In the early 2010s, there was a weird ritual in the stock market.

On Fridays we would get unemployment data, and the market would react in an “upside down” fashion.

If the jobs number was terrible, markets would rally. If it looked great, we would be down 1% into the close.

Why?

Because it’s not about the economy — it’s about the Fed’s reaction to the data.

Now we’re witnessing the same “upside down” phenomenon as central banks try to thread the needle of cooling inflation without destroying the economy (yeah, good luck with that…).

The idea is that if they can get rates into a “sweet spot” then the input costs drop while keeping jobs high.

So far, they’re doing a pretty good job.

But here’s the problem with central banks:

They’re always looking in the rearview mirror.

Remember 2021? How damn near every central bank head told us inflation would be contained?

Isabel Schnabel quote. When Bad News Is Good For Stocks

Now they’re telling us the fastest rate hike in the history of modern markets won’t affect the real economy as much as we may think.

Currently, they’re correct… but they’re probably early.

Anyway, I digress…

We’re in the upside-down, bad-economic-data-is-good-for-stocks environment again.

But there are cracks appearing in the macro data… and that’s a good thing for commodities.

Because if we start into a recession in the next year, the central banks will need to be more accommodative — and they’ll have to accept a slightly higher rate of inflation.

That means the gloves are off in the commodity markets… and I’ve just spotted a prime oil and gas play to take advantage.

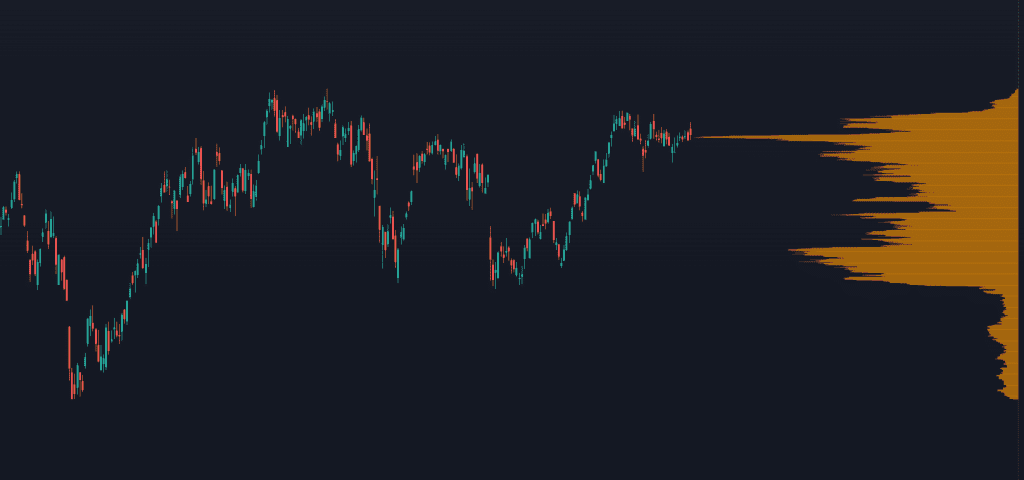

Chart

As you can see, the stock is trading near its highs.

But company insiders can’t get enough of it.

The CEO recently went in for half a million worth of stock, then dropped another $1.5 million a week later.

You also have a director who’s been with the company seven years making his first insider buys in quite some time.

The last time he bought, the stock was at the lows on March 25, 2020. It’s returned 188% for him, with a dividend yield of 16.8%.

To put that in context: He bought the stock around $22 and has collected $13.15 in dividends.

So he’s received nearly 60% of his capital back in dividends alone.

This stock is poised for a serious move, and I just gave all the critical details to my paid readers.

Original Post Can be Found Here