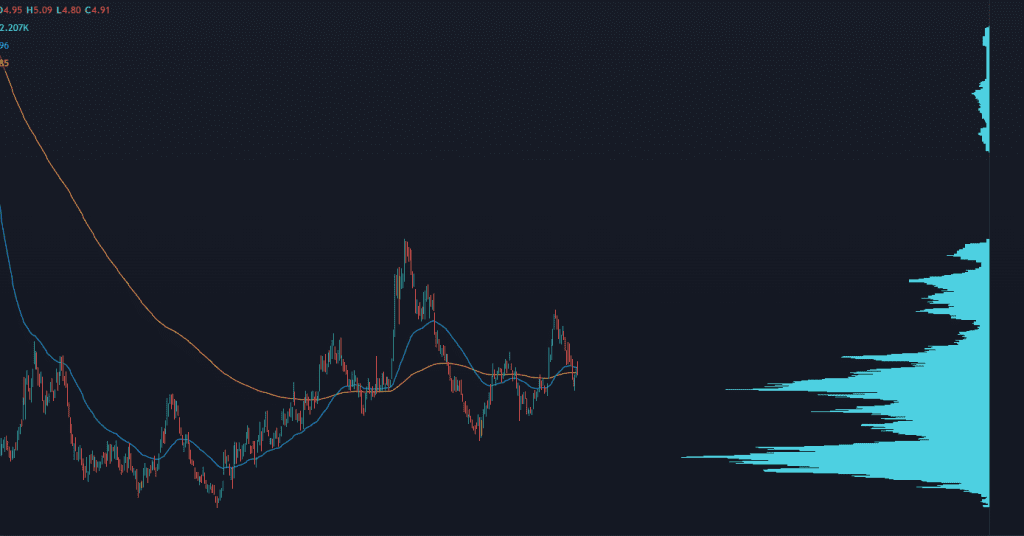

There’s a shifting current under the market… and it’s the greatest misallocation of capital that we have seen in decades.

We have all of this monetary policy that has helped to keep equity prices bid, but it’s been more concentrated into just a handful of names.

The top seven stocks account for 30% of the weighting in the S&P 500.

And they’re all technology stocks that benefited from ZIRP (zero interest rate) policies.

But just like the US State Department, the interest rate shock has left many scrambling to keep up.

The “fire” is now in the US Treasury market, with about 70 trillion in losses if we were to see a mark to market accounting of all these holdings.

Meanwhile, there’s been a drastic underinvestment in energy systems, infrastructure, mining…

All of the industries that are in the “real world.”

If this plays out over the next few years, those who are smart enough to invest in companies that benefit from inflation and “real world” economics are set to benefit.

Investing In the New Era of Conflict Pt. 2

We recently found a silver mining company that offers a way to exploit this market inefficiency.

The company has zero debt and proven cash flow.

And the best part? We’ve seen insiders loading the boat recently.

Four separate insiders put in nearly $900,000 of their own money into the trade.

On its own, it looks like a name that is set for a nice move to the upside. I wouldn’t be shocked to see a 150% rally just to retest some prior levels.

But if commodities start a run, whether it be geopolitical risk or central banks easing their monetary policy…

Then it’s got a lot of fuel that can skyrocket it higher.

In a recent training video, I showed how these insiders have historically signaled some of the best buying opportunities through every market condition of the past 25 years…

And gave complete details of several opportunities they’re signaling right now

Original Post Can be Found Here