If the mainstream media were honest…

They might have come up with a clever moniker like “SPRingtime in November” to describe the Biden admin’s plan to relieve gas prices just before the midterms.

Instead, they leave it to me to do it for them… then pat myself on the back for it 😉

Hopefully I don’t dislocate my shoulder in the process.

Anyway, sucking the SPR dry just to relieve prices so voters won’t punish you for being stupid…

Is a very special kind of cynical.

Now, those of you that have read me for a while know I’m pretty mild on politics generally…

But, after the way the press eviscerated the Trump admin for every policy that even sniffed of self-serving…

… only to turn around and give “Hunter’s Dad” a total pass on more brazen versions of the same behavior…

It’s enough to turn me into a partisan… ALMOST!

Rant aside, Bloomberg is reporting that the Feds are looking to dump another 10 million barrels from the SPR out onto the market.

Obviously, this is a huge strategic mistake…

One that we have to hope plays out only “in theory” and not in the real world.

The SPR is meant for emergencies, like after the oil embargo in the 70s.

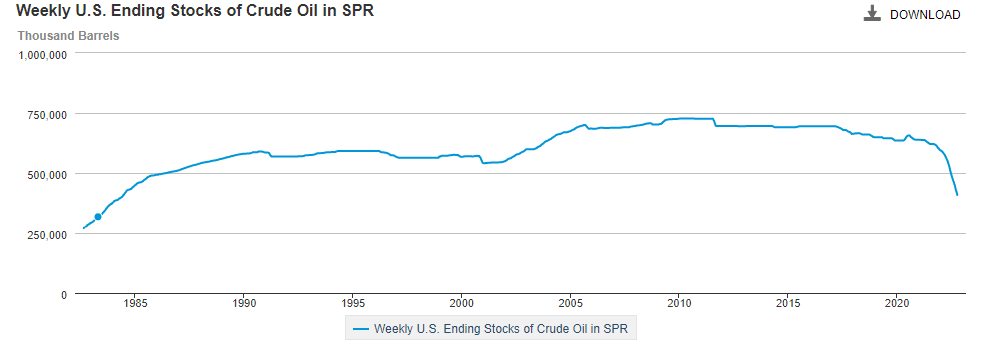

And the reserves continue to fall off a cliff:

Look, I get it. Saudi is not playing ball– Biden wanted them to delay an OPEC decision after the election.

And we’ve got a hot war in Europe that’s accelerating, but the German buffoonery around their energy policy shouldn’t be subsidized by American reserves.

I know, I’m armchair quarterbacking, but this is a terrible idea.

If this keeps up, then the US further loses geopolitical leverage.

Something we can ill-afford to do given the credibility bleed we’ve suffered under “President Houseplant.”

But here’s something interesting…

We’ve got three huge things going on:

If I told you a few years ago that all of this was happening at once, you’d probably believe that the oil markets would have completely crashed.

But that’s not the case:

Front month crude oil is trading over $80 per barrel.

Now there are some downside risks in energy with respect to demand destruction into a recession… but what happens if the dollar rolls over, or the Fed starts to pivot, or if the US needs to replenish the SPR?

Things can get absolutely wild in the energy markets, and there are some solid plays for when the Feds capitulate and finally allow permits to come back online.

Like this offshore oil company:

We’ve been stalking this name for a bit, because we started to see some aggressive flow from the smartest traders on the planet.

These “Hidden Geniuses of the Markets”... who don’t even work on Wall Street…

Are 917-0 when they buy stocks in a very specific way.

Want to know who they are and how to follow them?

Original Post Can be Found Here