The market feels like a jilted lover.

The Fed floated the possibility of hikes in 2024, and the market is attempting to come to terms with “the new normal.”

When rates are high, it creates a higher cost of capital. That means fewer investment dollars to go around through debt facilities.

It also means M&A deals can’t get done when you need cheap leverage.

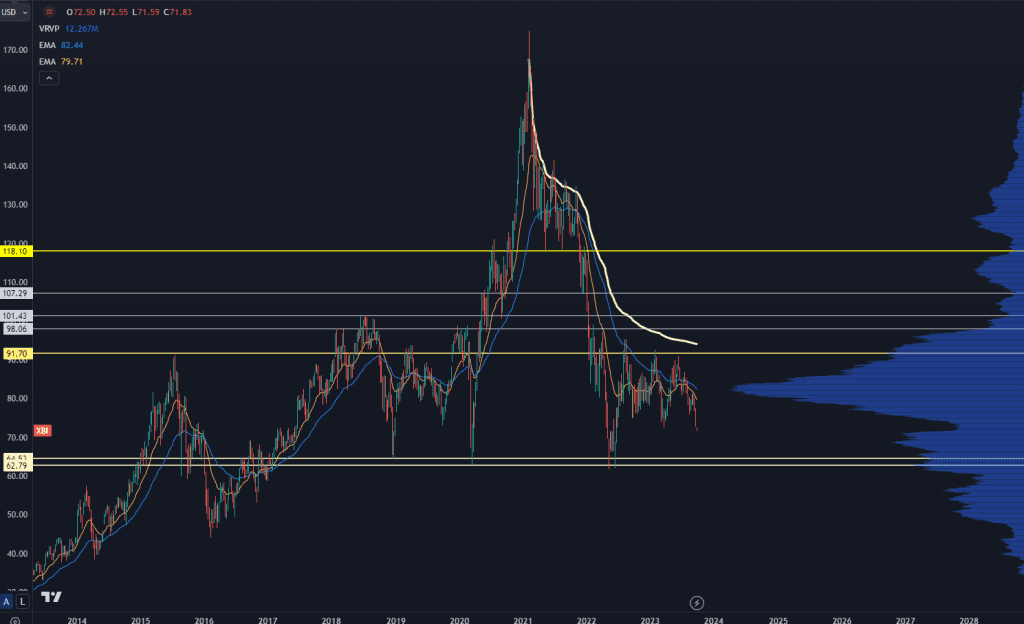

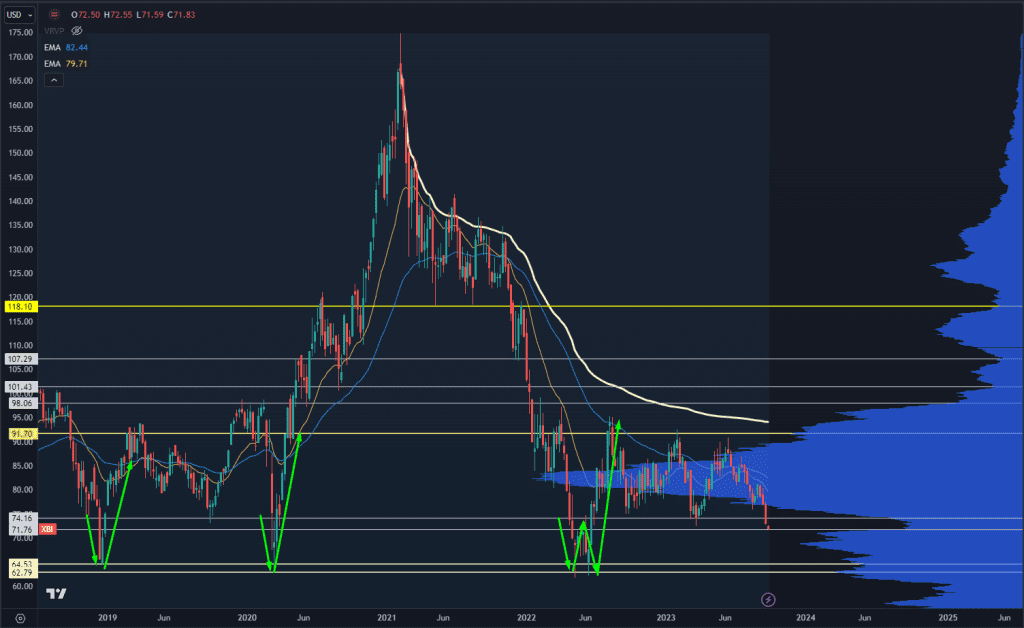

That 1-2 punch is why biotech stocks have underperformed the entire year:

Chart Stock Roadmap Signals Biotech Setup: Here’s My No. 1 Strategy

This ETF is still 60% off of all time highs, and is down 13% year-to-date (YTD). Meanwhile, the S&P 500 is up 12% YTD.

Many investors are throwing in the towel, but I think there’s a hidden area coming into play right now.

A part of our Trading Roadmap is on the right side of the chart. It shows the volume traded by price instead of time.

(I’ve provided a full training on exactly how we use this Roadmap to find high-potential entries and price targets — click here to check it out for free.)

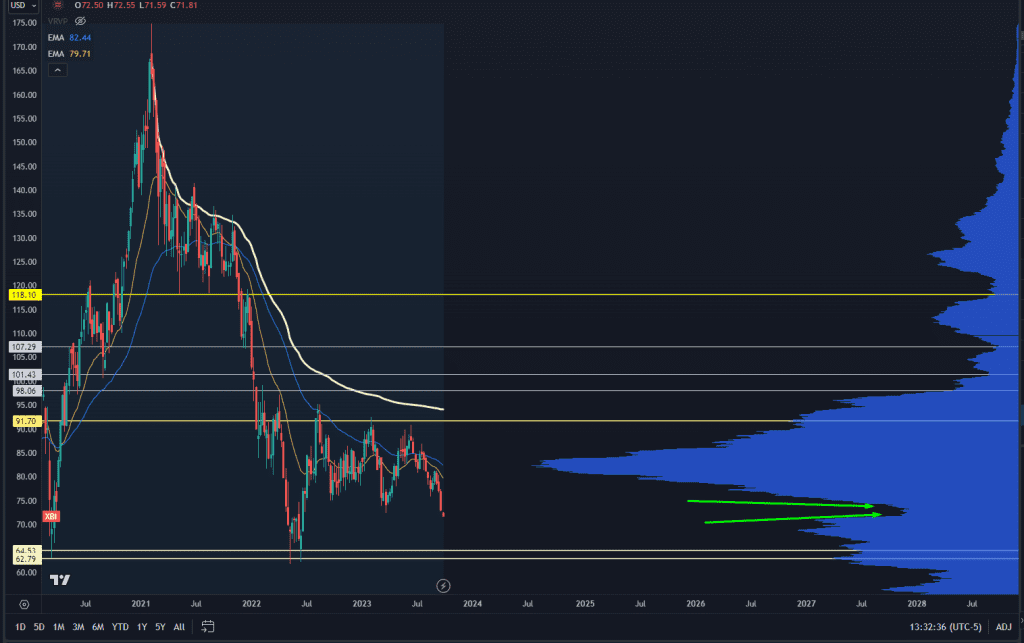

Let’s zoom into that part of the Roadmap:

Chart Stock Roadmap Signals Biotech Setup: Here’s My No. 1 Strategy

Do you see that “dip” in the volume? That’s a “liquidity pit stop” — it means when we hit these levels, the liquidity dynamics of the market rapidly shift.

We can split this into two levels, as this is more of a liquidity zone rather than a single price.

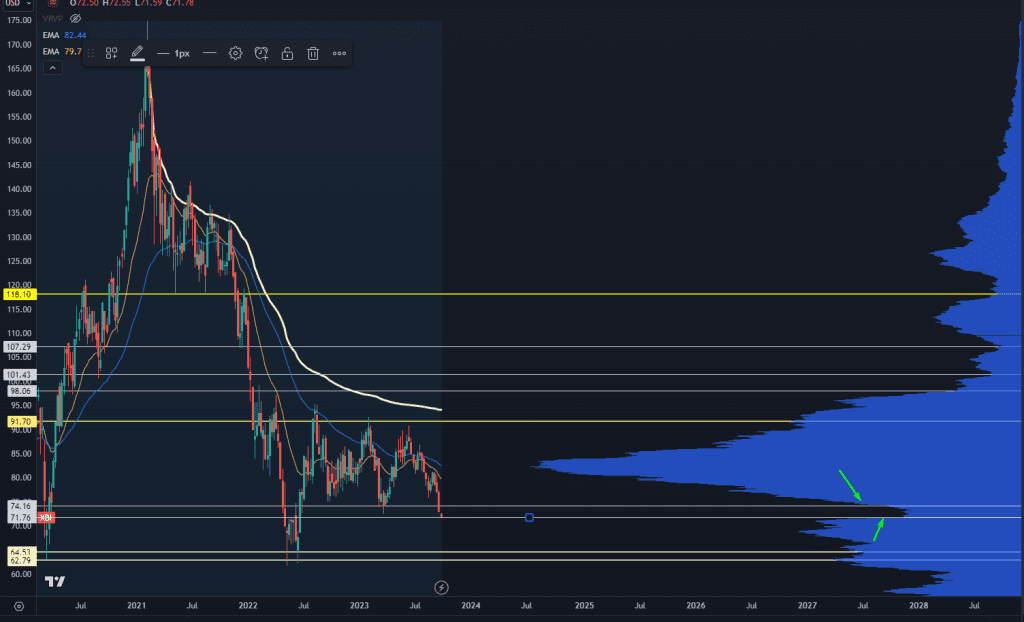

Stock Roadmap Signals Biotech Setup: Here’s My No. 1 Strategy

The index has seen response in this area once this year, and you could argue the 2022 year low was at the top end of this zone.

This is the first time we’ve come back into a big liquidity area:

Stock Roadmap Signals Biotech Setup: Here’s My No. 1 Strategy

The last few times we have moved into this, there was a volatile event that drove it to the low 60s before having massive double-digit rallies.

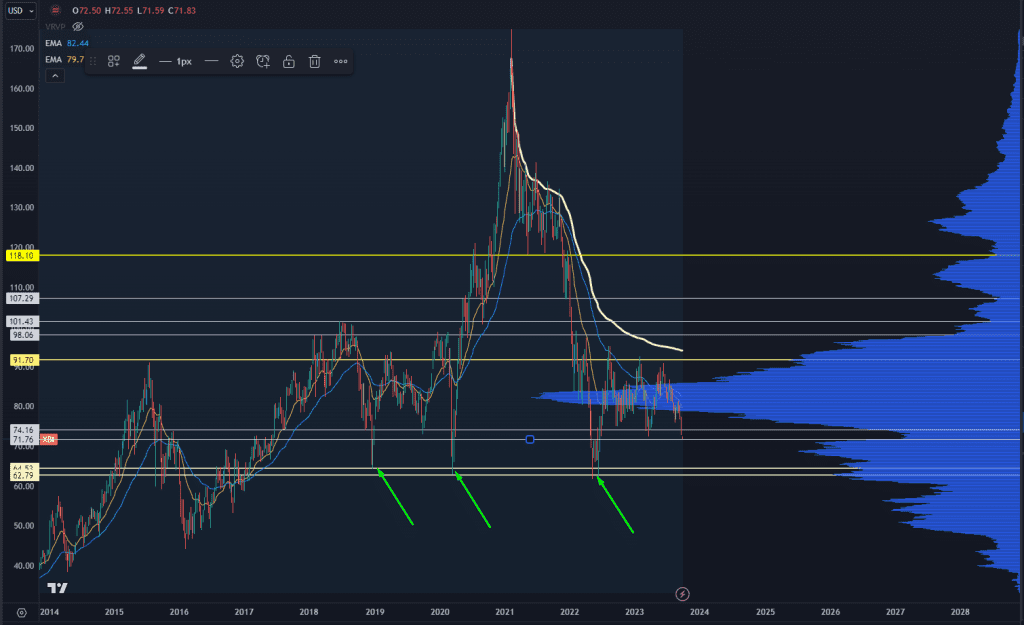

Chart

But I don’t think we will see the same thing this time.

Here are the other times we’ve seen these levels:

Each of those times was accompanied by the entire market taking a hit. And while the broad indices are taking a hit here, It’s nothing like the soul-crushing selloffs from these last times.

This means you should get your biotech shopping list together right now, and consider that if everyone is waiting for the retest of the low 60s, it simply might not come.

Because the market loves to disappoint as many people as possible.

So how do you find the best biotech names? Many are just dead weight in a portfolio – their drugs aren’t producing, and they can’t afford to raise so they will have to dilute on the open market.

Fortunately, I’ve got a framework that works great with the biotech sector…

Original Post Can be Found Here