Water started pouring through the ceiling.

I looked outside, and thought the rain was going to get us a delay out of the airport.

If I were in any other major hub, I wouldn’t worry too much about it.

But this was LAX. And we were trying to fly out as a hurricane was bearing down on us.

Escape from LA (Plus a New “Best in Class” Stock Play)

I was watching the radar and could see bands of rain barreling toward us.

But it still said “On Time.”

Maybe the experts aren’t too worried about this, even though this was the first LA hurricane in a lifetime.

We made it out fine, and landed in ATL just in time for sunset.

Escape from LA (Plus a New “Best in Class” Stock Play)

We were out in LA for an energy conference sponsored by a small oil play that is looking to attract investment dollars.

I’ve got a little more work to do on the name, and if it all checks out then I’ll share it with you… stay tuned for that– and put me in the “trusted” list in your inbox so you don’t miss it.

Until then, let’s look to another sector for our next stock opportunity…

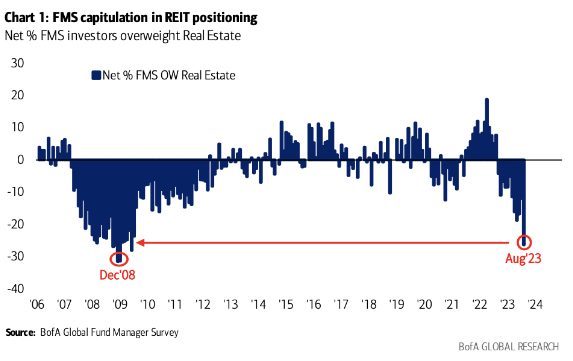

This is one heck of a chart:

Escape from LA (Plus a New “Best in Class” Stock Play)

The rest of the market has had a normal pullback, but Real Estate Investment Trusts (REITs) have been bludgeoned.

Here’s a look at the relative performance IYR, an ETF that tracks the space:

Escape from LA (Plus a New “Best in Class” Stock Play)

Not gonna lie, that’s ugly. This market has underperformed the S&P every year since the Great Financial Crisis.

By the way– this chart is dividend adjusted, so you can’t use “yield” as an excuse.

It’s tough being a REIT when the Fed has rates above 5%. Investors aren’t going to park their money into a shopping mall if you can get a risk free return that’s higher.

But we’re getting very close to capitulation, and I think it’s worth a look to dip a toe in the water.

I don’t think it’s a good idea to make a sector bet– you want to find the best in breed.

Luckily, I don’t have to do much work to find them. I’ve got a line on the best investors on the planet…

Original Post Can be Found Here