When I’m not using our PVA roadmap to see where housing prices are headed… And what that means for the lucrative setups on our radar (for us and private clients)…

I just want to enjoy a good steam bath (a man must enjoy the fruits of his labor).

That’s why I’ve spent the last six months living in a hideaway without a sub-70-degree day. But now I need a drop in humidity and cooler temps to save my sanity.

This is why I’ve circled my calendar for a business trip to the West Coast. I’ll meet with the execs of a private company transforming an untapped corner of the energy industry.

I’ll see if I can talk the CEO into getting on camera to discuss their latest project and answer any questions you might have about investing or partnering up with them.

No promises, but if we get something set up, I’ll let you know.

For Now, Let’s Look at Why Things Are Heating Up In

The Housing Market & Where We’re Putting Our Money

Housing Prices & My Next Business Trip

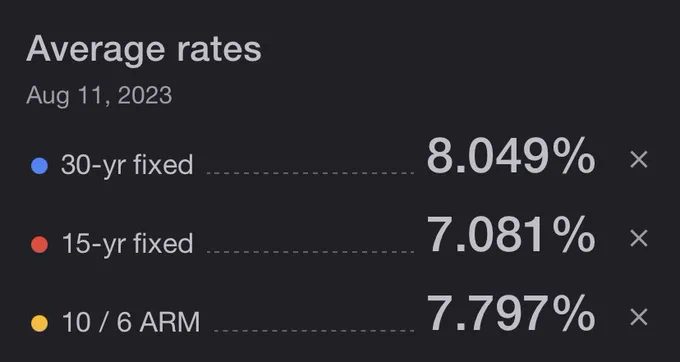

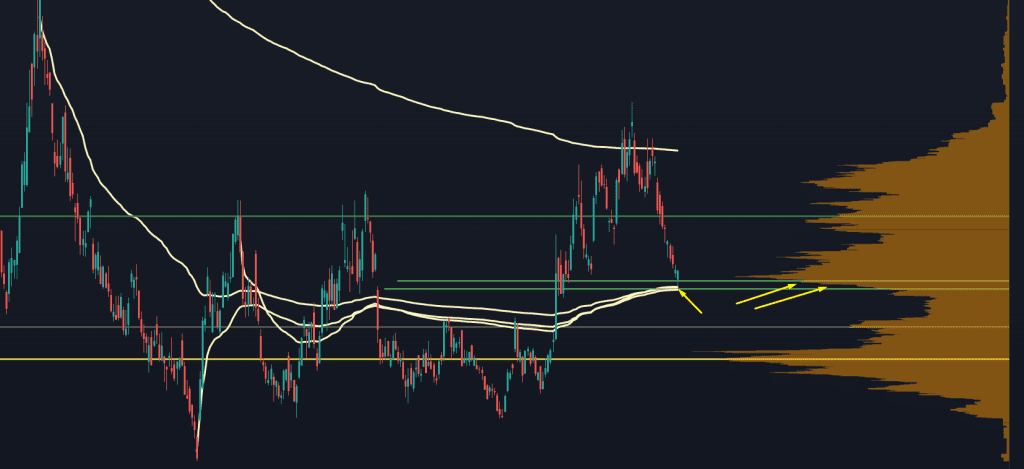

The screenshot above shows we could soon see a significant drop in housing prices.

But the reality is that housing problems often last longer than most investors expect.

For example, during the 2008 Financial Crisis, we saw some markets that didn’t turn around until 2011. Housing was one of them, and a similar story is playing out today.

Right now, the housing market is frozen. Homeowners with no equity are stuck with “golden handcuffs,” and they can’t sell because the rates are too damn high.

If rates go down, inflation slows, and a 6% mortgage suddenly doesn’t sound terrible.

Then, homeowners can list their houses on the market.

But if rates go down and there’s too much supply, we’ll see a significant price drop.

And that’s when the Fed starts taking its foot off the brakes.

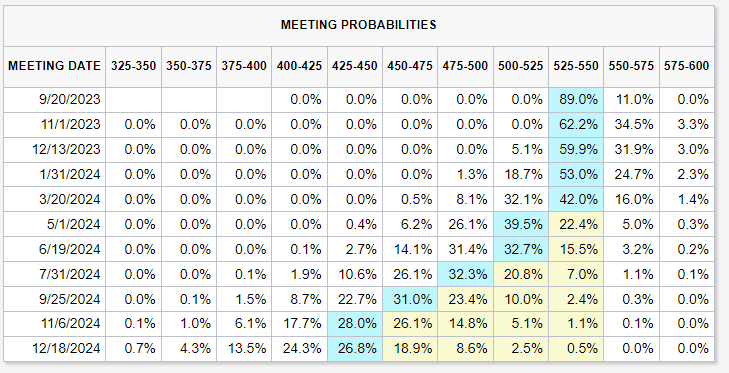

As I said earlier, housing has a significant lag effect, and right now, market movers expect the Federal Reserve will stay put until the second quarter of next year.

Housing Prices & My Next Business Trip

That’s about eight months from today.

In other words, if your local realtor tries to rush you into a hasty purchase, remember that houses might be more affordable by the second quarter of next year.

It’s been a normal market pullback these past few weeks.

I mapped out what the Qs will do (you can take a quick look here). We’re getting into places where institutional capital could unlock new trading opportunities.

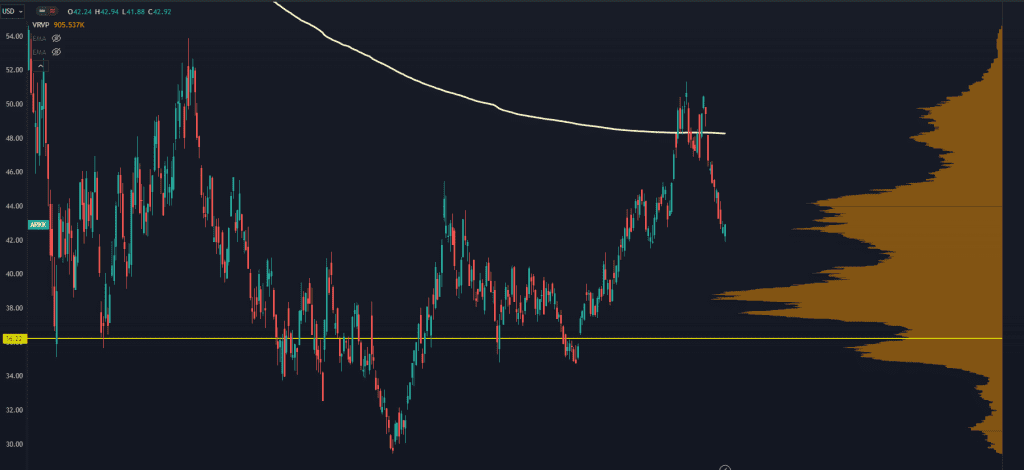

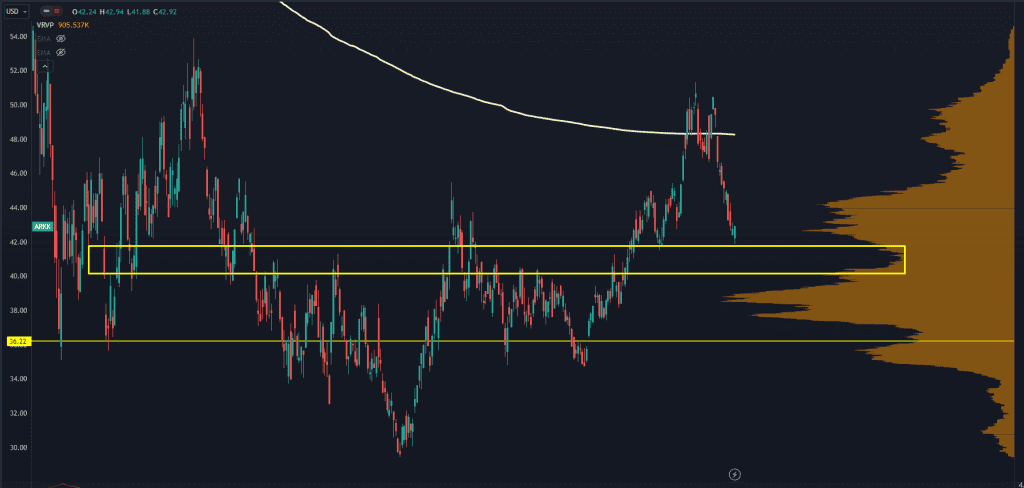

Let’s take a look at Cathie Wood’s ARKK Innovation ETF.

Chart

Our Trading Roadmap tells us that this ETF has jammed through several high liquidity zones, but now it’s approaching pockets of low liquidity.

Housing Prices & My Next Business Trip

There have been massive price responses to this trend, and momentum stocks in the technology sector look more likely to deliver substantial gains as this reset plays out.

In fact, we just sent the setup for one of these names to our PVA clients.

This one fits into a massive level that 10+ institutional players have their eyes on.

And we’ve picked some November calls because we’re looking for a more extensive run into the end of the year, and if I’m right, we could see a quick double on those calls.

That’s like turning every $350 into $700 over the next four months.

Unfortunately, I can’t share more on this because it’s reserved for our clients.

Still, that doesn’t mean you can’t find and profit from similar setups in this market.

Housing Prices & My Next Business Trip

See examples of how we find setups with a 100% upside in this tricky market.

Original Post Can be Found Here