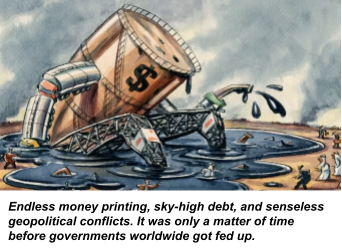

Endless money printing, sky-high debt, and senseless geopolitical conflicts.

It was only a matter of time before other countries got fed up.

Hence, we’re witnessing a massive realignment of geopolitics and global trade…

With profound implications for the U.S. dollar.

There’ll likely be unprecedented volatility in the months and years ahead.

So it helps to understand what’s coming and prepare.

Petrodollar

Russia and China recently signed a deal allowing China to buy Russian oil in the Chinese Yuan.

It marks a major step toward undermining the U.S. dollar as the defacto currency for oil and gas trading.

But it’s not just Russia and China.

Chinese and French energy companies recently finalized a deal to trade 65,000 tons of liquified natural gas (LNG) in the Chinese yuan.

Last week, China and Brazil struck a deal to trade in their currencies, ditching the dollar.

Then, there’s Venezuela.

Venezuela has about 304 billion barrels of proven reserves.

They’d typically rely on petrodollars to sell crude on the international market.

However, U.S. sanctions make dollar transactions very challenging.

Hence, the Venezuelans are happy to accept yuan as payment.

I expect more oil-producing countries to follow suit.

Not just because the dismal financial situation of the U.S. guarantees the dollar will lose significant purchasing power… but because there’s enormous political risk.

Oil producers are exposed to the whims of the US government, which can confiscate their money whenever it wants, as it recently did to Russia.

Nobody wants to be in that position, hence, the departure from the petrodollar.

The more countries move away from the petrodollar…

The more difficult it is for the U.S. to swing its weight economically.

If the petrodollar system crumbles, America would be stuck with hundreds of billions of dollars that would no longer be in demand, leading to massive inflation.

This doesn’t bode well for anyone with cash in the markets. It aligns perfectly with my “financial blackhole” warning last year. Just another chapter in a series of events that will erase over $20 trillion of invested wealth over the next few months and years.

As expected, clued-in investors are already looking for an escape hatch.

Gold is certainly one place to look, but you'll miss the big picture if that’s all you do.

During my strategy session at 11 am ET tomorrow… I’ll discuss the critical steps I’ve taken to protect my cash as this international monetary reset unfolds…

With details on three solid investments that could hand a small group of investors a minimum of 75% monthly gains in the difficult times ahead…

And how to maximize your returns without exposing your portfolio to painful losses.

The room opens at 11 am ET.

If you want to see what I’ve lined up for tomorrow, click here to save your seat.

Original Post Can be Found Here