It was my 20-year high school reunion over the weekend. I spent the majority of it disconnected from screens, instead focusing on quality time with friends and family.

Maybe you’re like me… thinking that a reunion will be chock full of drama, just like in the movies.

But it turns out, everyone’s well adjusted with families and careers. No fights, no crazy ex girlfriends… just a nice serotonin boost for the weekend.

Then I saw the headlines, and it looks like the Middle East is heating up again.

Looks like Iran wasn’t happy about the deals being made between Israel and the Arab states, and launched a full blown invasion by proxy.

I was in school when the 2006 Lebanon war kicked off, so I remember being shocked at how quickly violence accelerates in the region.

Even with that in my mind, this is a wild one.

And I think this confirms World War 3.

I know, that’s shocking to hear, but here’s some context…

FDR didn’t call it the “Second World War” until 1941, two years after hostilities started.

In fact, “World War 1” wasn’t even called that until 1939 when the globe lit on fire again.

But let’s consider what we’ve got going on right now:

I’m sure I’ve missed a few things… and we haven’t had Taiwan or India/Pakistan deployed on the table yet.

I know that the world is not a peaceful place, but it feels like it’s heating up right now. We could even view this as a second-order effect induced by the government shutdowns in 2020.

The US State Department has been asleep at the wheel ever since 2020. They were so laser focused on domestic issues that they were outmaneuvered by multiple players.

The symbolism of the Afghani withdrawal was enough to accelerate all of this.

Of course the US will feel compelled to respond. But what about Americans?

We just got done with a 20-year intervention in the Middle East.

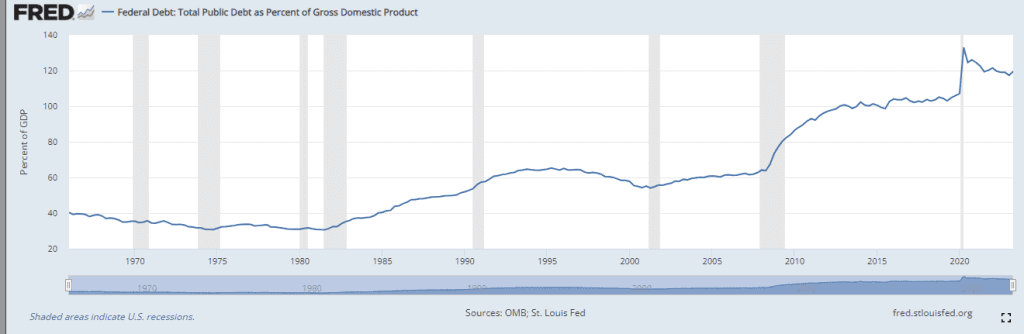

We’re still running a debt/GDP ratio over 100:

Investing In the New Era of Conflict

And the electorate is very divided, with Donald Trump leaning toward non-intervention across the board.

Unlike mainstream news, I don’t want you to “feel” one way or another about this. I want you to be as informed as you possibly can, because investing and trading through crises can drastically improve your financial life.

That means I won’t try to advocate for war or peace right now.

But I can tell you another effect of all this, which could have a significant effect on your portfolio.

A country can only be a reserve currency if they can do two things:

This has been consistent from the US empire through the British and Spanish global empires.

It holds true for the Dutch East India Company, the Roman Empire, and multiple Chinese dynasties.

The US currently controls trade across the world, which allows it to be the global reserve currency.

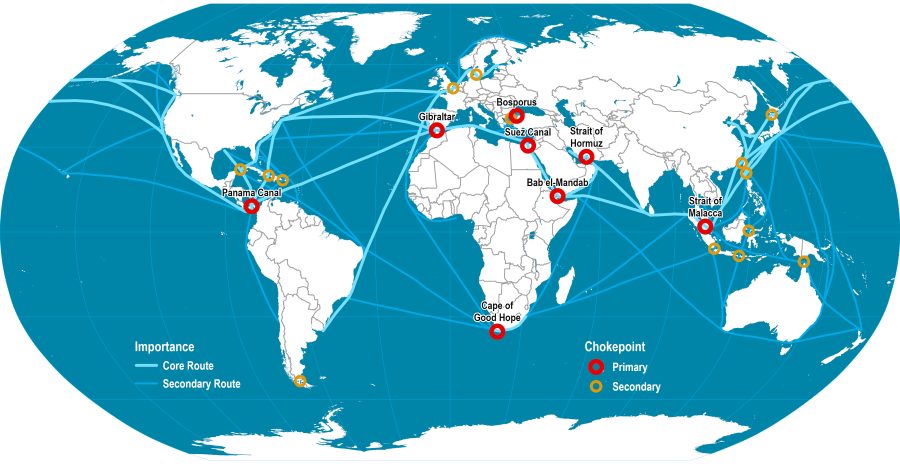

The secret here is that there’s only a few choke points that you have to keep control of:

Investing In the New Era of Conflict

You may not be able to see the entire map, so I’ll point out the locations and the conflict that is going on:

If the United States wants to keep hegemony, then they need to maintain control of these regions.

That’s a tall order right now, especially because the sovereign entities that are directly involved are often going against the instruction of the US State Department.

Western powers are going to need a lot more firepower, in multiple places.

And that means higher taxes… but now that central banks have cranked up rates, more spending has to go into current debt servicing instead of into defense.

Remember, the US is now spending more on interest payments than the defense budget.

Think about being a US legislator. You’ve given billions to the war effort in Ukraine. Energy prices are still through the roof. The deficit is not going down, and a recession looks like it’s going to hit right into a presidential election.

Are you going to go to your constituents with higher taxes to fund multiple wars?

Again, I’m not making a value judgment here. Just putting odds down on paper.

If other sovereign entities can no longer depend on the US government to keep trade flowing, then why do they need to do trade in US dollars?

What if commodity-backed currencies start to do more trade?

This means the US dollar starts to cede ground as reserve currency. It doesn’t have to happen all at once, but it does have massive implications for what the Federal Reserve can do.

Meaning they have to keep rates high, and once they cut they will have no choice but to accept higher inflation.

This is going to lead to a Financial Black Hole in the system… and by the time it’s all over, your portfolio could have shrunk by 75%.

Now — I mean right now — you have to learn to actively position in the markets. You can’t just rely on seven large cap tech stocks to hold the entire market up – you’ll need to better follow sector flows and start looking for opportunities that many have avoided for over a decade.

I’ve put together a free training going over how to do exactly that… click here to watch it now.

Original Post Can be Found Here